Auto Borrowers Underwater; U.S. Bank Consent Order; CRE Troubles

By Cole Gottlieb

December 24, 2023

Happy Holidays!

More auto borrowers are underwater. Forty percent of federal student loan borrowers still not making payments. U.S. Bank consent order. Student banking and overdraft reports. Consumers using BNPL to avoid hit to credit reports. Commercial real estate troubles persist. Mercury files suit against Synapse. TransUnion data.

New here? Subscribe here to get our newsletter each Sunday. For even more updates, follow us on Linkedin (PeerIQ by Cross River).

More Auto Borrowers Underwater

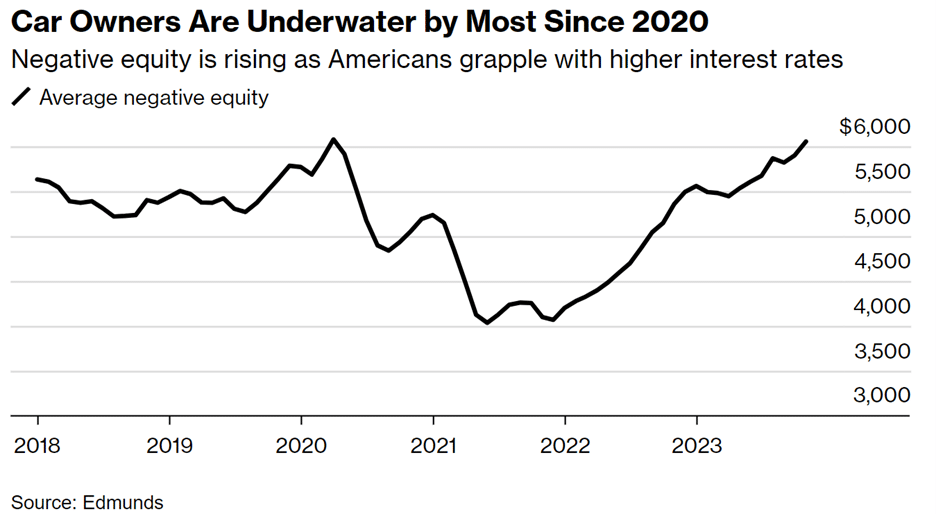

In yet another knock-on effect of higher rates, negative equity on automobiles has hit the highest level in more than three years. Last month, for auto owners with negative equity, borrowers were underwater by an average of $6,054.

Image: Bloomberg

Federal student loan payments, which restarted in October, may also provide cause for concern. Nearly 9 million borrowers didn’t resume making their payments, amounting to some 40% of the nation’s 22 million federal student loan borrowers. Under a plan the Biden administration implemented after its efforts for one-off loan forgiveness were struck down, borrowers have a one-year “on ramp” to begin repaying their loans. While the loans will begin accruing interest, they won’t be reported as delinquent to credit bureaus until September 2024.

CFPB: U.S. Bank Consent Order, Student Banking & Overdraft Reports

The CFPB has had a busy holiday season, with the release of several enforcement actions and reports.

The Bureau reached a consent order with U.S. Bank, stemming from the bank’s handling of a prepaid card program used to disburse state unemployment benefits. The CFPB argues that U.S. Bank froze tens of thousands of accounts and failed to provide impacted consumers a timely and reliable way to regain access. The Bureau also alleges that, when accountholders reported unauthorized transactions, U.S. Bank failed to provide provisional credits in cases where investigations would take longer than 10 days. The consent order requires U.S. Bank to pay $5.7Mn to impacted consumers and to pay a $15Mn fine. As a result of the joint investigation, the OCC separately fined U.S. Bank $15Mn for violating the FTC’s prohibition on unfair or deceptive acts or practices.

Last week also saw the CFPB release its annual student banking report. The report found that products targeted to college students, including school-sponsored products like credit cards or deposit accounts linked to student IDs, are more costly and offer less favorable terms than other readily available products. CFPB Director Chopra has indicated the Bureau plans to further investigate the practices of such program, focusing on any violations of consumer protection law.

