CFPB Proposes NSF Fee Rule; ModernFi Raises $18.7Mn; Klarna Plans IPO

By Cole Gottlieb

January 28, 2024

Happy Sunday,

Consumers lean on their credit cards. The CFPB targets “junk fees”. DailyPay raises $175Mn. ModernFi raises $18.7Mn. Sunbit secures new debt facility. Klarna targets IPO, rolls out subscription service. TransUnion credit data. Earnings season continues.

New here? Subscribe here to get our newsletter each Sunday. For even more updates, follow us on LinkedIn (PeerIQ by Cross River).

Credit Card Debt, Delinquencies Edge Up

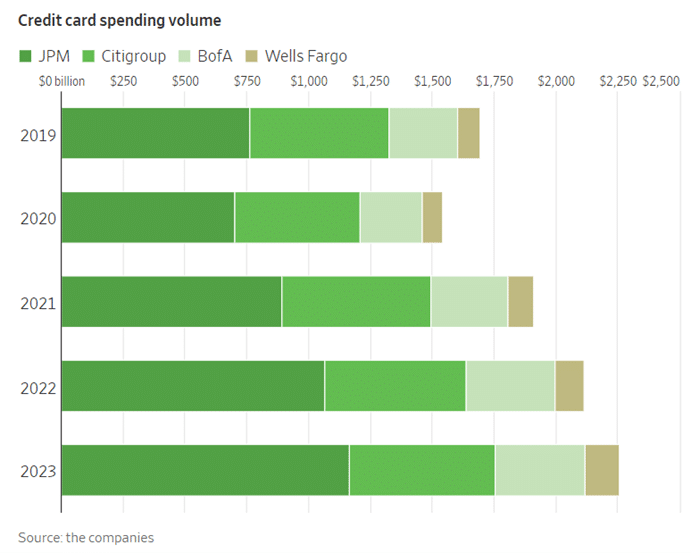

With household budgets stretched, consumers are putting more on their credit cards, and taking longer to pay it off. At the four largest U.S. banks, JPMorgan Chase, Citi, Bank of America, and Wells Fargo, credit card spending increased in 2023 vs. the year prior. Delinquency rates are also up. After bottoming out in Q4 2021, balances 30 or more days past due have steadily risen, eclipsing pre-pandemic levels by the end of last year.

Image: Wall Street Journal

Another CFPB “Junk Fee” Rule

The CFPB has been on a tear lately, introducing a number of proposed rules aimed at curbing “junk fees.” Fresh on the heels of a proposal designed to rein in overdraft fees, the Bureau has introduced a measure to prohibit banks from charging non-sufficient funds fees (NSFs) for certain transaction attempts. The latest proposed rule is quite narrow in scope. If finalized, it would prohibit all banks, not just those with more than $10Bn in assets, from assessing an NSF fee for transactions that are declined in real time, like debit card payments or ATM withdrawals that are declined when a customer doesn’t have adequate funds.

DailyPay Raises Fresh Funding

On-demand pay startup DailyPay announced it has raised a fresh $175Mn in debt and equity funding. $75Mn was equity in a round led by Carrick Capital Partners. The $100Mn debt is an expansion of an existing facility with Citi, bringing DailyPay’s total revolving capacity to $660Mn. The equity infusion values the company at $1.75Bn on a pre-money basis, which is a 75% increase over its prior valuation.

ModernFi’s $18.7Mn Series A

In the wake of this spring’s bank crisis, the previously boring topic of deposit insurance jumped to top of mind, especially for founders, VCs, and CFOs across Silicon Valley. Approaches to accessing FDIC coverage in excess of the typical $250,000 per depositor per bank have long existed, but many of the companies that operate in the esoteric space of deposit aggregation and sweep networks are relatively unknown. Now, a wave of startups are trying to find a better way to tackle challenges of deposit management. ModernFi, which provides end-to-end deposit management capabilities, announced it has raised a $18.7Mn Series A. The round was led by Canapi Ventures, with participation from Remarkable Ventures and a group of bank investors that included First Horizon, Huntington, and Regions.

