Goldman Reorganizes; FDIC Hikes Deposit Assessment; SBA Expands 7(a) to Fintechs

By Cole Gottlieb

October 23, 2022

Happy Sunday!

Housing market slows on rate hikes. OppFi’s “true lender” setback. FDIC hikes deposit assessment. SBA will expand fintechs’ access to 7(a) lending program. More regulatory scrutiny for Visa and Mastercard. Mastercard’s crypto bridge. Investors eye deposits. Goldman’s reorg. Earnings season continues.

To kick things off, we have an update from the structured finance conference ABS East after speaking to conference participants:

Investor sentiment was tepid, especially amongst those who invest further down the capital stack, with the prevailing opinion being markets are likely to get worse before they get better. That being said, investors are still willing to evaluate opportunities, have dry powder available, and have been able to raise fresh funds despite the broader market volatility.

Platforms aren’t having difficulty placing the top of the capital stack but are still having difficulty placing the equity. With ABS funding costs higher than warehouse costs, where possible, loans are sitting on lines for longer. At the current level of funding costs, higher rates to borrowers will likely result in a measured reduction in loan originations.

New here? Subscribe here to get our newsletter each Sunday.

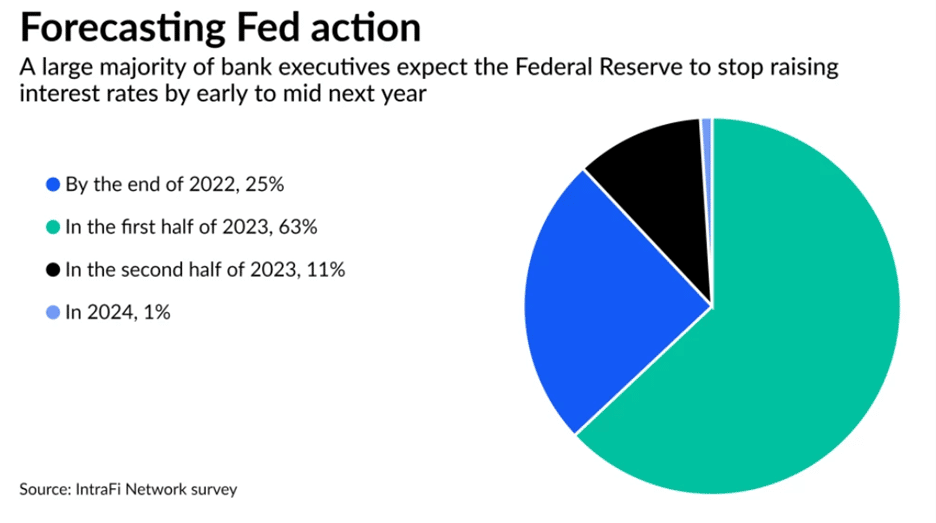

Will Rates Peak 1H 2023?

Last week’s CPI print came in at 8.2% for September. While below August, it was higher than anticipated. Core inflation hit its highest level since 1982, which suggests price pressures are widespread.

Image: American Banker

Still, bankers are predicting interest rates will peak in the first half of 2023. In a recent survey, nearly 60% expressed concern that the Fed would raise rates too quickly. The Fed is expected to raise rates again at its November and December meetings.

Meanwhile, rising rates are dampening the housing market. Faltering home prices and recession fears are hurting demand for junk-rated securities sold by Fannie Mae and Freddie Mac. However, some in the market think concerns are overblown, given the resilient employment picture and continued good credit performance.

OppFi Faces Setback in “True Lender” Case

Fintech lender Opportunity Financial, known as OppFi, was dealt a blow in its fight with the California banking regulator earlier this month. OppFi partners with Utah-based FinWise to originate loans at rates as high as 160% APR.

This March, OppFi filed a complaint in California seeking to proactively block the California DFPI from attempting to enforce a rate cap against the company. OppFi argues that it is a third-party service provider to FinWise. As a chartered bank, FinWise enjoys exportation and preemption protections, which allow it to write loans at rates permissible in its home state of Utah. Utah doesn’t have a specified interest rate cap on consumer loans.

The California DFPI, however, is arguing that OppFi is the “true lender,” as it holds a “predominant economic interest” in the loans in question.

In this most recent development, a California state court declined OppFi’s request to dismiss the DFPI’s cross-complaint that argues California usury law should apply.