Finally, in advance of proposals expected early next year, the CFPB released a report on how overdraft and non-sufficient funds fees impact consumers. One key finding of the report is that frequent overdrafters often use overdrafts as a form of short-term credit, even when they have less expensive options available. Unsurprisingly, lower-income households disproportionately bear the brunt of overdraft and NSF fees, with 34% of households making less than $65,000 paying at least one fee per year.

Consumers Using BNPL to Avoid Credit Reporting

Some consumers are shifting borrowing to buy now, pay later loans as a strategy to protect their credit scores, the Wall Street Journal reports. Use of BNPL has continued to grow in popularity, particularly with pandemic savings long gone for most households and inflation stretching household budgets. During Black Friday/Cyber Monday, BNPL was used in a whopping 7.2% of all online transactions, Adobe reported. But the lack of credit reporting is cause for concern for consumer advocates, who worry it can lead to consumers becoming overly indebted. It also poses a challenge for lenders, those offering BNPL as well as traditional credit products, as it obscures borrowers’ total debt load and thus their ability to repay. While the major credit bureaus have begun to support furnishing for BNPL transactions, most providers aren’t yet doing so.

Concerns about credit quality or data furnishing aren’t stopping BNPL lenders from plowing ahead, though. Last week, Affirm announced an expansion of its partnership with Walmart. Shoppers will now be able to choose Affirm as a payment option at Walmart’s in-store self-checkout kiosks.

Commercial Real Estate Troubles Persist

Commercial real estate is an increasing concern, especially for some local and regional banks with heavy concentrations in the sector. A new academic paper finds nearly half of lenders’ office loans are underwater, where loan balances exceed the current value of the property. CRE values have been hammered by continuing high vacancy rates. Office badge system provider Kastle found that occupancy rates in many markets remain at about half their pre-pandemic levels. Some banks have de-risked by selling CRE loans, but such sales typically come at steep discounts. Interest rate levels are also a critical factor, with many property owners needing to refinance loans in the next several years.

Mercury Files Suit Against Synapse

Mercury filed a lawsuit seeking to preserve its ability to recover as much as $30Mn from its former banking-as-a-service platform Synapse, Fintech Business Weekly’s Jason Mikula reported last week. The two companies parted ways earlier this year, when Mercury struck a deal to work directly with Synapse’s now-former bank partner, Evolve Bank & Trust. The suit was filed in quick succession to a confidential arbitration claim Mercury filed against Synapse, with the goal of securing a court order that would block Synapse from transferring or disposing of assets prior to resolution of Mercury’s arbitration claim against the company. In the heavily redacted public filing, Mercury argues that “[g]iven Synapse’s ongoing financial collapse, its failure to pay its outstanding debts, its apparent lack of liquidity, and the risk that it will liquidate its assets, Mercury has brought this application for provisional relief pending arbitration.”

TransUnion Credit Data Shows Rising Delinquency Rates

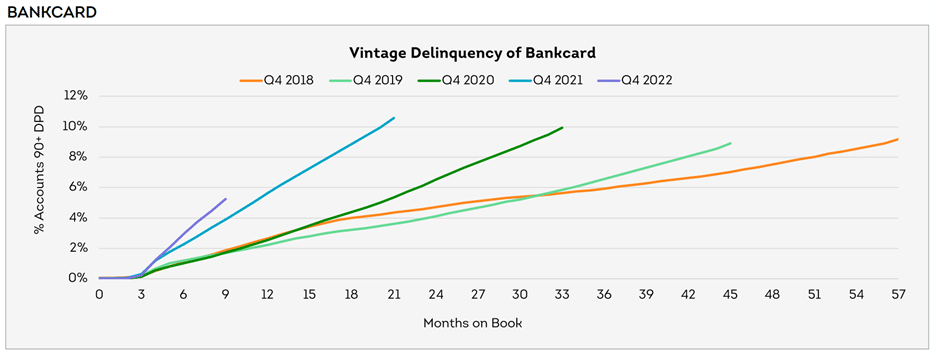

TransUnion released its November Credit Industry Snapshot this week. In November, 60+ DPDs increased across the board (MoM) for Unsecured Personal Loans ("UPLs") +15bps, Bankcard +9bps, Mortgage +4bps and Auto +2bps. This marks the fourth consecutive month of DPD increases for all products.

