Inflation Expectations Drop; Banks Tap FHLB, BTFP; UBS Acquires Credit Suisse

By Cole Gottlieb

March 26, 2023

Happy Sunday,

Despite bank turmoil, Fed still hikes 25 bps. TransUnion Credit data. Inflation expectations drop. Home prices fall. Banks tap FHLB, BTFP for liquidity. U.S. evaluates emergency deposit insurance measures. FDIC extended deadline for SVB bids. NYCB acquires most of Signature Bank. UBS acquires troubled Credit Suisse, wiping out “CoCo” bonds. PacWest gets $1.4Bn lifeline. Jamie Dimon looks for First Republic solution. OppFi reports earnings.

New here? Subscribe here to get our newsletter each Sunday. For even more updates, follow us on Linkedin (PeerIQ, a Cross River Company) and Twitter (@PeerIQAnalytics).

Fed Still Hikes 25 Bps

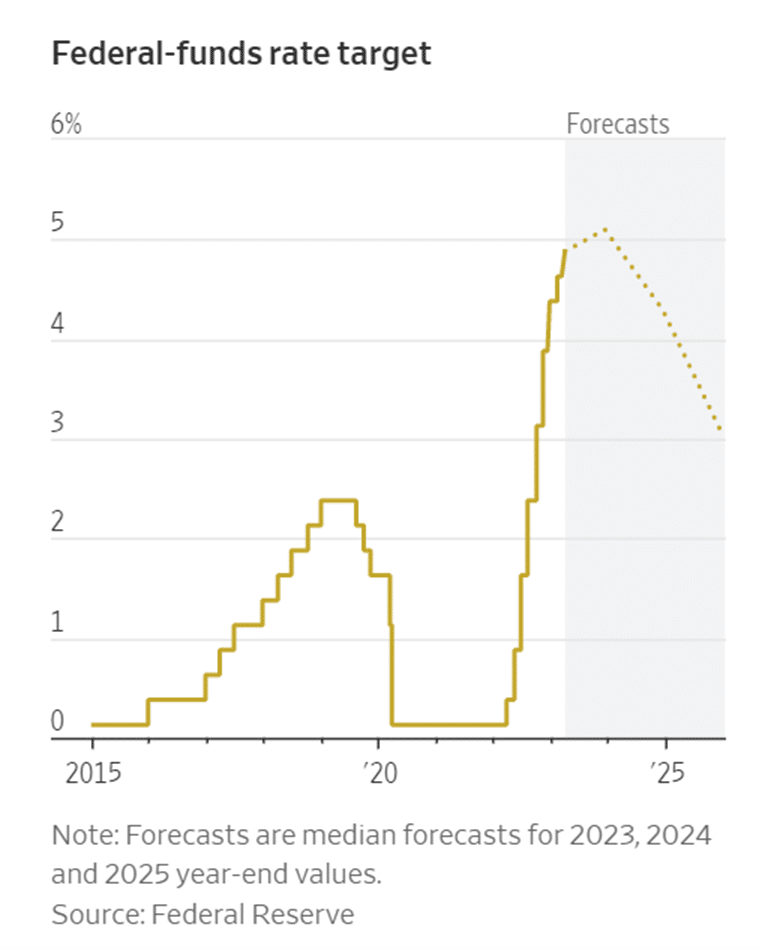

Despite growing stress in the banking sector, the Fed proceeded with a 25 bps rate hike last week. However, the Fed acknowledged greater uncertainty on its rate outlook, given the recent failures of SVB and Signature. In its statement about the increase, it no longer mentions expecting “ongoing increases,” instead saying that "the committee anticipates that some additional policy firming may be appropriate." An updated forecast shows that 17 of 18 officials expect the Fed funds rate to rise to just 5.1% by the end of year, which implies only one additional 25 bps hike.

Image: Wall Street Journal

There’s good news on inflation for once. Inflation expectations dropped, hitting their lowest since April 2021. Consumers expect prices to rise a more modest 3.8% over the next year. Home prices fell in February, breaking a decade-long streak of year-over-year price increases. The median home price was down 0.2% in February vs. the year prior.

Meanwhile, banks are making use of liquidity backstops amid the ongoing stress. Federal Home Loan Banks, intended as a next-to-last-resort lender, issued some $304Bn in loans to meet banks’ demands for liquidity. In aggregate, banks also borrowed $152Bn from the Fed discount window. The new Bank Term Funding Program, which lets banks borrow against assets at their par value, has been tapped for at least $12Bn in funds so far.

TransUnion Data Shows Unsecured Personal Loan Delinquencies Back on the Rise

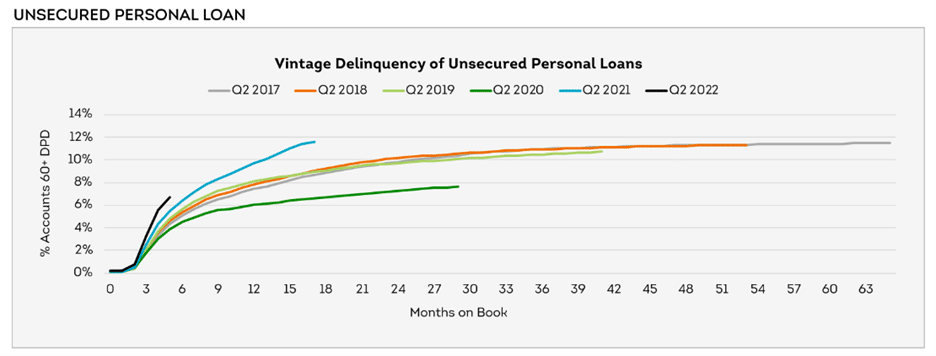

TransUnion released its Credit Industry Snapshot for February. Mortgage (no change), Bankcard ((1)bp) and Auto (+1bp) 60+ DPDs were flat from January. In contrast, Unsecured Personal Loan 60+ DPDs rose 12 bps.

