Greetings,

The Fed reiterated its plan to

raise rates for a fourth time in December. The yield curve continues to flatten with the spread between 10 and 2-year treasury yields down to about one rate hike (~27 bps).

Consumer credit grew by $10.9 Bn in September – well below expectations of $15 Bn.

Revolving credit contracted by $312 Mn to $3.95 Tn outstanding, the third decline in the last 6 months. Any sustained drop in consumer credit could curtail growth in an economy where consumer spending accounts for nearly 70% of economic activity.

We noted in our

previous newsletter that credit card issuers have grown their loan books in Q3 and are seeing near

record low charge-offs and delinquencies.

JP Morgan is pulling back from subprime auto and credit card lending to avoid higher losses – and capital charges from CECL – when the credit cycle turns.

Discover and Capital One are also proactively lowering credit limits for some customers for the same reason.

In regulatory news, OCC Chief

Otting expects to grant a FinTech charter to an online lender soon despite legal challenges from state banking regulators. Mr. Otting conveyed that

many FinTech companies have decided to apply for the charter despite pending legal concerns. You can

view our prior presentation on the OCC’s FinTech charter and

watch the webinar replay.

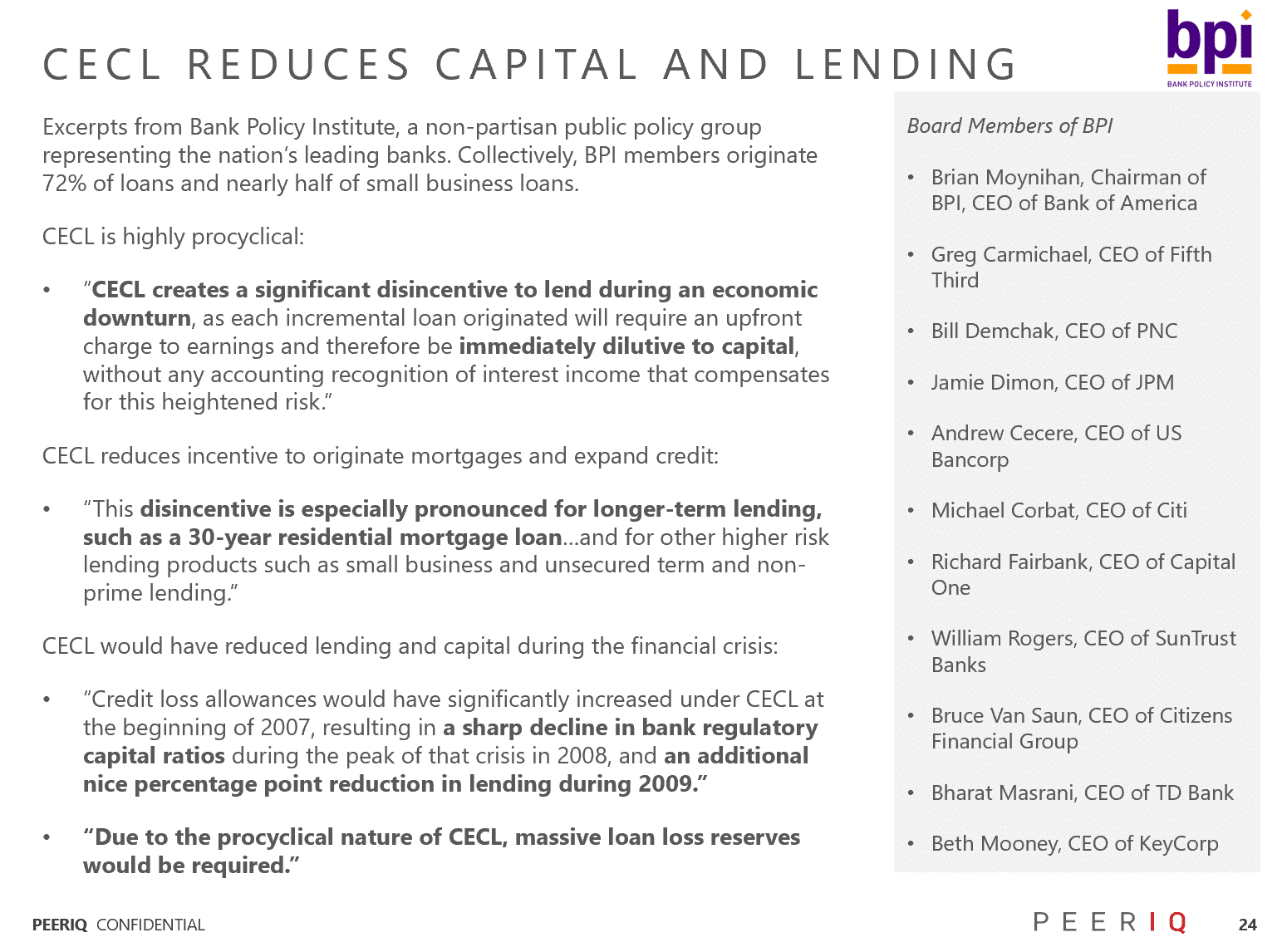

Banks Pushback on CECL

The Banking Policy Institute

set out its opposition to the implementation of CECL in a letter to Treasury Secretary Mnuchin and FSOC. The Bank Policy Institute represents the nation’s largest banks and its members are responsible for originating 70% of loans.

Source: PeerIQ, Bank Policy Institute.

PeerIQ summarized CECL and how you can prepare in a prior

newsletter. The Banking Policy Institute urges the Treasury to delay the impact of CECL to conduct further study. Banks signing the letter include virtually all of the nation’s largest originators of consumer credit risk.

Reach out to learn how PeerIQ can help comply with CECL valuation and loss-forecast requirements.

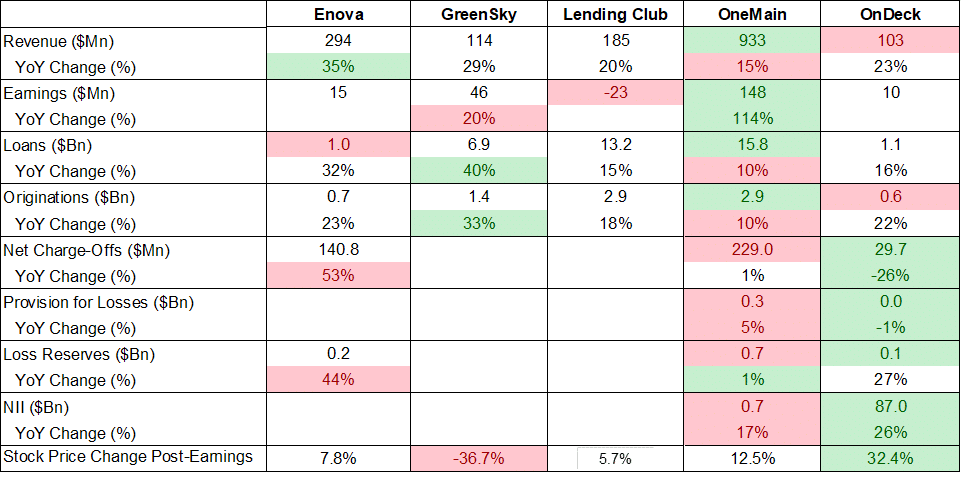

In this week’s newsletter we will analyze the earnings of FinTech lenders.