Looking at bankcard, 90+ DPDs rose 6bps MoM, marking a fifth straight month of increases and 30+ DPDs rose 6bps marking a seventh straight month of increases. Q4 2022 vintage DPDs continue to track higher than Q4 2021 and well above Q4 2017-2020 vintages. Average bankcard balances rose +1.0% MoM, to $6,140.

Source: TransUnion

Turning to originations, we got information on UPL origination volume for the August 2023 – September 2023 period (lag due to reporting time). September MoM UPL origination growth was largely positive, after a largely positive month in August.

September fintech UPL originations declined by double-digits across the board (reversing the August trend) with super prime (18.3)%, prime plus (27.7)%, prime (19.0)%, near prime (18.8)% and subprime (14.1)% on a MoM basis. All risk tiers remain significantly below September 2022 levels, with super prime (29.4%), prime plus (44.9)%, prime (61.8)%, near prime (65.6)%, and subprime (61.1)%.

Credit unions also showed MoM UPL origination pullbacks, with super prime (19.4)%, prime plus (17.1%), prime (11.2)%, near prime (17.3)%, and subprime (22.1)%. On a YoY basis, only super prime +8.3% originations were above 2022 levels, while prime plus (2.2)%, prime (5.9)%, near prime (5.1)% and subprime (14.0)% lagged.

Finance companies largely reported MoM UPL origination declines with super prime +3.4% the exception. Prime plus was down (1.0)%, prime (8.4)%, near prime (11.0)%, and subprime (13.8)%. While near prime originations are up 4.3% from September 2022, super prime was down (2.4)%, prime plus (2.8)%, prime (4.6)%, and subprime (11.3)%.

Banks reversed August UPL origination growth, reporting September declines across super prime (16.8)%, prime plus (10.7)%, prime (12.3)%, near prime (8.0)%, and subprime (9.4)%. Bank originations were mixed from September 2022 levels, with super prime +12.6%, near prime +18.0%, and subprime +15.9%, but prime plus (3.6)%, and prime (4.7)%.

Finance companies expanded their lead in UPL balances, growing to 27.8% of the total in November. Fintech companies followed, accounting for 26.6%, while banks accounted for 25.6% and credit unions for 20.1%. Average UPL balances per consumer increased +0.8% on a MoM basis, to $11,933 in November.

In the News:

Navy Federal faces lawsuit, allegations of racial bias in mortgage lending (American Banker, 12/18/2023) The credit union approved 77% of mortgage applications from white borrowers but only 56% of Latino and 48% of Black applicants.

Borrowers Turned to Nonbank Lenders for Mortgages — And It’s Costing Them (Bloomberg, 12/18/2023) Fees at nonbank lenders are higher than at traditional banks.

Court Approves $2.7 Billion Binance-CFTC Settlement, CZ to Pay $150 Million Fine (Decrypt, 12/19/2023) Binance reaches another settlement as it seeks to put its legal problems behind it.

How generative AI is upending tech at big payment companies (American Banker, 12/19/2023) Major payment firms like Visa and Mastercard are making big investments in generative AI.

MoneyGram's CEO on cross-border payments: 'This is an expensive business.' (American Banker, 12/18/2023) MoneyGram plans to invest in digital currency and blockchain in coming months.

FTX Files Plan to End Bankruptcy, Pay Crypto Creditors Billions (Bloomberg, 12/17/2023) FTX reveals plan to return billions to creditors, customers in order to exit bankruptcy.

Citizens making it easier for new customers to reroute direct deposits (American Banker, 12/18/2023) Citizens is partnering with Pinwheel to make it easier for customers to move their direct deposit.

Greenwood launches investing platform to help minorities have a piece of the American pie (Tearsheet, 12/19/2023) Greenwood to offer stock and ETF investing.

How the Fintech Rally Could Fizzle in 2024 (Wall Street Journal, 12/18/2023) Falling interest rates pose a challenge for some fintechs that have benefited.

Simon Khalaf channels energy into scaling Marqeta (BankingDive, 12/18/2023) Marqeta is focusing on embedded payments to power growth.

Why consumer neobanks are making B2B pivots (American Banker, 12/19/2023) More fintechs are pivoting to focus on selling to banks as consumer segments falter.

Lighter Fare:

The Biggest Food Stories in New York in 2023 (Eater, 12/19/2023) The year in food in New York City.