A Cooling in Recession Talk, Heat Up in Housing, Facebook To Offer Loans?

By Vy Phan

September 22, 2019

Greetings!

This week the housing market heated up, recession fears cooled down, and Libra was put on the hot seat once again.

The 3% growth rate that President Trump set as his goal in the beginning of the year is seeming out of reach, as economists expect a rate around 1.7% by the beginning of 2020. This comes despite tax reform, the lower growth in population and productivity.

In other macro news, the fed has once again cut rates by a quarter point. The range of views on the committee is wide – one governor (Brullard) dissented arguing for deeper rate cuts, while another (Rosengren) argued lower rates are unnecessary.

Lower rates, improved credit scores, and tighter housing inventory are improving the outlook for housing. Housing market achieved an 18-month high in housing starts and a record high in FICO scores.

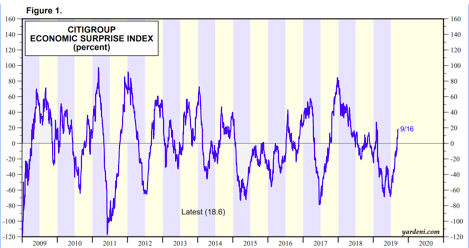

The Citigroup Economic Surprise Index – a measure of actuals vs economist’s expectations – has also registered readings above the neutral baseline suggesting slowdown fears may be exaggerated.

Source: PeerIQ, CitiGroup

In financing news this week, San Francisco online transaction company Stripe pleaded headlines this week with their $35BB valuation.

“FinTechs for the Gig Economy” appears to be an emerging theme (see Salaro and Joust) for example.

Ten years after the financial crisis, the Congressional hotseat has shifted from big banks to big tech firms. Facebook crypto project “Libra” leader David Marcus was called back in hot seat. Marcus assured Congress that:

- Libra would not be released until satisfying all regulatory concerns

- The decision to HQ Libra in Switzerland has “nothing to do with evading responsibilities” but about embracing an “international platform”

Marcus also insisted that Facebook is not getting into banking – no bank accounts, no earned interest, no deposit taking. Libra is digital cash.

However, most relevant for our sector, Marcus indicated that Facebook could one day offer financial services products including potentially loans via partnerships with an existing bank.

Conferences

- We arrived at the ABS East Conference in Miami today. Shoot us a note if you are interested in meeting!

Industry Update

- Fintech company Plaid discloses investments from Visa, Mastercard (Reuters, 9/16/2019) Company that helps you connect you Venmo account to your bank account lands an undisclosed amount from card giants in the $250MM series C.

- FDIC Chair: Fine Line Between Regulation and Innovation (Bloomberg, 9/9/2019) Jelena McWilliams talks regulations and fintech for Bloomberg Radio.

- Average FICO score stands at record high (Housing Wire, 9/16/2019) Jump in scores most likely due to score improvement, not inflation.

- Is Facebook a Bank? Congress Pushes for Answers on Crypto Foray (Bloomberg, 7/17/2019) House members talk and ask regulation, specifics of Facebook crypto Libra .

- Economists Don’t See Path to 3% Growth in 2019 (WSJ, 9/12/2019) White House goal of reaching 3% growth is looking tough to reach, now sitting at a projected 1.7% by 2020.

- US Fed cuts interest rates for second time since 2008 (BBC, 9/18/2019) The main concern remains slowing global growth and trade wars.

- Petal Raises $300 Million in Debt (LendIt Fintech, 9/18/2019) Startup focused on evaluating those with no credit history has risen $300MM in debt from Jefferies.

- America's housing starts spike to 12-year high in August (Housing Wire, 9/18/2019) Housing starts at 12.3% in August , 6.6% above last years rate.

- Mission Lane Names New CEO, Raises Half Billion Dollars In Financing (Yahoo, 9/16/2019) Purpose-driven card company appoints experienced CEO, announces funding from GS, Invus Opportunities, LL Funds, QED investors, and Oaktree.

- Low mortgage rates bolster August's existing-home sales to 17-month high (Housing Wire, 9/19/2019) Existing home sales moved toward 1.3% in August from July, buyers finding it hard to resist current rates.

- Fintech Company Stripe Joins Silicon Valley Elite With $35 Billion Valuation (WSJ, 9/19/2019) The valuation is 50% higher than the valuation from an early 2019 funding round.

Lighter Fare

- Navy Confirms UFO Videos Posted by Blink 182 Rocker Are Real and Should Not Have Been Released (NBC 7 San Diego, 9/18/2019) Aliens exist; the fuel to generations of adolescent angst and mischief has leaked top secret Naval footage of “UFOs”.