Biden Calls For “Junk Fee” Crackdown; Housing Market Thaws; Treasury Prime Raises

By Cole Gottlieb

February 12, 2023

Happy Super Bowl Sunday,

Strong employment numbers could mean higher rates for longer. Housing market thaws. Biden calls for “junk fee” crackdown. Banks push back on credit card late fee cap. Treasury Prime raises Series C. Blip Labs raises $2.1Mn for embedded bill pay. Banks borrow more in fed funds as deposits run off. EWA provider offers gift card bonus. Robinhood pushes back on SEC efforts to crimp PFOF.

New here? Subscribe here to get our newsletter each Sunday.

Strong Employment Suggests Higher Rates for Longer

In normal times, a strong employment report is viewed as a positive. But as the Fed continues its battle against inflation, continued strong jobs numbers have taken on a different meaning. Fed Chair Powell and Minneapolis Fed President Kashkari both reiterated that stronger-than-expected employment numbers demonstrate that the Fed will need to hold rates higher, longer. A surprise jump in used car prices points to the unpredictability of some major drivers of cost pressures. All signs point to continued, albeit smaller rate hikes that will allow the Fed more time to assess their impact on inflation and the broader economy.

Image: Wall Street Journal

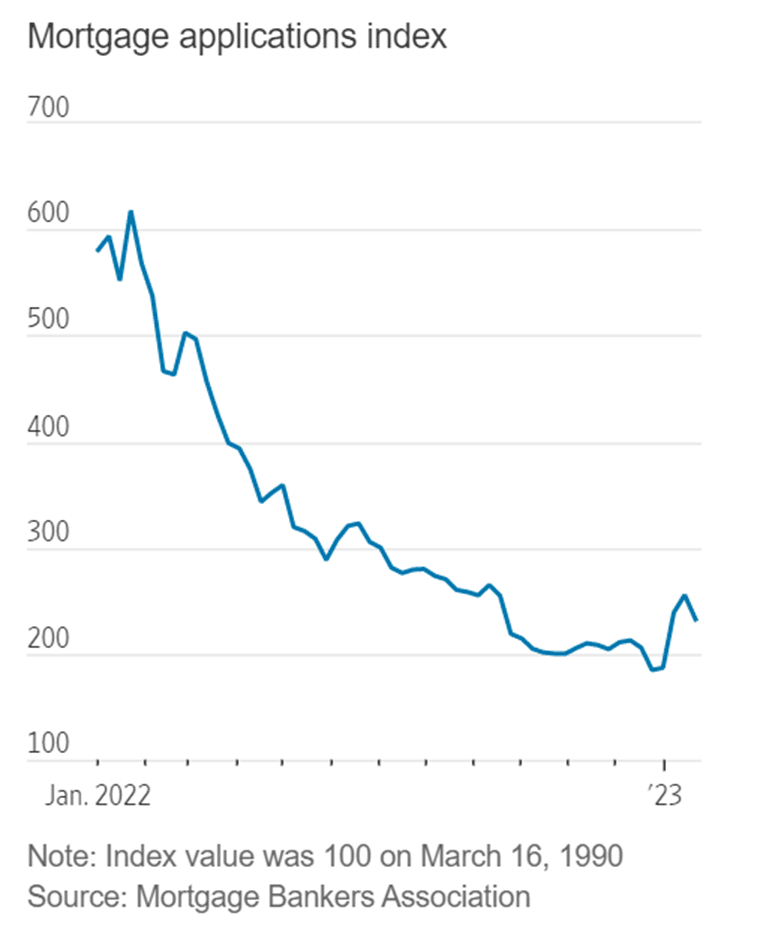

Meanwhile, there are some signs of a thaw in housing markets. Thirty-year mortgage rates touched a 20-year high in November above 7%, but they’ve since come down. Applications for purchase mortgages are up 15% since the end of last year, while refis are up 50%.

Biden Calls for “Junk Fee” Crackdown in SOTU

In his state of the union address last week, President Biden called on Congress to pass the Junk Fee Prevention Act. He also touted achievements in encouraging banks to lower overdraft and other service fees and referenced the recently released proposed rule from the CFPB to lower the “safe harbor” amount on credit card late fees from $30 to $8. As covered last week, the CFPB estimates its proposed rule would reduce late fee revenue by some $9Bn per year.

