Dave SPAC Deal; Inflation Fears Con’t; Job Openings Climb

By Tito Donis

June 14, 2021

Greetings,

This week, inflation pressures continue, and employment indicators improve. Consumer credit expands, slightly. Corporate treasurers are holding too much cash. Fintech-SPAC dealmaking remains active. And some banks begin offering the fintech-like feature of early direct deposit.

New here? Subscribe here to get our newsletter each Sunday.

Inflation Fears Continue; Could It Pave the Way for Higher Rates?

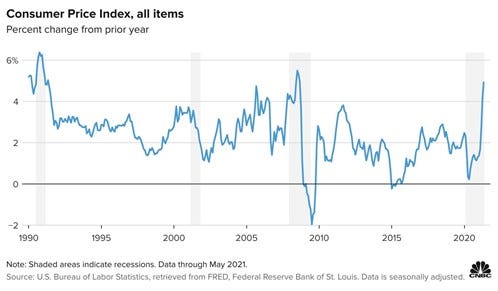

Consumer prices in May rose 5% vs. the year prior — the fastest pace since August 2008. The rate excluding food and energy prices was 3.8%. The year over year increase may be somewhat overstated, as consumer prices dipped in the months after the pandemic began.

Increasing used car prices were a major driver of the elevated inflation numbers. Used car and truck prices have risen 29.7% in the past 12 months. Commodities like lumber, iron ore, corn, and copper have also seen prices jump, though these tend to make up a small portion of consumer prices.

Commenting on the risk of inflation and higher interest rates last week, Treasury Secretary Janet Yellen said, “We’ve been fighting inflation that’s too low and interest rates that are too low now for a decade.”

The statement indicates a historically new approach to the Fed. Namely, a willingness to tolerate higher inflation so that the long-term inflation rate clocks in at 2%.

Given the drivers of price increases, we continue to expect the current elevated rate of inflation to be transitory.

We view near-term rate increases as unlikely, especially as the Fed has committed to only begin scaling back its $120Bn per month asset purchases once further progress is made on employment.

Job Openings Climb While Unemployment Claims Drop

Job openings continue to climb in April, hitting a record high of 9.3Mn. The number of employees voluntarily quitting also rose to 4 MM, indicating workers’ confidence in their ability to find new, better jobs. New unemployment claims have continued to decline, hitting a pandemic low of 376,000 last week.

As a result, employers continue to face hiring challenges, with many raising wages, adding benefits, and even offering signing bonuses. To encourage people back into the labor market, half of US states plan to discontinue supplementary federal unemployment programs early. If the remaining states continue the extra benefits until their scheduled end date, it should provide an interesting natural experiment on the benefits’ impact on employment. We’ll follow the data.

As additional unemployment support begins to end, health fears wane, and childcare normalizes, we expect those on the sidelines to continue returning to the workforce.

Consumer Borrowing Increases, Driven by Auto and Student Lending

Overall consumer borrowing increased by a modest $18.6Bn in April, an annualized growth rate of 5.3%. The increase was driven primarily by increased auto and student loans, with non-revolving debt increasing at 7.6%. Revolving debt decreased by an annualized -2.4% in April.

The increase in auto lending is consistent with pandemic shifts in consumer preference to avoid public transportation and the rising cost of new and used vehicles driven by supply shortages. As the economy continues to reopen and the employment picture improves, we expect lenders to loosen underwriting criteria in order to put more capital to work.

Keep on top of how the evolving economic climate is impacting credit origination volume with PeerIQ’s best-in-class loans analytics platform for originators and buyers. Reach out to sales@peeriq.com to learn more about what we’re building.

Excess Deposits Weigh on Bank Balance Sheets

Still rattled by the uncertainty of the pandemic, corporates are continuing to hold excess cash on their balance sheets. Corporate treasurers are prioritizing the safety of cash over yield. This is posing a problem for banks, which are struggling to deploy the deposits as loans.

Further complicating matters, a temporary pause on regulations requiring banks to hold capital equivalent to at least 3% of total assets expired in March. Faced with the prospect of needing to raise additional capital, some banks are encouraging corporate clients to spend or move assets into money market accounts or to another bank altogether.

We expect some of this pressure on banks to dissipate as businesses increase spending with the reopening economy and as opportunities to deploy deposits as loans improve.

Banks Look to Fintech Features to Stay Competitive

Part of the early appeal of challengers like Chime and Varo was their willingness to forgo fees common at big banks and offer novel features, like early direct deposit. The feature encourages users to direct their payroll to challenger banks, driving a higher share of wallet and more interchange revenue.

