FT Alphaville by Kahdim Shubber (Feb. 26, 2016)

Earlier this week we looked at the performance of loans originated by the likes of Lending Club and Prosper Marketplace and wondered what an uptick in delinquencies in conjunction with a hike in rates, particularly for risky borrowers, might signal about economic conditions.

In fine Alphaville tradition, the first comment was a skeptical “more data, please”. So we thought it worth revisiting and digging into more detail, particularly in light of weakness in the subprime auto loan market.

The data, we would suggest, are pretty clear: credit quality is deteriorating.

Let’s look first at blended Lending Club and Prosper Marketplace loan data from PeerIQ, who sent us the most current information they have on how loans originated in 2015 were doing 5 months into their lives, compared with loans originated in 2014. You can see delinquencies, meaning one or more missed payments, are somewhat higher across the 2015 vintages, although the debt hasn’t been charged-off yet:

| Vintage |

Delinquencies after 5 months (2015 loans) |

Delinquencies after 5 months (2014 loans) |

| September |

2.19 |

1.77 |

| August |

2.15 |

1.69 |

| July |

1.79 |

1.43 |

| June |

1.69 |

1.46 |

| May |

2.09 |

1.53 |

| April |

1.59 |

1.4 |

According to PeerIQ, FICO scores at origination have remained consistently around the 700 mark across the portfolio. Data for Q4 2015 is coming soon, says chief executive Ram Ahluwalia, so we’ll be able to see if delinquencies have continued to tick higher.

But in the meantime we can also look at this blogpost from Monja, a data insights company for marketplace lending, published on Monday after our post and titled: “Lending Club Performance – The Good And The Bad”.

Head over there for the full chart experience, but broadly “the good” is that charge-offs for Lending Club loan grades A-D “consisting of higher quality borrowers” are stable.

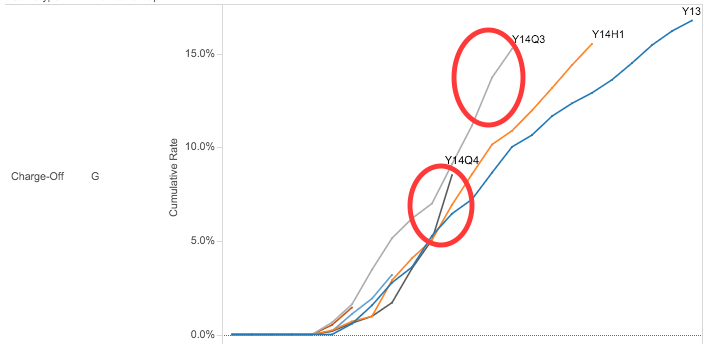

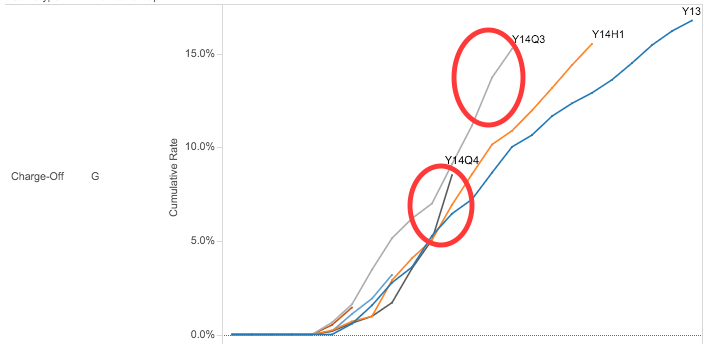

However, writes founder James Wu, “on the lower end of the credit spectrum, things look very different,” as his chart shows:

Here are the observations Wu makes (with our emphasis):

Two of the recent seasoned vintages (Y14Q3 and Y14Q4) have charge-off levels above prior vintages, in contrast to Lending Club’s general ability to keep charge-offs level across vintages for other segments.

The last few points of these two vintages appear to have higher slope than prior months, indicating a potential acceleration of losses in Q3 and Q4 of 2015.

Based on the corresponding rolling of delinquencies, some of the effect is likely seasonal and coincidental with the timing of prior DQ. Nonetheless, it’s worth monitoring this vintage closely.

On the Prosper side of things, we can see similar effects. For example, Blue Elephant Capital Management, whose chief investment officer Brian Weinstein we quoted previously, told investors in a January letter that in the twelve months to June 2015, their book of Prosper loans averaged a 1.75 per cent annualised default rate, “with only modest distinction between grades”.

For the twelve months to December that had trended up to 2.85%, “with more meaningful differentiation between loan grades”. The spread in annualised loss rate between AA and C grade loans had increased from about 130 basis points in 2013/14 to about 550 basis points in 2015. In English what that means is that the deterioration was greater in the loans to riskier borrowers, just as with the Lending Club loans above. (It should also be noted that this does not include the riskier end of the Prosper spectrum, in which Blue Elephant does not currently invest.)

That is obviously on a book basis — which is to say that any portfolio of loans will see an increase in delinquencies because loans are more likely to go bad as they get older, with the roughest spot after six months but before one year (worth keeping in mind when thinking about the data above). But Weinstein argues that the more pronounced effect in the riskier credit suggests there’s more at play, which seems plausible given the performance of Lending Club’s loans described above.

So what should we make of this?

These aren’t blowout delinquency or charge-off rates — as we said before, it’s a mild uptick. And this is a small part of the loan universe. But take into account the signals that the credit cycle is getting quite old indeed, and the direction of travel is worth noting.

What’s more, it isn’t at all strange to see Prosper and Lending Club hike rates (and indeed hike rates for risky borrowers in particular). After all, the point of marketplace lending is to tie investors directly to loans and therefore to loan performance. Matt has previously argued marketplace lenders would probably move rates more cyclically because they would be unable to fund loans unless they kept investors happy on a more real-time basis than a balance sheet lender capable of issuing money-like debts guaranteed by the state.

So far, both Lending Club and Prosper are taking the line that their rate hikes are primarily about broader unease in the credit markets. Josh Tonderys, Prosper’s chief risk officer, says the cost of borrowing has increased for its investors, who are therefore demanding a higher rate of return on the Prosper loans they buy. He adds that loan performance has been consistent with what they were expecting and that delinquencies for some Q3 and Q4 vintages are “actually lower than some of the 2014 vintages”.

“Our early delinquencies on the two most recent quarters look really strong, they look great,” says Tonderys.

To the extent these measures tell us about the underlying health of American consumers, we hope he’s right.

[Original article available here. Subscription required.]