Fed Presses Pause; Pagaya’s 7th ABS Deal; Cross River & Momnt Team Up

By Cole Gottlieb

June 18, 2023

Happy Sunday,

Inflation cools. Fed pauses on rate hikes. Renters get a break. CFPB pushes ahead with open banking rules. FIS acquires BaaS platform Bond. Lower credit card late fees are no free lunch. PayPal SMB lending fills bank branch gap. Pagaya announces seventh ABS deal this year. Cross River and Momnt announce partnership.

New here? Subscribe here to get our newsletter each Sunday. For even more updates, follow us on Linkedin (PeerIQ, a Cross River Company).

Inflation Cools, Rate Hike Pause

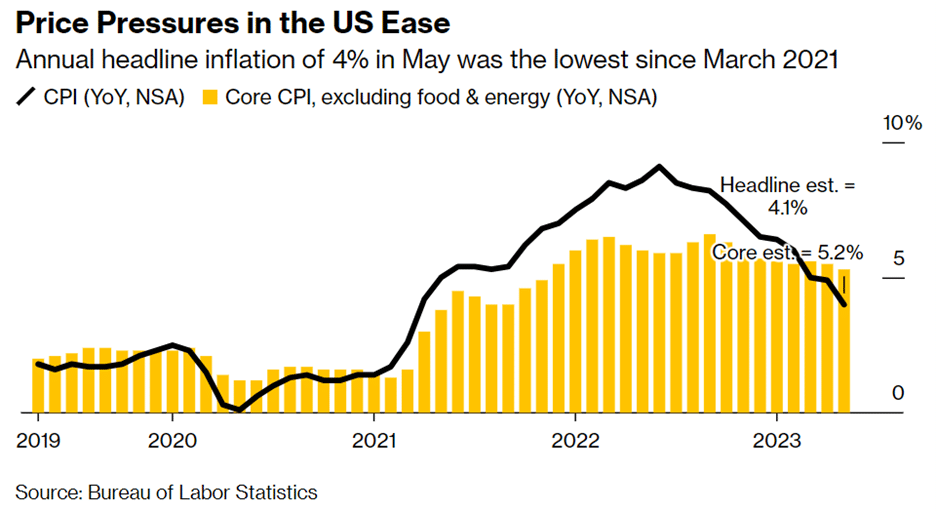

U.S. inflation slowed in May, with prices up a more modest 4% year over year. That’s the slowest rate of inflation since March 2021 and slightly below what was expected for the month. Cooling inflation has given the Fed cover to take a pause on rate hikes. After 10 straight increases, the Fed held rates steady at its most recent meeting. But the central bank is seeking to make clear that its work isn’t yet done. It’s still projecting two additional rate hikes this year.