Seeing challenger banks’ growing number of users and ballooning valuations, some banks are beginning to respond. In recent months, a number of banks have announced reduced- or no-fee accounts and initiatives to help consumers avoid overdrafting. Last week, Ally Bank announced it’s eliminating overdraft fees altogether.

Now, a handful of banks, including Capital One, OneUnited Bank, and a number of credit unions are following challengers’ lead and making their customers’ payroll available early. The feature is made possible due to the delay between when a payroll processor, like ADP or Paychex, sends a payment file to a bank and the effective settlement date. Fintechs and banks that offer “early” pay are making the funds available upon receipt of the file, rather than waiting for the settlement date to release funds.

This is a great example of the profound and disproportionate impact that fintech is having on the banking system. Like trading fees before overdrafts, fintechs are pushing everyone to offer better deals to customers. Reducing overdrafts fees for banks will also help answer renewed regulatory scrutiny of their practices. Happily, consumers are the ultimate winner here.

SPAC Values Neobank Dave at $4Bn

Banking app Dave announced its intention to merge with a SPAC sponsored by Victory Park Capital in a deal valuing the fintech at approximately $4Bn. Dave offers consumers not well served by the traditional banking system spending, overdraft, and credit building products.

Dave is Victory Park’s second SPAC deal this year. In January, crypto marketplace Bakkt announced a $2.1Bn deal with another VPC vehicle, underlining how Crypto Payments (e.g., stablecoins, and DeFi lending) is increasingly FinTech 3.0.

Despite heightened regulatory scrutiny, SPACs are still a viable route to the public market for fintechs, with major deals this year including SoFI, MoneyLion, OppFi, and Acorns. Attractive targets remain, with well-established startups like Prosper and Upgrade still privately held.

That said, with around 50 fintech-focused SPACs looking for deals, it’s not clear to us that there are that many private fintechs at sufficient maturity to make attractive merger targets. The potential mismatch between capital available and suitable deals should be constructive for fintech valuations.

Walmart Continues to Expand Financial Offerings

Walmart has long partnered with others, like Green Dot and American Express, to offer financial services to its customer base. Earlier this year, the retailer announced a new consumer-focused fintech initiative with Ribbit Capital.

The latest example of its commitment to financial services is its improvement of in-store bill pay by extending the functionality of its partnership with Green Dot Network by bringing onboard payments platform PayNearMe. The combined service allows a user to pay their bills with cash at 4,000 Walmart stores by scanning a biller code rather than needing to supply more detailed biller information and their account number.

Walmart’s expanding financial services offerings make sense, given its customer base of lower and moderate income consumers in suburban and rural geographies. Offering financial products and services give its consumers a reason to come in to the store while also enabling their spending. We see future potential of bundling financial offerings into Walmart+, its Amazon Prime competitor, to create the type of recurring revenue and platform lock-in Amazon has so successfully achieved.

In the News:

Crypto Lender BlockFi in Talks to Raise Funding at $5 Billion Valuation (The Information, 06/09/2021) VC interest in crypto overrides crypto crash, as BlockFi looks to raise several hundred million dollars just three months after its last round, and at a valuation 70% higher.

Credit Sesame Raises $51 Million, Acquires FinTech Software Platform (PYMNTS, 06/08/2021) The financial wellness platform has seen its premium subscriptions grow by 200% annually.

Trulioo Raises USD $394M in Series D; at $1.75 Billion Valuation (FINSMES, 06/09/2021) The Vancouver-based global ID verification company raised a $394MM funding round, led by TCV.

Berkshire Hathaway to Buy $500 Million Stake in Brazil’s Nubank (Wall Street Journal, 06/09/2021) Brazil’s largest digital bank raises its largest single investment, valuing the company at $30Bn.

Inside Credit Suisse’s $5.5 Billion Breakdown (Wall Street Journal, 06/07/2021) Archegos’ implosion reveals Credit Suisse’s risk-management systems left the bank vulnerable and overexposed to individual companies.

Amazon Taking Bids To Replace Co-Branded JPMorgan Card (PYMNTS, 06/09/2021) AMEX and Synchrony bid for Amazon’s credit card business, which generates spending of $50Bn a year.

Lighter Fare

Jeff Bezos Will Fly on the First Passenger Spaceflight of his Company Blue Origin in July (CNBC, 06/07/2021) $BEZOS to the moon? Billionaire to take first passenger flight offered by his space company, Blue Origin.