Fed Steps Up Regionals Oversight; Grayscale’s ETF Win; Goldman Nears GreenSky Sale

By Cole Gottlieb

September 3, 2023

Happy Labor Day weekend!

The U.S. job market seems to be cooling. Consumer confidence drops. The Fed steps up regional bank oversight. Regulators proposed new rules for mid-sized banks. Farmington puts “charter stripping” in the spotlight. Grayscale gets court win in bitcoin ETF case. A $2.7Bn CFPB settlement (sort of). JPMC begins tap to pay rollout. Goldman nears GreenSky sale. Visa and Mastercard to raise fees.

If you missed our Q2 Consumer Lending review and analysis last week, make sure to give it a read here.

New here? Subscribe here to get our newsletter each Sunday. For even more updates, follow us on Linkedin (PeerIQ, a Cross River Company).

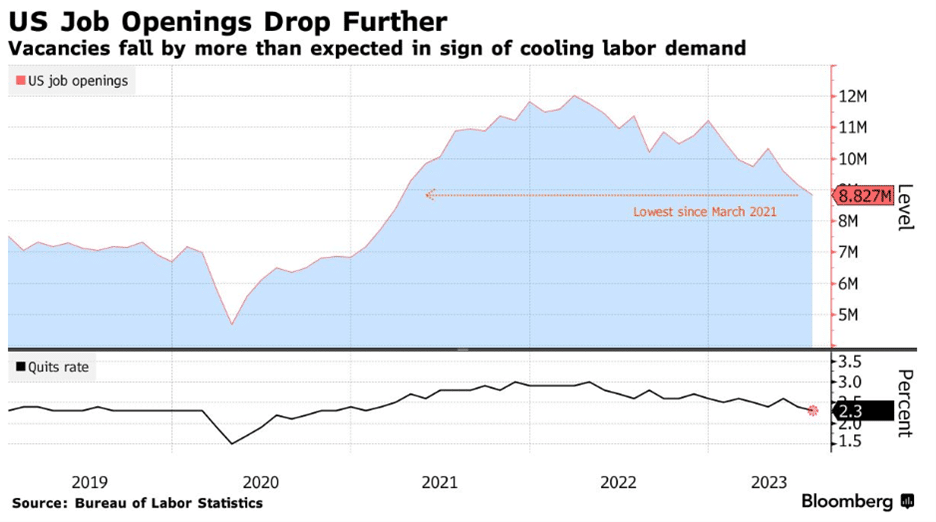

Job Market Cooling

The job market seems to be cooling, the latest JOLTS survey shows. Job openings in July fell by more than expected, decreasing to 8.83Mn. That marks the sixth such decline in the past seven months. The quit rate also dropped, to 2.3%, which is the lowest since 2021. The lower quit rate suggests tempering confidence in workers about their ability to find new roles.

Consumer confidence, meanwhile, dropped by more than forecast in August. The decline was the largest in two years, erasing improvements notched over the summer as inflation began easing. Higher borrowing costs as the Fed hikes rates and lingering price pressures are primarily to blame for the drop.

Image: Bloomberg

Fed Steps Up Regional Bank Oversight

In the wake of the bank failures earlier this year, the Fed is ramping up supervision of regional banks with $100Bn-$250Bn in assets, including names like Citizens, M&T, and Fifth Third. Warnings so far have been non-public matters requiring attention (MRAs) and matters requiring immediate attention (MRIAs), according to reporting from Bloomberg. Feedback has run the gamut, from liquidity and capital planning to tech and compliance. One area of focus has been banks’ ability to access the Fed’s discount window, should they need to. Technology glitches and, in the case of SVB, different time zones are understood to have impacted SVB and Signature’s ability to access emergency liquidity from the Fed’s discount window facility.

The Fed is likely to demand quicker resolution of any MRAs/MRIAs than before the failure of SVB, where bank supervisors’ warnings seemingly went unheeded. Non-public supervisory actions can result in public enforcement actions, if they’re not resolved to regulators’ satisfaction in a timely manner.

Regulators Propose New Rules For Regional Banks

In other news likely to impact regional banks, U.S. regulators released much-anticipated proposals that would require mid-sized banks to issue loss-absorbing debt and beef up so-called “living wills,” which lay out how they would wind down in an orderly manner in the face of a crisis. The new rules would apply to all U.S. banks with $100Bn or more in assets, bringing them more in line with expectations faced by G-SIBs.

The measures would require banks to maintain long-term debt levels equal to at least 3.5% of average total assets or 6% of risk-weighted assets, whichever is higher. To reduce the risk of contagion, banks will be discouraged from holding the debt of other lenders. The proposal would also require regional banks to realize losses on bonds they hold for the purposes of capital calculations. The updated requirements are expected to drive “moderately” higher funding costs, regulators acknowledged.

Farmington Puts “Charter Stripping” In the Spotlight

The recent Fed enforcement action against Farmington State has reignited discussion about the so-called practice of “charter stripping.” What had been a sleepy, one-branch bank primarily serving farmers and local residents was acquired by the primary shareholder of Bahamas-based Deltec Bank, the primary bank partner for stablecoin Tether. Renamed Moonstone, in reference to its new crypto-focused business plan, the bank also saw a significant investment from now-bankrupt crypto exchange FTX. The recently released enforcement action makes clear the bank and its management ignored requirements to seek state and federal regulatory approval before embarking on new lines of business, including those involving digital assets.

At the time of its acquisition, Farmington was one of the smallest banks in the country, with just $22Mn in assets, leading some to argue its takeover by outside investors should have raised more red flags. While Farmington may have been an aberration, the fallout from the disaster is likely to raise the bar for similar investor-led bank acquisitions in the future.