Image: Bloomberg

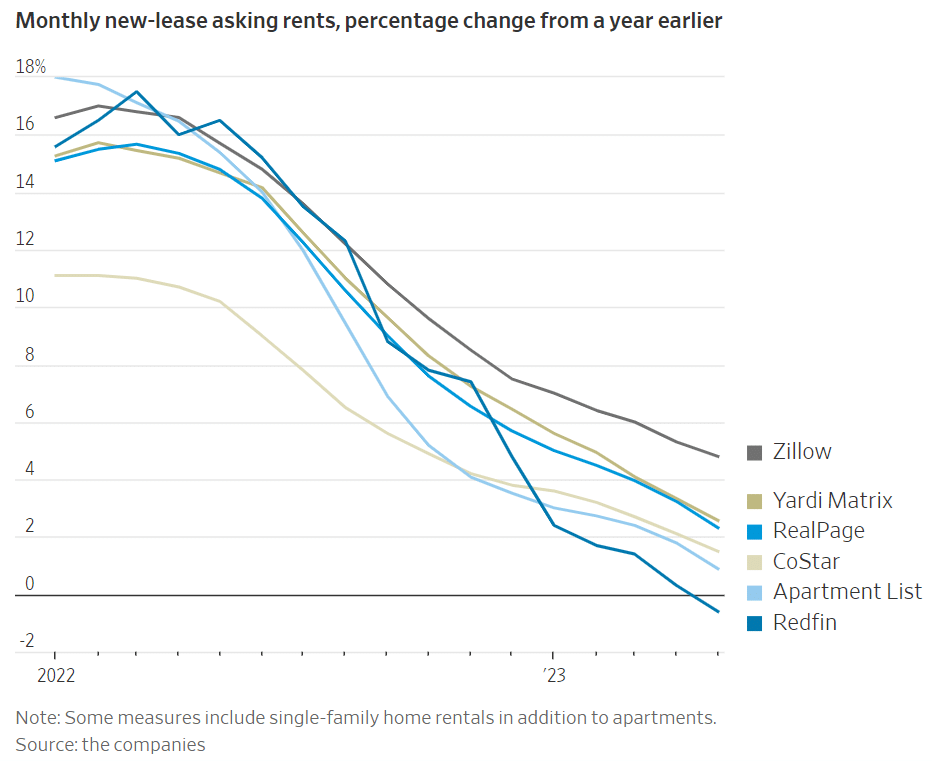

In what’s surely welcome relief for renters, price hikes have slowed considerably. New lease asking rents rose less than 2% in the last twelve months through May. And new lease rents are expected to fall on an annual basis for the first time since 2008.

Image: Wall Street Journal

CFPB Expects Final Open Banking Rules In 2024

The CFPB is slowly but surely advancing its agenda when it comes to open banking. Director Chopra outlined the bureau’s timeline in a blog post last week, saying it expects to release a proposed rule in the coming months and to finalize one in 2024. The rule, often referred to as “1033” for the section of Dodd-Frank that calls for it, has been a long time coming. The bureau hopes that requiring banks to enable consumers to share their data will promote competition, especially with the largest financial institutions.

Meanwhile, Chopra took aim at P2P payment platforms during his testimony in front of the House Financial Services Committee last week. Chopra argued that financial institutions aren’t working quickly enough to implement changes to protect consumers and make them whole when they fall victim to scams. Chopra specifically pointed to EWS-operated Zelle and PayPal-owned Venmo, saying they need to make sure they’re following the law as well as updated rules that they control.

FIS Acquires Bond

Banking and payments services behemoth FIS has acquired banking-as-a-service platform Bond, according to reports from Fintech Business Weekly’s Jason Mikula, and confirmed by TechCrunch and others. Bond’s client roster includes neobanking, lending, and payments companies such as College Ave, Squire, FloatMe, Atomic, Staq, Flutterwave, and others. Coatue Management led Bond’s last financing round, which valued the company at $182Mn.

FIS and Bond have not publicly confirmed the acquisition nor terms of the deal. The acquisition is the latest sign of cooling fintech markets spreading beyond consumer companies to “picks and shovels” players. Additional consolidation in the BaaS platform space and more broadly in “fintech infrastructure” is likely in the coming months.

Lowering Credit Card Late Fees Won’t Be Without Consequences

Card issuers, understandably, aren’t happy about the CFPB’s push to cap credit card late fees at a relatively paltry $8. That would represent a steep cut from the $30+ most issuers charge for first-time late fees, and penalties that can rise above $40 for subsequent late payments. Card issuers say late fees serve as a motivator for cardholders to pay on time. Citi and Synchrony may provide examples of how the industry could respond to late fee caps.

Citi’s Simplicity card has no late fees, but it also has no rewards. Synchrony, a major private label and co-brand issuer, derives a greater share of revenue from late fees, which it shares with retail partners. Possible reactions to lower late fee revenue include adding or increasing annual membership fees, increasing APRs, reducing credit lines, limiting lending to riskier borrowers, or experimenting with new pricing strategies to deter late payments.