Sunbit Inks Deal for New Debt Facility

Sunbit, a point-of-sale lending startup, announced it has secured a new $310Mn debt facility with Citi and Ares Capital Management. The company offers merchant-distributed financing for purchases from $500 to $10,000, repayable over 3, 6, or 12 months. Like other BNPL providers, Sunbit is also planning a card product, which will enable users to shop anywhere and pay for their purchase with a fixed-rate, close-ended loan that they repay over 3-12 months. As of 2023, Sunbit boasted over 2.6Mn loan customers and $1Bn of annual GMV.

Klarna Launches Subscription Service, Plots IPO

Is BNPL back? Klarna’s CEO Sebastian Siemiatkowski has been doing the rounds, floating that a Klarna IPO could happen “quite soon,” though he was quick to caveat that there is no set date. Siemiatkowski said the firm is leaning toward a U.S.-based listing, as it is the company’s largest market by revenue. As part of the plan to get ready for a public offering, Klarna announced the launch of a subscription offering in the U.S. The offering, dubbed Klarna Plus, costs $7.99 per month. In return, consumers get double rewards points, access to exclusive retailer deals, and can use 0% APR pay-in-four at merchants outside of Klarna’s network. For nearly $100 a year and relatively limited benefits, it’s not immediately clear how this is meaningful better than a good old rewards credit card.

Still, Klarna and the wider BNPL industry continue to face challenges. Some consumers who leaned heavily on BNPL over the holiday season have struggled with payments, at least according to anecdotal news reports. And while it feels like regulators have moved on to other topics, questions linger about BNPL providers’ approach to underwriting, sustained use, so-called “data harvesting,” and furnish data to the credit bureaus.

TransUnion Releases New Consumer Credit Data

TransUnion just released its monthly credit snapshot for December. In December, 60+ DPDs increased across the board (MoM) for Bankcard +8bps, Auto +6bps, Mortgage +4bps and Unsecured Personal Loans ("UPLs") +3bps. This marks the fifth consecutive month of DPD increases for all products.

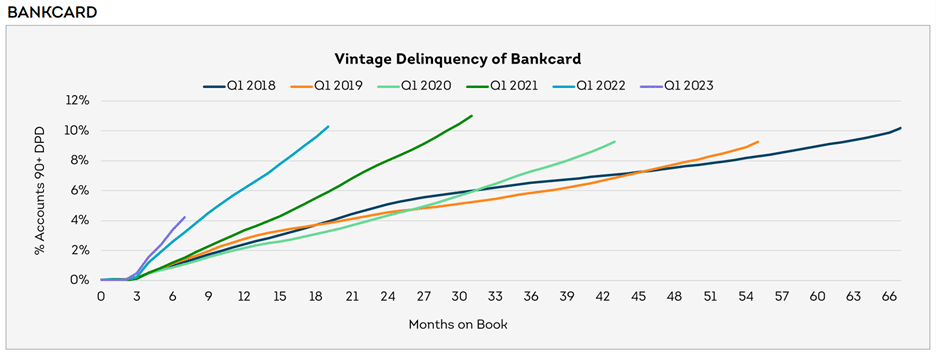

Looking at bankcard, 90+ DPDs rose 9bps MoM, marking a sixth straight month of increases and 30+ DPDs rose 11 bps marking a seventh straight month of increases. Q1 2023 vintage DPDs continue to track higher than Q1 2022 and well above Q1 2017-2020 vintages. Average bankcard balances rose +3.3% MoM, to $6,343.

Source: TransUnion

Turning to originations, we got information on UPL origination volume for the September 2023 – October 2023 period (lag due to reporting time). October MoM UPL origination growth was largely positive.

October fintech UPL originations increased by double-digits across most tiers (reversing the September trend) with super prime +36.7%, prime plus +33.2%, prime +22.5% and near prime +7.1% on a MoM basis. Subprime originations were down (2.2)% MoM. All risk tiers (outside of super prime) remain significantly below October 2022 levels, with prime plus (18.5)%, prime (45.3)%, near prime (59.4)%, and subprime (60.7)%. Super prime was up +11.5% YoY.