Mixed FinTech Earnings

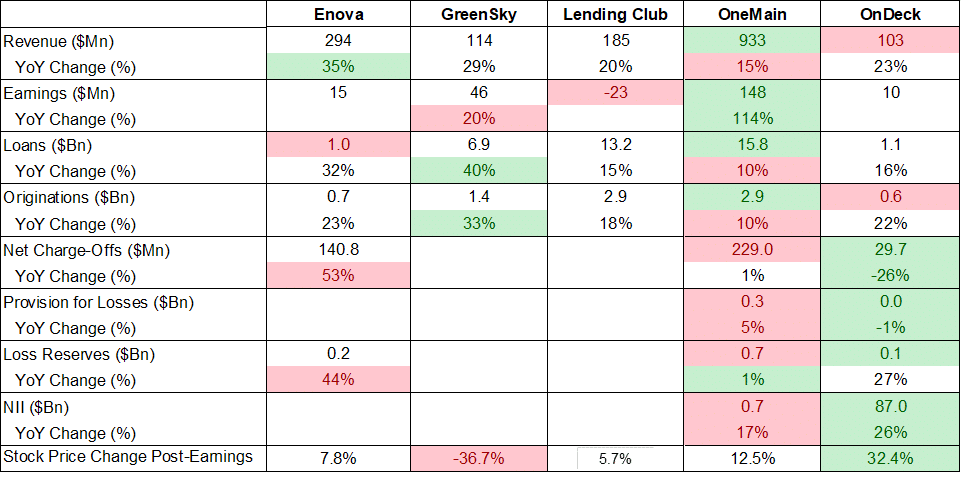

We analyze the earnings of Enova (ENVA), GreenSky (GSKY), LendingClub (LC), OneMain (OMF) and OnDeck (ODK). All lenders delivered

high-double digit revenue growth YoY. ENVA’s revenues grew 35% YoY, and GSKY’s revenue grew 29% YoY, albeit from a low base.

Originations also grew by double digits YoY, with originations at GSKY growing by 33% YoY.

Credit performance remains on a solid footing driven by low unemployment and a strong economic growth. Growth in loan losses reserves is consistent with loan growth.

Delinquency rates at OneMain and at OnDeck are close to their post-crisis lows.

Lenders have raised their borrowing rates, although well below the rate of Fed Rate increases leading to margin compression. In the last 12 months, LendingClub, for instance, has raised interest rates across the credit spectrum by between 49 bps and 114 bps, while the Fed has raised short-end rates by 100 bps. The flattening yield curve is raising the cost of borrowing on lenders’ credit facilities which are benchmarked to short-term interest rates. Overall, lenders and investors are experiencing margin compression. By contrast, large banks continue to issue deposits at ultra-low rates (< 6 bps for large money center banks) and have benefitted from rising rates.

Source: PeerIQ, Bloomberg, Capital IQ. Change shows the value in % difference since Q3 2017.

Stock price performance post earnings has been good in a relatively volatile market. Margin compression at GreenSky disappointed investors and the stock slid by over 35% after earnings. All other stocks gained post earnings with OnDeck up by nearly 33%.

Enova Earnings

- Enova’s revenues grew by 35% YoY to $294 Mn and net income was $15 Mn, compared to a loss in Q3 2017.

- Loans grew by 32% to $1 Bn, and originations grew by 23% YoY to $0.7 Bn driven by 28% YoY growth in the US subprime business. 31% of Enova’s new originations in the first nine months of 2018 came from new customers. This was the highest proportion of originations from new customers since 2004, demonstrating a large untapped market as Enova expands.

- Loan loss reserves increased by 44% YoY to $0.2 Bn. Enova is seeing charge-off rates increase from near cycle lows. Charge-offs in Q3 were $141 Mn, up by 53% YoY. The company noted that charge-offs on new customers are roughly three times those on recurring customers, and the company evaluates every loan decision based on the lifetime expected value of that customer.

- Enova had $164 Mn in cash and equivalents and $951 Mn in debt outstanding at the end of Q3. Enova issued $375 Mn of seven-year notes at 8.5%, which were used to retire existing 9.75% notes and added a new two-year $150 Mn secured facility points to grow the near prime installment product. The company also priced its inaugural $125 Mn NetCredit term securitization at a blended fixed cost of 6%.

GreenSky Earnings

- GreenSky’s revenues grew by 29% YoY to $114 Mn and net income increased by 20% YoY to $46 Mn. It was GreenSky’s second quarter with more than $100 Mn in revenues and $50 Mn in EBITDA.

- GSKY had record originations this quarter of $1.4 Bn, up by 33% YoY. GreenSky’s portfolio is focused on home-improvement borrowers and the company is looking to expand into elective healthcare and e-commerce financing.

- 30+ day delinquencies decreased marginally to 1.44%.

