Consumers Tap Savings; Fed Seeks Regional Presidents; Tax Startup Raises $30Mn

By Cole Gottlieb

July 10, 2022

Greetings,

Despite continued negative economic news, unemployment remains low. Commodity prices fall. Another 75 bps rate hike in the works? CFPB terminates Payactiv sandbox approval. Fed seeks new regional presidents. Tax startup April raises $30Mn. Commercial depositors want higher rates. Klarna valuation sinks lower. Openpay exits the U.S. Partnership enables community bank credit cards.

New here? Subscribe here to get our newsletter each Sunday.

Despite Negative Economic Sentiment, Job Market Remains Strong

If the U.S. is in a recession, it’s a weird one. Although it feels like the sky is falling, and economic output has contracted, the job market remains strong. Unemployment fell from 4% in December to just 3.6% in May.

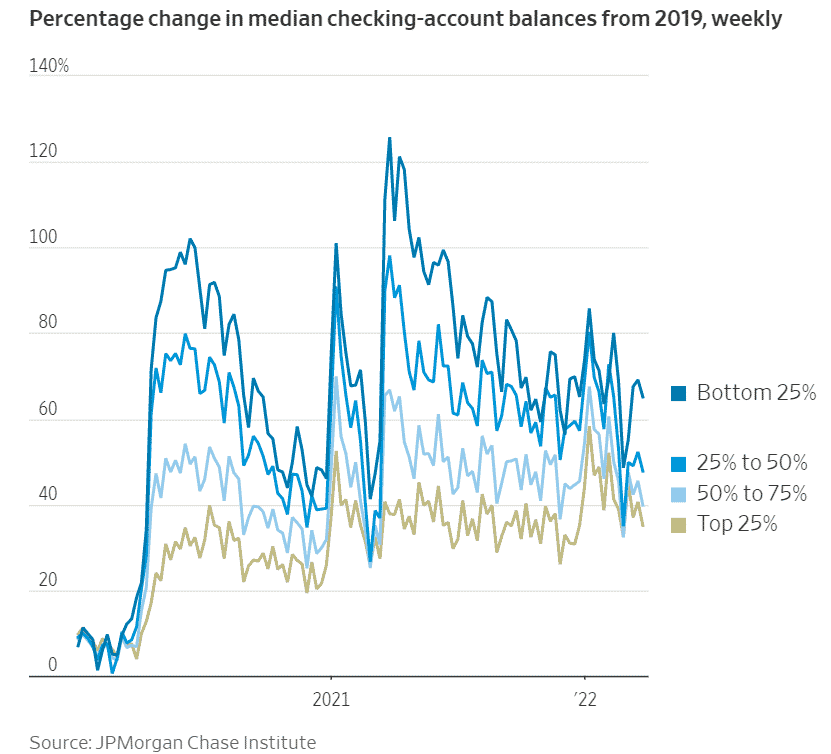

As inflation has pushed prices higher, Americans have tapped their savings to cope. While consumers’ account balances have dipped from pandemic highs, they remain above where they were in 2019. JPMorgan Chase CEO Jamie Dimon said last month that American consumers have 6-9 months of spending power, given current trends.

Image: Wall Street Journal

Falling commodity prices are raising hopes that the peak of inflation is behind us. Still, minutes from the Fed’s most recent meeting suggest another 75 bps rate hike is likely later this month.

CFPB Terminates Payactiv’s Sandbox Approval Order

The CFPB has terminated earned wage access company Payactiv’s “sandbox approval order.” The order, granted as part of the CFPB’s now defunct fintech sandbox program, gave Payactiv special regulatory treatment by temporarily exempting it from liability under TILA Reg Z. Friction arose between the CFPB and Payactiv over the company’s use of language describing its products as “CFPB-approved.”

Ultimately, Payactiv requested the order be terminated to allow it to more easily make changes to products without needing review and approval from the CFPB. The CFPB rescinded the approval order on June 30th.

Fed Seeks New Regional Presidents Amid A Volatile Climate

The Kansas City and Chicago regional Fed banks are seeking new presidents. The current heads are both shortly turning 65 and must retire, per Fed rules.

The search comes at a time of increased scrutiny of the Federal Reserve System. The central bank is facing calls for increased transparency and reform on a number of topics from both sides of the aisle.

Policies governing access to Fed master accounts for fintech and crypto companies remain a hot-button issue. Lack of diversity across the Fed system has caught the attention of lawmakers. Legislators have pressed the regional Fed banks, a public-private hybrid, for greater accountability. And the Fed is still dealing with fallout from last year’s stock trading scandal.

Even once new Fed presidents are selected for Kansas City and Chicago, pressure to answer these questions will remain.

Embedded Tax Startup April Raises $30Mn

April, a personal income tax platform that can be embedded into other financial apps, has raised a $30Mn Series A. The new funding brings the startup’s total equity raised to $40Mn since its launch in January 2022. The funding round included participation from investors like QED, Nyca Partners, Team8, and Euclidean Capital. April plans to use the new capital to continue developing its platform capabilities and to increase its operational capacity.

April’s fundraise demonstrates that, although fintech VC funding has slowed, the right team tackling the right problem can still raise funds.