Credit unions reversed September's MoM UPL origination pullback reporting increases across the board, with super prime +8.1%, prime plus +5.7%, prime +2.3%, near prime +11.8%, and subprime +18.5%. On a YoY basis, super prime +19.6%, prime plus +9.2% and prime +0.1% originations were above 2022 levels, while near prime (4.6)% and subprime (14.5)% lagged.

Finance companies largely reported MoM UPL origination declines with subprime +6.0% the exception. Super prime was down (13.1)%, prime plus (8.6)%, prime (3.8)% and near prime (2.9)%. While prime originations were up +9.4% and near prime originations up +15.0% from Oct. 2022, super prime was down (9.4)%, prime plus (7.2)%, and subprime (1.2)%

Banks reversed September UPL origination declines, reporting October growth across super prime +4.7%, prime plus +2.7%, prime +3.1% and subprime +12.5%, while near prime fell (1.6)%. Bank originations were all higher than October 2022 levels, with super prime +26.4%, prime plus +5.2%, prime +6.3%, near prime +30.3% and subprime +25.4%

Finance companies maintained their lead in UPL balances, with 27.8% of the total in December. Fintech companies followed, accounting for 26.3%, while banks accounted for 25.7% and credit unions for 20.1%. Average UPL balances per consumer were down (0.1)% on a MoM basis, to $11,925 in December.

Earnings Season Continues

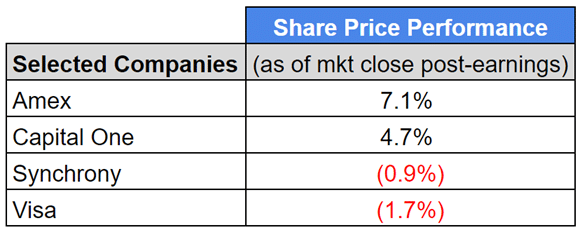

Source: Yahoo Finance

This week in earnings, Synchrony +4.0% and Capital One - Consumer Banking +1.4% reported sequential increases in deposits. This comes in contrast to the consumer divisions of JPMorgan (4.5)% QoQ, Wells Fargo (2.7)% QoQ, Bank of America (2.1)% QoQ, which reported declining consumer deposits. Consumers may have been swayed by Synchrony and Capital One’s attractive rates, with Synchrony paying an average yield of 4.42% (up 24bps QoQ) and Capital One’s Consumer Banking division paying an average yield of 3.06% (up 21bps QoQ).

Consumers have continued to break out their wallets, with Visa reporting an 8% YoY increase in payments volume, Amex reporting a 5% YoY increase in network volume, Capital One - Credit Card reporting a 4% YoY increase in purchase volume, and Synchrony reporting a 3% YoY increase in purchase volume.

Turning to credit, we continued to see NCOs rise, with Synchrony +98bps QoQ, Capital One - Credit Card +91bps QoQ, Capital One - Consumer Banking +52bps QoQ and Amex - Average Card Member loan net write-off rate +30bps QoQ.

Pay later options continue to be popular among consumers, with Amex CFO Christopher Le Caillec, explaining, “The biggest contributors in terms of loan balances are their pay overtime facility that we offered with our charged products and their co-brands cards.” Additionally, Synchrony CEO Brian Doubles, said, “We continue to scale our pay later solutions, which is now offered at over 200 provider locations in our health and wellness platform and at 18 retail partners…Since we launched, partners who have offered these [pay later] solutions have seen a 20% lift in new accounts, with 95% of pay later sales coming from net new customers.”

As we covered in last week’s newsletter, Synchrony agreed to acquire Ally Lending, Ally’s POS financing business. Synchrony CEO Brian Doubles commented on the transaction, saying, “Through this acquisition, Synchrony will create a differentiated solution in the industry, simultaneously offering both revolving credit and installment loans at the point-of-sale in the home-improvement vertical.”