- GreenSky had $294 Mn of cash and cash equivalents and $387 Mn in term loans. Funding commitments from bank partners increased by $3.5 Bn QoQ to $11 Bn. GreenSky’s bank partners are charging higher funding spreads. GreenSky has not been able to completely offset this increase by passing on higher rates to borrowers.

- The investor presentation is here.

LendingClub Earnings

- LendingClub delivered another quarter of record revenue of $185 Mn, an increase of 20% YoY. LC’s net loss was $23 Mn, up from $7 Mn YoY.

- LendingClub announced a partnership with Intuit to offer loans to TurboTax customers by directly accessing their tax records. It’s a smart deal. The partnership enables LendingClub to keep customer acquisition costs low and also use alternative data to underwrite borrowers.

- Originations grew by 18% YoY to $2.9 Bn, the highest quarterly originations at LC. Net interest income was offset by fair value adjustments on loans of $20 Mn while the structured program generated revenues of $6.3 Mn, the highest to-date.

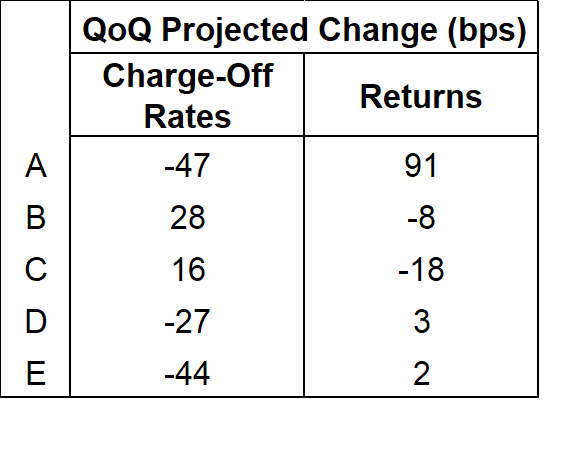

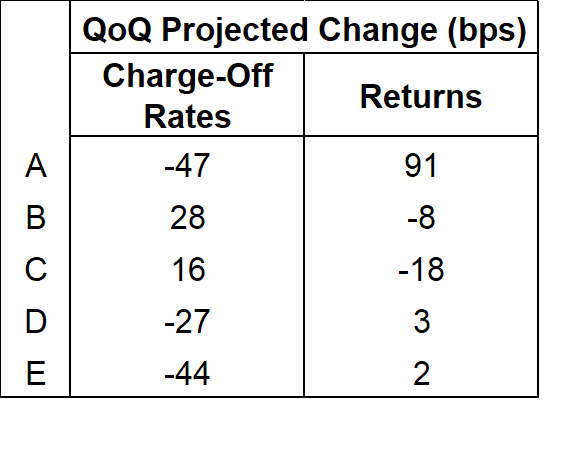

- Over the last 12 months LC has continued to tighten credit to reduce portfolio charge-off rates. The table below shows the QoQ change in the return and charge-off estimates across grades. Projected returns for grade A increased by 91 bps QoQ.

Source: LendingClub

- LendingClub ended the quarter with $514 Mn of cash and equivalents and no unsecured debt. LendingClub held about $459 Mn in loans on the balance sheet, most of which will be used future securitization programs. The CLUB Certificates program has raised more than $1 Bn in capital. LC issued a $270 Mn prime securitization this quarter.

- The investor presentation is here.

OneMain Earnings

- OneMain reported revenue growth of 15% YoY to $933 Mn and net income more than doubled YoY to $148 Mn.

- Originations this quarter were $2.9 Bn, of which 54% were secured, and receivables grew by 10% YoY to $15.8 Bn. OMF generated interest income of $933 Mn, up from $808 Mn YoY. OMF’s receivables portfolio yielded 23.7%, up from 23.4% YoY.

- 30 to 89-day delinquencies were 2.3% and 90+ delinquencies were 2.0%, near all-time lows. Provisions for loan losses increased by 5% YoY to $0.3 Bn and the total loss reserves increased by 1% to $0.7 Bn. The net charge-off rate dropped to an all-time low of 5.8%.