FDIC Proceeds with Deposit Assessment Increase

The FDIC board voted unanimously to proceed with a rule that will require banks to pay more for deposit insurance. The change will increase assessment rates by 2 basis points beginning in 2023. The increase is intended to bring the FDIC’s insurance fund to its legally required minimum of 1.35%. Surging deposits during the pandemic have caused the fund to fall below its minimum ratio of 1.26%.

Bankers aren’t happy about the change. The increased assessment is forecast to reduce banks’ income by 1.2% on average. Banks argue the problem will fix itself as excess deposits are drawn down by consumers and businesses. They also argue the increase in assessment will reduce banks’ ability to lend, potentially contributing to a contraction in credit.

SBA to Add Fintech Lenders to Popular 7(a) Program

Fintech small business lenders are applauding a move by the Small Business Administration that would enable more SBA-backed lending by non-depository institutions. The number of non-banks permitted to write loans under the SBA’s 7(a) program has been capped at 14 since 1982. The 7(a) program guarantees up to 85% of loans written by private lenders.

According to an SBA public affairs rep, the SBA is preparing a notice of proposed rulemaking, which would affect the change. The exact timing has not yet been confirmed.

More Regulatory Scrutiny for Visa and Mastercard

Major card networks Visa and Mastercard are facing FTC scrutiny around debit card routing practices. The two biggest card associations have faced increasing pushback from regulators, legislators, and merchants around the globe about pricing and potentially anti-competitive practices in recent years.

In the issue at hand, the FTC is investigating whether the networks’ security tokens restrict debit transaction routing in ecommerce payments. A token is used in place of a card’s 16-digit number and associated information when used in mobile payment services like Apple Pay. Once a card’s information is tokenized, by Visa for instance, it is unusable to other networks, though the issuing network could decode the token such that an alternate network could be used. This could have the effect of favoring Visa and Mastercard over competitive debit networks.

Mastercard’s Crypto Bridge

What crypto winter? Despite a sharp decline and crypto asset prices and trading volumes, establishment financial services companies are still slowly moving to embrace the sector. Last week, Mastercard announced a service to help financial institutions offer crypto trading to their customers.

What’s being described as a “bridge” between traditional FIs and Paxos, a crypto trading platform, will handle security and regulatory compliance. In justifying the move, Mastercard execs pointed to survey data that show there’s still demand for crypto, but that a majority would be more comfortable experimenting with digital assets through their existing banks or brokers.

Investors Keeping Eyes on Deposits

Investors are paying increased attention to financial institutions’ deposit activities. Large money center banks like JPMC, BAML, WF and Citi, which have plentiful consumer and business deposits, have been slow to raise deposit rates. As interest on lending has increased, this has lifted their spreads and boosted net interest income.

Other institutions aren’t so lucky. Idle cash sitting in brokerage accounts, which are typically swept into affiliated banks, aren’t so sticky. Investors are more likely to intentionally deploy those funds as the rate environment changes. For instance, Charles Schwab has seen its bank deposits drop by 10% in the third quarter. Morgan Stanley’s sweep deposits are down by 18%, though some of those funds moved into high-yield accounts at the bank.

Chase Testing Early Deposits

JPMorgan Chase is adding a fintech feature. Chase will begin to offer “two day early” direct deposit, a capability popularized by neobanks like Chime and Varo. The underlying mechanism that makes this possible is the lag between when an ACH file is received by the bank vs. the state settlement date in the file. In turn for accepting a relatively small amount of risk that the ACH file is incorrect or could be reversed, banks can make these funds available “early.”

Chase is debuting the feature specifically for its “Secure Banking” product. The account offering has no minimum balance requirement and doesn’t allow overdrafts. But it does carry a $4.95 per month price tag.

This Week in Earnings: Deposits Ease Off Record Levels, Credit Normalizing?

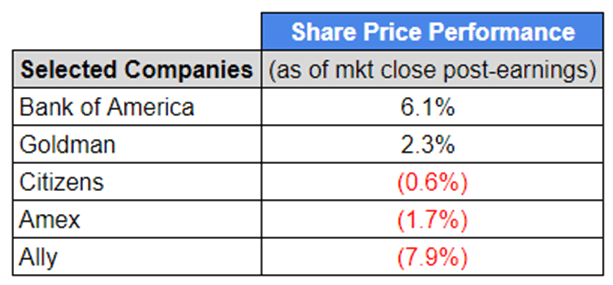

This week, Bank of America +6.1% and Goldman +2.3% jumped on earnings beats fueled by strong fixed income trading results. Citizens fell (0.6)% with broader markets, despite beating earnings expectations. Amex fell (1.7)%, despite beating earnings, on news that it built bigger provisions to prepare for potential defaults. Ally, one of the largest auto lenders in the country, sank (7.9)% after reporting that fewer people than expected took out new loans to buy vehicles.