Banking trade groups, perhaps unsurprisingly, are not thrilled with the plan. Trade groups have argued such a drastic reduction in fee income would constrict access to credit, particularly for those with lower credit scores. They’re also contesting that the CFPB is proposing a significant rule change without input from a small business review panel. For its part, the CFPB says the rule would not impact a substantial number of small businesses.

BaaS Platform Treasury Prime Announces Series C

Banking-as-a-Service platform Treasury Prime announced it has raised a $40Mn Series C. While the company declined to reveal a valuation for the round, CEO Chris Dean did confirm it was “an up round” from its Series B fundraise in May 2021. The current round was led by BAM Elevate with participation from Banc Funds and Invicta, along with existing backers Deciens, QED, and SaaStr. While it’s unclear when the round was raised, it does suggest continued appetite for BaaS deals, despite a challenging fundraising environment and escalating regulatory scrutiny of the sector.

Blip Labs Raises $2.1Mn for Embedded Bill Pay

Embedded bill pay startup Blip Labs announced it has raised $2.1Mn. The New York-based startup builds developer tools that enable financial services companies to easily add bill pay capabilities to their apps or website without needing to build out custom connections to thousands of individual billers. Investors include Susa Ventures, Dash Fund, Shrug Capital, Wischoff Ventures, Picks and Shovels, Browder Capital, and Rief Ventures.

As Deposits Run Off, Banks Borrow

During the heights of the pandemic, many banks struggled to manage a glut of deposits. Now, the picture looks quite different. Consumers, especially lower-income households, have drawn down savings built up from stimulus measures. As rates have risen, higher-income and more rate-sensitive consumers have been more likely to move funds out of deposit accounts in search of better returns. The result? Banks are borrowing in fed funds markets in growing numbers. Borrowing this way hit $120Bn in late January, which is the highest single-day total since 2016.

Still, despite changing deposit levels and liquidity conditions, there aren’t major concerns yet, industry watchers say. Rather, this is a result of the Fed beginning to allow small amounts of its balance sheet to run off and overall tightening conditions.

EWA Provider Offers Wage Advance Onto Retailer Gift Cards

By definition, workers using earned wage access products are having difficulty meeting their day-to-day expenses. A new player in the EWA space, ZayZoon, has a novel approach to help these consumers stretch their pay a bit further. The company facilitates the disbursement of EWA funds onto retailer gift cards, with employees getting a bonus on top of the amount they choose to advance. For instance, if a user chooses to advance their pay to a CVS gift card, they’ll receive a 7% bonus. ZayZoon also supports traditional disbursements to worker bank accounts (for a $5 fee) or to a ZayZoon debit card for no fee. (PeerIQ has previously profiled the earned wage access market here.)

Robinhood Pushes Back on SEC Efforts to Curb PFOF

Pioneer of no-fee trading Robinhood is pushing back on an SEC proposal that it says threatens commission free trading. The SEC proposal would limit payment for order flow (PFOF) for orders executed in auctions to a max of $0.05 per 100 shares. This would have a significant impact on Robinhood’s revenue, given the company made on average $0.25-$0.44 per 100 shares for routing orders to wholesalers in December.

The SEC has been looking to crack down on PFOF, arguing it represents a conflict of interest for brokers. For its part, Robinhood says the proposal is a “backdoor attempt” to ban PFOF.

Earnings Coverage: ABS Markets Open, Credit Tightening and Cost Cutting

Source: PeerIQ

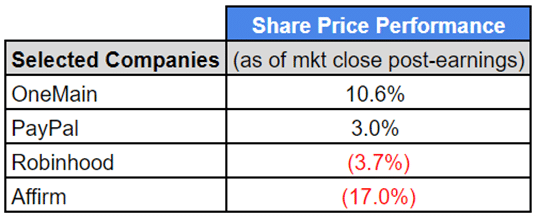

Affirm’s stock slid on earnings, after missing analyst revenue and EPS estimates. In its earnings announcement, the company reported plans to cut 19% of its workforce and to “sunset” its crypto unit, as it refocuses on its core business.

On the bright side, Affirm reported record GMV (+29% QoQ and +27% YoY), though GMV missed company guidance. And a disciplined credit approach helped delinquencies decline sequentially.

CEO Max Levchin is very bullish on Affirm’s Debit+ offering, stating, “And as we were looking at the usage and the fact that the product [Debit+] is so sticky, consumers would literally shift from using Affirm in any other mode to using the card the second they had access to it.” He also noted that, “Every class of transactions in Debit+ is profitable.”

However, investors are concerned with the company’s future ability to pass on increased funding costs to merchants and/or consumers. Management reported that its mix shifted to more interest-bearing loans and that the company retained more loans on its balance sheet.