- OMF had $1.2 Bn of cash and cash equivalents and revolving conduit facilities of $5.8 Bn at the end of Q3. 50% of the company’s debt is secured. In 3Q, OMF net issued $700 Mn in unsecured notes and $900 Mn in ABS. Moody’s revised One Main’s outlook to positive.

- The investor presentation is here.

OnDeck Earnings

- Revenues at OnDeck grew by 23% YoY to $103 Mn, the first time that quarterly revenue exceeded $100 Mn. OnDeck also delivered net income of $10 Mn.

- OnDeck launched ODX, a Software-as-a-Service company, that will provide underwriting services to banks. ODX has already been working with JP Morgan and also announced a partnership with PNC. OnDeck is investing $15 Mn in strategic growth initiatives, two-thirds of which will be in ODX in 2019.

- OnDeck’s originations grew by 22% YoY to an all-time high of $0.6 Bn and the loan book grew by 16% to $1.1 Bn. OnDeck has navigated the rise in interest rates well with the Effective Yield on its portfolio rising by 340 bps YoY to 36.5% and the NIM increasing by 400 bps to 33%.

- OnDeck’s provision for loan losses decreased by 1% YoY to $40 Mn, while the loss reserve increased by 27% YoY to $134 Mn. Net charge-off rate decreased significantly from 16.9% to 11.1% YoY. The 15+ Day Delinquency Ratio dropped to an all-time low of 6.4% from 7.5% YoY.

- ONDK’s total debt was $771 Mn and cash and cash equivalents were $71 Mn at the end of Q3. OnDeck’s cost of funds dropped by 40 bps YoY to 6%. OnDeck closed an additional $175 Mn in credit facilities.

- The investor presentation is here.

Investors can analyze the credit performance of FinTech lenders on PeerIQ’s platform.

Reach out to learn more!

PeerIQ Mentions:

Industry Update:

- Fed Stands Pat on Interest Rates Ahead of Expected December Hike (Bloomberg, 11/8/18) The Fed reiterated its plan to raise rates for a fourth time in December.

- Consumer Credit Rose by Less Than Estimated in September (Bloomberg, 11/7/18) Consumer credit grew by $10.9 Bn in September to reach $3.95 Tn outstanding. Growth was lower than expected, as revolving credit shrunk by $312 Mn. The full report can be found here.

- JPMorgan Pulls Back on Some Types of Higher-Risk Consumer Loans (Bloomberg, 11/6/18) JP Morgan is pulling back from subprime auto and credit card lending to prevent higher losses when the credit cycle turns.

- Fintechs interested in OCC charter despite lawsuits: Otting (American Banker, 11/7/18) OCC chief Otting is confident of granting a FinTech charter to an online lender soon.

- Bank Policy Institute Letter on the Impacts of CECL (BPI.com, 10/17/18) The Banking Policy Institute set out its opposition to the implementation of CECL as it contends that it would undermine financial stability

- Enova Q3 results (Enova, 10/25/18) Enova’s revenues grew by 35% YoY to $294 Mn and net income was $15 Mn, compared to a loss in Q3 2017.

- GreenSky Q3 results (GreenSky, 11/6/18) GreenSky’s revenues grew by 29% YoY to $114 Mn and net income increased by 20% YoY to $46 Mn. The investor presentation is here.

- LendingClub Q3 results (LendingClub, 11/6/18) LendingClub delivered another quarter of record revenue of $185 Mn, an increase of 20% YoY. The investor presentation is here.

- OneMain Financial Q3 results (OneMain, 11/5/18) OneMain reported revenue growth of 15% YoY to $933 Mn and net income more than doubled YoY to $148 Mn. The investor presentation is here.

- OnDeck Q3 results (OnDeck, 11/6/18) OnDeck delivered record earnings of $10 Mn on revenues of $103 Mn, up by 23% YoY. The investor presentation is here.

- Small banks join forces to address fintech challenges (American Banker, 11/7/18) Alloy Labs is an alliance of a dozen community banks to explore FinTech opportunities.

- Synchrony has a lot to lose in fight with Walmart (American Banker, 11/2/18) Wal-Mart has challenged Synchrony’s underwriting criteria and the resulting high losses. Synchrony can potentially also lose the Sam’s Club account.