Additionally, we covered Visa’s acquisition of Pismo last week, which should boost Visa’s capabilities in LatAm, Europe, and Asia-Pacific, including better support for real-time payments and emerging payment methods in those regions. Visa also reported on a study about U.S. tap-to-pay use. CEO Ryan McInerney reported, "In a recent Visa study in the US, we saw, on average, two more transactions a month and spend lift of $70 a month for those who tap with a Visa debit card versus those who don't tap.” It is interesting to see that tap-to-pay drives higher volume, on top of the additional security benefits it offers.

Hi all, Cole here. If you’ve made it this far, thank you for being a loyal subscriber to the newsletter. Looking for more updates on the companies covered during earnings season? Follow/connect with me on LinkedIn and join my Discord server for exclusive access to earnings updates (and archives), including bullet notes on important info from earnings releases, key quotes from earnings calls, and relevant slides from decks.

In the News:

More Workers Want to Change Jobs, but the Market Is Getting Tougher (Wall Street Journal, 1/22/2024) As the employment market has tightened, job hoppers are having a more difficult time finding new roles.

For Property Investors, the Price of Homes Is Still Not Right (Wall Street Journal, 1/23/2024) With high prices and high rates, investors have pressed pause on homebuying.

Senate Democrats ask regulators to probe Navy Federal (American Banker, 1/12/2024) Amid allegations of mortgage lending discrimination, Democrats are asking regulators to probe Navy Federal.

Bank of America, U.S. Bank fight back against 'Right to Gripe' suits (American Banker, 1/22/2024) BofA and U.S. Bank are pushing bank on plaintiffs’ lawsuits against the companies.

Bilt Nabs $3.1 Billion Valuation, Ken Chenault Joins as Chairman (Bloomberg, 1/24/2024) Rewards card startup Bilt scored a $200Mn equity investment at a $3.1Bn valuation.

Nearly 40% of Consumers Say No to Pay-by-Bank Payments Even With Incentives (PYMNTS, 1/22/2024) According to a PYMNTS survey, some consumers can’t be swayed to use A2A payments.

LoanDepot says 16.6M customers had ‘sensitive personal’ information stolen in cyberattack (Techcrunch, 1/22/2024) The company, which has suffered a drawn out cyber attack, said over 16Mn customers had data compromised in the breach.

Revolut hires lobbyist in bid to end banking license limbo (This Is Money, 1/21/2024) Revolut is still trying to close the deal on getting its U.K. bank license.

Inside Amex's global merchant strategy (American Banker, 1/22/2024) Amex is counting on a strong ground game to close its gap in merchant coverage vs. Visa, Mastercard.

How Apple's new payment fees portend more legal fights (American Banker, 1/21/2024) Apple’s response to developments in its legal battle with Epic Games suggest more lawsuits are likely.

Grow Credit Expands Banking Relationship with Wells Fargo to Support Its Financial Inclusion Capabilities (Yahoo, 1/23/2024) Grow Credit and Wells Fargo announced a partnership on depository and treasury services.

Grayscale Led the Fight for Bitcoin ETFs. Now Its Fund Is Bleeding Billions. (Wall Street Journal, 1/23/2024) Since Grayscale’s conversion to an ETF, investors have cashed out billions.

Brex cuts 20% of staff amid reports of stalled growth, high burn (Techcrunch, 1/23/2024) Spend management and charge card startup Brex has laid off 20% of staff in an effort to get its high burn rate under control.

Debate Over Debit Interchange Caps Set to Heat Up as Commentary Deadline Is Pushed Out (PYMNTS, 1/24/2024) The Fed has pushed out its deadline for filing comments on its new debit interchange cap proposal.

Lighter Fare:

The 13 biggest food trends for 2024, from fig leaves to world whisky (NatGeo, 1/20/2024) What’s on culinary trend for 2024? Hot sauce, world whiskeys, and modern martinis.