There is still strong demand for Affirm’s loans, as the company recently closed a $500Mn ABS offering that was 3.3x oversubscribed (averaged across all tranches). Cost of funding has come down, with the offering closing at an average spread 100bps lower than a similar transaction pre-marketed in November 2022.

OneMain also closed an $800Mn ABS offering in December, describing “strong support from returning investors, while also attracting some new investors.” The lender has significantly tightened its credit box, which has led to a decline ((2)% sequentially) in originations. NCOs have continued to normalize, up 99bps to 6.88% for the quarter.

CEO Doug Shulman outlined the company’s plans to tighten credit, with, “To better illustrate the point on improved credit quality, I'll point out that our top two risk grades, those with the best credit quality and lowest risk customers make up about 60% of our new customer originations today versus just 37% in mid-2021.”

PayPal’s BNPL business has continued to grow processing roughly $7Bn during the quarter, compared to just $5Bn in Q3. While it has lost some BNPL market share in Australia, the company reported gaining significant market share in the U.S. as well as gaining or maintaining market share across Europe.

SVP of Corporate Finance Gabrielle Rabinovitch, explained that, “In 2023, we plan to externalize a meaningful portion of our Pay Later receivables portfolio, reducing our balance sheet exposure and securing a sustainable long-term funding partner for this part of our business.”

Robinhood reported that its Board approved a plan to buy back SBF’s Emergent Fidelity Technologies $587Mn stake in Robinhood (representing over 7% of shares outstanding). The ownership of the shares is still in flux, but the company is working with the DoJ on a plan to purchase them.

After a processing error that let customers short Cosmos Health led to a $57Mn loss, CEO Vlad Tenev made the decision to eliminate the executive team’s 2022 cash bonuses. Tenev and co-founder Baiju Bhatt will also cancel nearly $500Mn in stock-based compensation, “To ensure the company has as many resources as possible to deliver value to customers and shareholders.”

Monthly active users continued to slide, down to 11.4Mn, from 12.2Mn in Q3. Assets under custody dropped 4% sequentially to $62Mn, but with the January tech rally stood at $75Bn, the highest in nine months.

In the News:

Americans’ Economic Outlook Is Mostly Negative in Gallup Poll (Bloomberg, 2/6/2023) Roughly half of Americans see equities declining in the next six months.

California Agency Seeks to Block OppFi from Making New High-Cost Loans (American Banker, 2/2/2023) The California Department of Financial Protection and Innovation requested a preliminary injunction that would prevent OppFi from making loans with interest rates above 36% to California consumers.

Signature Bank Lawsuit Alleges It 'Substantially Facilitated' FTX Fraud (Decrypt, 2/7/2023) Statista claimed that plaintiffs "expressly" told the bank that suspicious funds transfers to Alameda initially were for FTX.

Oxygen Announces $20 Million Funding and Appointment of New CEO as Platform Doubles Down on Growth (Fintech Finance News, 2/3/2023) Oxygen is a digital banking platform that provides services to consumers and SMBs.

Ex-SoFi Boss Cuts Funding Targets for Blockchain Startup, Mulls Spinoffs (American Banker, 2/6/2023) Figure is seeking to raise $100Mn, just one-third of the sum it initially planned.

The Unusual Crew Behind Tether, Crypto’s Pre-Eminent Stablecoin (Wall Street Journal, 2/2/2023) Several years ago,a group of four men controlled 86% of Tether Holdings.

The Unlikely Crypto Companies Using the Trump-era 'Hot Money' Rule (American Banker, 2/6/2023) Critics say crypto-related companies are using a loophole to more freely place deposits at banks.

Gemini, Genesis Reach $100 Million Agreement Over Earn Program (Decrypt, 2/6/2023) DCG will exchange its $1.1Bn note for convertible preferred stock and refi its term loans.

Trustly Powers Real-Time Bank Account Payouts for Sportsbook Player Winnings (PYMNTS, 2/7/2023) - The real-time payouts are being powered by Cross River Bank and are deposited directly into users’ bank accounts.

Buy Now/Pay Lenders Lenders Focus on Niches Hit Hard by Inflation (American Banker, 2/8/2023) Lenders focus on niches like auto expenses and travel payments.

Lighter Fare:

SpaceX Put a Tesla Sportscar into Space Five Years Ago. Where is it Now? (CNN, 2/6/2023) The roadster has logged more than 2.5Bn miles in space.