Grayscale ETF One Step Closer To Reality

The D.C. Circuit Court of Appeals sided with Grayscale against the SEC in a decision that removes a major obstacle to the launch of a spot bitcoin ETF in the U.S. The securities regulator has approved exchange traded products composed of bitcoin futures but declined Grayscale’s application to convert its existing Grayscale Bitcoin Trust, which directly holds bitcoin, into an ETF. The court said in its ruling, “The Commission failed to adequately explain why it approved the listing of two bitcoin futures ETPs but not Grayscale’s proposed bitcoin ETP. In the absence of a coherent explanation, this unlike regulatory treatment of like products is unlawful.” Bitcoin, ether, and other major cryptocurrencies surged on the news.

CFPB Reaches $2.7Bn Settlement With Credit Repair Companies

The Consumer Financial Protection Bureau reached a $2.7Bn settlement with a group of affiliated credit repair companies, including CreditRepair.com and Lexington Law. The settlement stems from allegations the companies violated the Telemarketing Sales Rule, known as TSR, by accepting advanced payment for credit repair services, despite a prohibition on doing so. The TSR only allows credit repair firms to ask for or accept payment after a period of at least six months and requires firms to provide documentation to customers demonstrating the positive impact of their services.

While the $2.7Bn number garnered plenty of headlines, the companies themselves are unlikely to ever pay this amount, as they’ve already filed for Chapter 11 bankruptcy protection. The settlement also includes a prohibition on the companies conducting telemarketing for credit repair services for a period of 10 years. That prohibition will remain in effect regardless of the bankruptcy proceedings.

JPMC To Begin Tap To Pay Rollout With Sephora

JPMorgan Chase has begun testing Apple’s soft point-of-sale “Tap to Pay” capabilities, in a move that may put pressure on traditional merchant acquirers and payment processors. The offering enables merchants to use existing Apple smartphones to accept Apple Pay, contactless cards, and other digital wallets, without any additional hardware. JPMC’s pilot is beginning with beauty retailing giant Sephora, which plans to deploy the payment capabilities across all of its stores. JPMC’s decision to support Apple Tap to Pay may drive other processors to accelerate plans to support the functionality as well.

Goldman Nears Greensky Sale

Close to a sale? Goldman, which acquired POS home improvement lender GreenSky less than two years ago, seems to be in the homestretch of negotiations to sell the business unit, most likely at a steep loss. Bidders for the business include Sixth Street, Apollo Global Management, and fintech firm Pagaya Technologies. Apollo is partnering with Blackstone on its bid, while Pagaya’s consortium includes General Atlantic, and Sixth Street has a number of unknown partners as well. Pricing is unclear, but is certain to be significantly less than the $2.2Bn Goldman paid to acquire the lender at the height of the market.

Visa & Mastercard to Raise Fees

Visa and Mastercard are set to raise the fees merchants pay to accept card payments. Price hikes are set to roll out this October and next April, according to the WSJ. Increases will focus on card-not-present transactions, typically online purchases, which typically suffer from higher rates of fraud vs. in-person transactions. Such fees have historically been a sore spot for merchants, ranging from mega-sellers like Walmart and Amazon down to the corner bodega that won’t take Amex or has a $20 minimum spend requirement. The issue has bubbled up again in Congress, with a “Durbin 2.0” bill being introduced that would require the largest issuers to enable credit cards to be routed over two unaffiliated networks. Still, history suggests that merchants pocket most of the savings from lower interchange, rather than passing them along in the form of lower prices.

In the News:

Student Loans Are Emerging From Deep Freeze, and Borrowers Are Confused (WSJ, 8/28/2023) U.S. student loans are, finally, set to resume accruing interest and payments. Borrowers aren’t ready.

The fight ahead over earned wage access (American Banker, 8/31/2023) Different states are taking different approaches on EWA, and it’s likely to cause providers some headaches.

Massachusetts’ top court rules against Robinhood (BankingDive 8/28/2023) The state’s Supreme Judiciary Court ruled 5-0 against Robinhood to uphold the state’s fiduciary rule for broker-dealers.

LemFi raises $33m for immigrant-focused payments platform (Finextra, 8/28/2023) Y Combinator, Zrosk, Olive Tree, and others joined the Series A for the Canada-based company.

Digital Payments Can’t Serve Up a Free Lunch (WSJ, 8/27/2023) After the beating Adyen took on slowing revenue growth, investors are growing more skeptical on Paytech.

The Smallest Bank in Tennessee Grew Fast With BaaS. Why It May Give The Entire Industry A Hangover. (Fintech Business Weekly, 8/27/2023) Tiny Lineage Bank partnered with Synapse, Synctera to grow quickly, but problems may lurk beneath the surface.

SEC Filing Provides Additional Details on PacWest Sale Process (Bank Reg Blog, 8/29/2023) SEC filings shed additional light on PacWest-Banc of California merger process.

Berlin-based fintech Denario gets acquired by American company Pandadoc to integrate payments workflow (EU Startups, 8/28/2023) Contract automation platform PandaDoc acquires German B2B SaaS fintech Denario.

Key's profits have sunk. Can it move fast enough to soothe investors? (American Banker, 8/28/2023) KeyCorp is underperforming other regional banks, with its stock down 38% this year. Can it turn things around?

No wiggle room for fintechs: The challenges of risk and compliance management (Tearsheet, 8/29/2023) According to a recent report from fintech infrastructure provider Alloy, fintechs are struggling to meet risk and compliance expectations.

Visa to spread the word about credit fintech Uplinq among its banks (American Banker, 8/30/2023) Visa announced a partnership with SMB credit decisioning platform Uplinq.

Lighter Fare:

Inside FlipTop: The Legendary Battle Rap League From the Philippines (Vice, 8/30/2023) A profile of the most legendary rap-battle league in the Philippines.