PayPal Lending Fills Bank Gap

PayPal is filling a credit gap for SMBs in areas banks are retreating from, the company says. Some 54% of the total value of PayPal Business Loans and PayPal Working Capital originations went to businesses in ZIP codes where 10 or more bank branches closed between 2017 and 2021. Over 66% of PayPal-originated loans went to low- and middle-income areas, and 33% of credit went to SMBs in majority-minority communities. Average loan sizes have also grown, from $28,000 to $42,000, over the past five years.

Pagaya Seals 7th ABS Deal

Lending platform Pagaya announced the closing of its seventh ABS deal this year. The $541Mn deal brings its total raised so far this year to some $3.4Bn. The company is currently the top issuer of unsecured personal loan-backed ABS transactions in the U.S. The deal comes at a time of tightening credit and rising costs of funding that have put pressure on the business models of many non-bank lenders.

Cross River Partners With Momnt

Cross River Bank and Momnt, which powers real-time lending and payments for businesses at the point of need, announced their new partnership last week. Momnt’s platform connects lenders with borrowers via its merchant network, which is primarily focused on the health care and home improvement industries. The partnership with Cross River will enable merchants on Momnt’s platform to offer a wider array of loan options and serve more consumers.

In the News:

Stablecoin Bill Moves Closer to Bipartisan Agreement in House (American Banker, 6/9/2023) The new draft merges in some Democratic priorities, such as giving the Fed the power to write requirements for issuing stablecoins.

Colorado Residents Could Soon be in a Mountain of Hurt When it Comes to Access to Credit (Fintech Nexus, 6/9/2023) A new bill would have Colorado opt out of DIDMCA, which allows state-chartered banks to export interest rates permitted in their home states.

OCC Seeks Public Comment on ‘Trust in Banking’ Survey (Banking Dive, 6/12/2023) The OCC is seeking comment on a proposed annual survey to understand, measure, and track the public’s trust in banking and bank supervision.

Why Apple Pay Later is the Tortoise in the Buy Now/Pay Later Race (American Banker, 6/9/2023) Apple Pay Later targets users solely through the iPhone's digital wallet.

Big Commercial Real Estate Downturn Could Sink 300+ Banks: Report (American Banker, 6/9/2023) More than 300 banks have enough commercial real estate loans on their books to see their Tier 1 capital wiped out under a worst-case scenario, said Richard Barkham, chief economist and head of research at CBRE.

Top Banks Under $2B: Leading Small Banks Ride NIM Strength (American Banker, 6/12/2023) University Bancorp, Oregon Bancorp and FinWise Bancorp retained the top three spots for publicly traded community banks with under $2Bn of assets.

GoCardless to Cut 17% of Staff (Finextra, 6/13/2023) About 135 roles will be eliminated.

BofA Eyes Seven New Markets, Including New Orleans and Milwaukee (American Banker, 6/13/2023) The bank currently operates in 83 of the top 100 markets, and plans to increase that number to 90 by the end of 2025.

Credit — Not Cash — for Gold? A Secured Card Tackles Pawn Loans (American Banker, 6/13/2023) Pesto provides a way for consumers to rebuild credit by shipping their valuables to the firm as collateral to obtain a secured Mastercard.

The Hidden Risks Of BaaS And Embedded Finance: Inside Apple’s Struggle (Forbes, 6/14/2023) BaaS providers have to consider customer support, flow of funds and compliance requirements.

SMB Lending Fraud Keeps Growing – How can Lenders Protect Themselves? (Tearsheet, 6/14/2023) Fintech lenders, in particular, face the threat of SMB lending fraud.

Regional Banks Face Years of Trouble (Wall Street Journal, 6/14/2023) Regional banks will be focused on strengthening their balance sheets and trying to keep depositors and regulators happy.

Lighter Fare:

The Horse Isn't Real. People Are Betting on It Anyway. (Vice, 6/13/2023) Inside the world of virtual sports betting.