Commercial Depositors Want Higher Rates

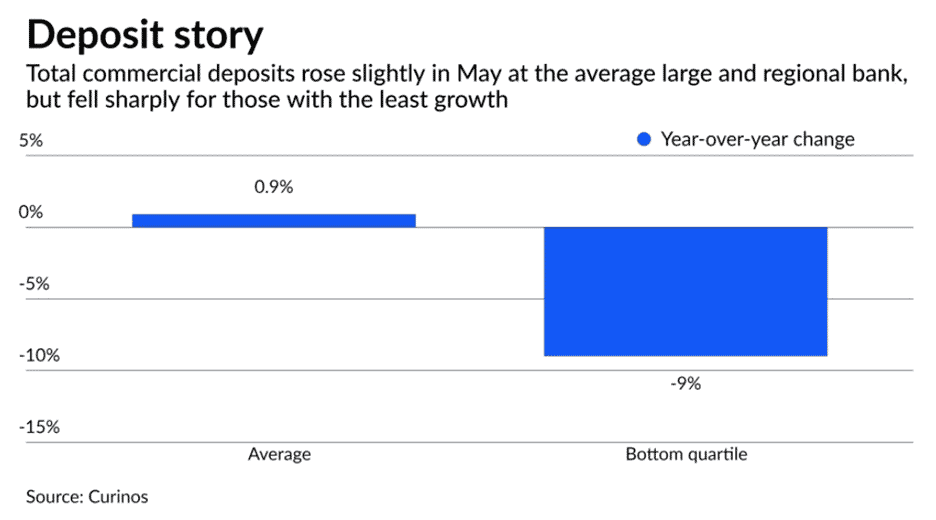

With interest rates quickly rising, some commercial depositors are pushing banks to pay more on their deposits. While, overall, business deposits remain elevated compared to last year, smaller banks are seeing commercial deposits shrink. Banks that serve corporates’ operational needs, like payroll and supplier payments, have seen less outflow than those banks that rely on non-operational deposits.

The upshot? As some businesses seek out higher rates on their deposits, banks may see their cost of funds rise, eating into their net interest margin and profits.

Image: American Banker

Klarna Valuation Sinks Even Lower

What goes up must come down? We’ve been keeping tabs on Klarna’s efforts to raise new funding. According to press reports over the past several months, the BNPL startup, once valued at nearly $46Bn, has seen its valuation progressively pushed lower as negotiations for new funding unfolded.

Now, Klarna is reportedly close to finalizing new funding of about $650Mn – at a valuation of just $6.5Bn. The majority of the new funding is said to come from existing investors, led by Sequoia. Part of the negotiation reportedly included Klarna’s approach to the all-important U.S. market. It’s unclear if the company will continue its aggressive (and expensive) push to capture U.S. market share.

Openpay Presses Pause on U.S. Operations

In other BNPL news, Australian BNPL provider Openpay announced it is pulling out of the American market.

Citing the “current macroeconomic and public market conditions,” along with the capital that would be required to compete effectively, the company said it would “pause” its U.S. operations indefinitely. The company will reduce its employee base in the U.S. as part of winding down the business. Exiting the U.S. will allow Openpay to better focus on its home market of Australia, company CEO Dion Appel said.

Corserv and Bank of Missouri Launch Community Bank Card Offering

The Bank of Missouri and Corserv, a card issuer, announced they are partnering with Visa to enable community banks to launch consumer and business credit card programs. The goal of the partnership is to allow smaller, local banks to expand their businesses into the card space, without needing incremental tech infrastructure or staff. Community banks will be able to leverage existing customer account and relationship data for marketing and credit decisioning.

Under the partnership, the Bank of Missouri will supply the BINs and sell the card purchase volume to participating banks, which will receive all interchange, interest, and fee income associated with cardholder accounts.

In the News:

Bill to Grant Crypto Firms Access to Federal Reserve Alarms Experts (Washington Post, 7/3/2022) A provision would let the Fed grant master accounts to certain crypto firms seeking them.

Amid ‘Whiplash’ at OCC, Hsu Expects to Serve for ‘Foreseeable Future’ (American Banker, 7/5/2022) The OCC has been without a Senate-confirmed leader since Joseph Otting left in May 2020.

DeFi Is Real, Whatever Happens To Cryptocurrency (Forbes, 7/4/2022) Jamie Dimon, JPM CEO and bitcoin skeptic, explicitly states “DeFi and blockchain are real.”

Meta is Pulling the Plug on its Crypto Payments Wallet, Novi (Tech Crunch, 7/4/2022) The move comes 3 years after Facebook announced its push into crypto with the Libra project.

Crypto Lender Celsius Cuts 150 Jobs Amid Restructuring: Report (CoinDesk, 7/4/2022) Withdrawals remain paused as the company cuts ~23% of its headcount.

Celsius Repays $183M on DeFi Exchange Maker, Gets Back Collateral, Blockchain Data Shows (CoinDesk, 7/5/2022) The latest move frees up ~$40Mn of wrapped bitcoin that Celsius had posted as collateral.

BMO Harris Hops on Overdraft Fee-Cutting Bandwagon (American Banker, 7/1/2022) The U.S. arm of BMO announced it will reduce overdraft fees from $36 to $15.

Why Glitches like Bread’s Payment Outage are Riskier Now (American Banker, 7/1/2022) Bread’s subsidiary’s online credit card bill payment went offline, leaving some customers unable to pay their bills online for a few days.

Lenders' Use of Rent Data in Loan Decisions Helps Homebuyers, but Dangers Lurk (American Banker, 7/5/2022) While rent data may help some with low or no credit score, it has to be implemented carefully, as it may end up hurting those with currently stable income streams who have missed rent payments in the past.

Lighter Fare:

A 76 Million-Year-Old Dinosaur Skeleton Will be Auctioned in New York City (NPR, 7/5/2022) For an estimated $5-8Mn, you can own the only privately available Gorgosaurus skeleton.