Lighter Fare:

Source: PeerIQ, Bank Policy Institute.

PeerIQ summarized CECL and how you can prepare in a prior newsletter. The Banking Policy Institute urges the Treasury to delay the impact of CECL to conduct further study. Banks signing the letter include virtually all of the nation’s largest originators of consumer credit risk.

Reach out to learn how PeerIQ can help comply with CECL valuation and loss-forecast requirements.

In this week’s newsletter we will analyze the earnings of FinTech lenders.

Mixed FinTech Earnings

We analyze the earnings of Enova (ENVA), GreenSky (GSKY), LendingClub (LC), OneMain (OMF) and OnDeck (ODK). All lenders delivered high-double digit revenue growth YoY. ENVA’s revenues grew 35% YoY, and GSKY’s revenue grew 29% YoY, albeit from a low base. Originations also grew by double digits YoY, with originations at GSKY growing by 33% YoY.

Credit performance remains on a solid footing driven by low unemployment and a strong economic growth. Growth in loan losses reserves is consistent with loan growth. Delinquency rates at OneMain and at OnDeck are close to their post-crisis lows.

Lenders have raised their borrowing rates, although well below the rate of Fed Rate increases leading to margin compression. In the last 12 months, LendingClub, for instance, has raised interest rates across the credit spectrum by between 49 bps and 114 bps, while the Fed has raised short-end rates by 100 bps. The flattening yield curve is raising the cost of borrowing on lenders’ credit facilities which are benchmarked to short-term interest rates. Overall, lenders and investors are experiencing margin compression. By contrast, large banks continue to issue deposits at ultra-low rates (< 6 bps for large money center banks) and have benefitted from rising rates.

Source: PeerIQ, Bank Policy Institute.

PeerIQ summarized CECL and how you can prepare in a prior newsletter. The Banking Policy Institute urges the Treasury to delay the impact of CECL to conduct further study. Banks signing the letter include virtually all of the nation’s largest originators of consumer credit risk.

Reach out to learn how PeerIQ can help comply with CECL valuation and loss-forecast requirements.

In this week’s newsletter we will analyze the earnings of FinTech lenders.

Mixed FinTech Earnings

We analyze the earnings of Enova (ENVA), GreenSky (GSKY), LendingClub (LC), OneMain (OMF) and OnDeck (ODK). All lenders delivered high-double digit revenue growth YoY. ENVA’s revenues grew 35% YoY, and GSKY’s revenue grew 29% YoY, albeit from a low base. Originations also grew by double digits YoY, with originations at GSKY growing by 33% YoY.

Credit performance remains on a solid footing driven by low unemployment and a strong economic growth. Growth in loan losses reserves is consistent with loan growth. Delinquency rates at OneMain and at OnDeck are close to their post-crisis lows.

Lenders have raised their borrowing rates, although well below the rate of Fed Rate increases leading to margin compression. In the last 12 months, LendingClub, for instance, has raised interest rates across the credit spectrum by between 49 bps and 114 bps, while the Fed has raised short-end rates by 100 bps. The flattening yield curve is raising the cost of borrowing on lenders’ credit facilities which are benchmarked to short-term interest rates. Overall, lenders and investors are experiencing margin compression. By contrast, large banks continue to issue deposits at ultra-low rates (< 6 bps for large money center banks) and have benefitted from rising rates.

Source: PeerIQ, Bloomberg, Capital IQ. Change shows the value in % difference since Q3 2017.

Stock price performance post earnings has been good in a relatively volatile market. Margin compression at GreenSky disappointed investors and the stock slid by over 35% after earnings. All other stocks gained post earnings with OnDeck up by nearly 33%.

Enova Earnings

Source: PeerIQ, Bloomberg, Capital IQ. Change shows the value in % difference since Q3 2017.

Stock price performance post earnings has been good in a relatively volatile market. Margin compression at GreenSky disappointed investors and the stock slid by over 35% after earnings. All other stocks gained post earnings with OnDeck up by nearly 33%.

Enova Earnings

Source: LendingClub

Source: LendingClub