Source: PeerIQ

As we reported last week, large bank’s elevated consumer deposits have started to decline. The trend continued in this week’s earnings, with Bank of America and Citizens reporting their deposits each declined roughly (1)% from the second quarter and Ally reporting its deposits declined (0.2)% from the second quarter.

At the same time, some NCOs are ticking up from the second quarter (Ally +32bps, Citizens +11bps, Amex +0bps, Bank of America (10)bps), with management attributing this to the normalization of credit. While it is true that NCOs remain at historically low levels (compared to pre-pandemic levels), this uptick is worth monitoring, and could be the beginning of a greater trend if the economy enters a recession.

Ally saw its auto originations contract on a sequential basis, to $12.3Bn from $13.3Bn in 2Q22. This was largely due to decreased auto demand in the wake of lower consumer confidence and higher inflation as well as continued supply chain issues.

Amex’s network volumes were close to flat sequentially. CEO Steve Squeri noted that the rebound in travel spending has exceeded expectations throughout the year and that, “As we sit here today, we see no changes in the spending behaviors of our customers. And our credit metrics continue to be strong with delinquencies and write-offs remaining at low levels, even as loan balances are steadily rebuilding.”

Goldman reported $5Bn of installment loans (Marcus personal loans) for the quarter, roughly flat from the $5Bn reported in 2Q22. Unfortunately, Goldman does not break these figures down further, so there is less visibility into any potential growth or decline of the business.

In the third major reorganization since David Solomon became CEO, Goldman will shrink from four divisions to three. Asset and wealth management will combine to become a single division. Likewise, Goldman’s powerhouse investment banking and trading divisions will become a single division.

The firm’s fledgling consumer assets will be split up. “Marcus” branded consumer offerings will be part of the new asset and wealth management group. BNPL lender GreenSky and the Apple and GM card programs will join the firm’s relatively new transaction banking business in a new division to be called “Platform Solutions.”

The move is a bit of a comedown for the firm, after spending years (and billions) trying its hand at building a mass-market, digital-first consumer bank. Making Marcus part of asset and wealth is likely to reduce the amount Goldman needs to spend advertising and marketing its offerings. But it also will put a ceiling on the potential reach and adoption of its consumer products.

In the News:

Regulators Propose Large-Bank Resolution Reforms, Approve U.S. Bank Acquisition (American Banker, 10/14/2022) Potential changes could require that large bank organizations hold certain types of long-term debt to absorb losses.

Fintechs Clamor for FedNow Access (Banking Dive, 10/18/2022) Fintechs are pushing the Fed to consider allowing nonbanks access to the new RTP network the Fed plans to launch next year.

Warren Roasts Wells Fargo’s ‘Severely Bad Performance’ on Zelle Fraud (Banking Dive, 10/14/2022) Warren says all is not Well(s), that the rate of reported scams and fraud is double for Wells Fargo’s customers than customers of other banks.

Chase’s Playbook to Beat PayPal and Square in Digital Payments (The Financial Brand, 10/17/2022) Banks are catching up to fintechs with new offerings that combine banking, payments, and other services under the same roof.

Nova Credit and HSBC Target Migrants’ Financial Exclusion (Fintech Nexus, 10/14/2022) Nova Credit partnered with HSBC to expand its network of international pathways (that can share credit data) from 20 in the U.S. to over 400, interconnected between themselves.

Brex Cuts 11% of Workforce (Finextra, 10/17/2022) The corporate spend management platform becomes the latest fintech to reduce headcount.

What the Apple Card High-Yield Savings Account is Really About (The Financial Brand, 10/19/2022) The account is one more brick in Apple’s “walled garden” of financial and other services for iPhone users.

Lighter Fare:

Black Hole ‘Burps’ Up Star Years After Eating It, Stumping Scientists (New York Post, 10/17/2022) 3 years after a black hole swallowed a star, it began mysteriously regurgitating stellar matter.