Q2 2022 vintages (for Unsecured Personal Loans) are performing worse than historical vintages. While Unsecured Personal Loan 60+ DPDs flattened from 3Q22 to 4Q22 (only rising 2 bps) early 2023 data shows delinquencies resuming their upward trend.

Source: TransUnion Credit Industry Snapshot

Could the U.S. Insure All Bank Deposits?

Government officials are evaluating the possibility of temporarily expanding FDIC insurance beyond the current $250,000 cap. The Treasury Department is working to determine whether regulators can do so under existing emergency authority. The idea of expanding such coverage doesn’t have universal support, with some arguing it will create a “moral hazard” by encouraging excessive risk taking by banks. While regulators used the “systemic risk exception” to backstop depositors at SVB and Signature, Treasury Secretary Yellen has so far ruled out “blanket insurance” for all U.S. deposits.

FDIC Extends Deadline for SVB Sale

The FDIC extended the deadline for bidding on SVB’s assets through the end of day last Friday. Per the agency’s press release, there has been “substantial interest from multiple parties,” but the bidders and the FDIC need more time to “explore all options.” The FDIC is permitting bidders to make separate offers for Silicon Valley Bridge Bank, the successor to SVB, and its subsidiary, Silicon Valley Private Bank.

NYCB Agrees to Acquire Most of Signature Bank

The Flagstar Bank subsidiary of New York Community Bank (NYCB) agreed to acquire substantially all deposits and certain loan portfolios of Signature Bank, which was seized by regulators last Sunday. NYCB’s offer excluded about $4Bn in deposits related to Signature’s “digital banking business,” which includes, but is not limited to, Signature’s crypto clients. The $34Bn in deposits included in the purchase agreement reflect about 38% the bank reported at the end of 2022, which demonstrates the scale of deposit flight from the bank in the wake of SVB’s collapse.

The FDIC will pay out depositors related to the digital banking unit directly. The deal will ultimately cost the deposit insurance fund about $2.5Bn. The FDIC will have equity appreciation rights in NYCB.

Swiss Central Bank Brokers UBS’ Acquisition of Troubled Credit Suisse

Following the chaos in the U.S. banking sector, UBS reached a deal to acquire Credit Suisse for about $3Bn. The agreement comes after a lengthy period of troubles and a sliding share price for the Swiss investment bank, including more than $5Bn in losses related to failed hedge fund Archegos. The deal will wipe out $17.3Bn in AT1 contingent convertible “CoCo” bonds in a so-called “bail in.” The higher-yielding bonds are designed to absorb losses in the case of a bank’s failure where regulators need to step in.

The acquisition ends Credit Suisse’s 167 years as an independent institution.

PacWest got $1.4Bn from Atlas Partners

Regional bank PacWest is one of several institutions that has come under pressure in the wake of SVB and Signature’s collapse. PacWest has seen about 20% of its total deposit base, or some $6.8Bn, exit the bank this year. Over 70% of those deposits, or $4.9Bn, were related to its venture banking unit.

PacWest has already tapped multiple sources for liquidity, including $3.7Bn from the FHLB, $10.5Bn from the Fed discount window, and $2.1Bn from the new Bank Term Funding Program. Now, the bank has taken an additional $1.4Bn in liquidity from a financing facility provided by Atlas Partners.

Dimon Looks for First Republic Solution

Despite 11 banks joining forces to deposit some $30Bn at First Republic, the regional bank is still under pressure. Customers have withdrawn about $70Bn in deposits since SVB’s collapse earlier this month. The $30Bn in deposits has a 120-day term, meaning bank execs are still searching for a permanent solution to stabilize the troubled bank.

JPMC CEO Jamie Dimon is reportedly leading such efforts, which are focusing on arranging an equity investment that would boost First Republic’s capital. One option being considered is the 11-bank consortium stepping up to make the equity investment itself, possibly by converting some or all of the $30Bn in deposits into a capital infusion. An outside capital injection or outright sale are also under consideration.

Presumably JPMC itself isn’t considering buying First Republic. After acquiring Bear Stearns and Washington Mutual during the GFC, the bank had to absorb significant losses and faced lawsuits and regulatory actions. Dimon has said he regretted buying the two troubled companies during the ‘08 crisis and wouldn’t play a similar role again.

OppFi Reports Earnings

OppFi’s reported $186.5Mn in net originations, a 2% increase from the third quarter. While originations increased from the third quarter, ending receivables declined (1)%.

With the increase in net originations came an increase in NCOs. NCOs as a % of average receivables were 71%, up from 66% a quarter prior and 53% a year prior. Management explained that the NCO increase reflected “elevated delinquencies from higher loss customers originated prior to credit adjustments during 2022.” While NCOs rose, first payment default rates for new customers ended Q4 down 29% from the end of Q2. Going into the new year, CEO Todd Schwartz reported that, “First payment default and the total delinquency rates have continued to improve in the first quarter of 2023.”

During the fourth quarter, OppFi closed a $150Mn credit facility with Castlelake, bringing funding capacity to $530Mn.

In the News:

What the Fed’s Next Interest-Rate Move Means for Your Money (Wall Street Journal, 3/21/2023) The bar Americans will need to clear to get approved for loans and credit cards will likely rise.

White House Takes Aim at Crypto in Scathing Economic Report (CoinDesk, 3/22/2023) The "Economic Report of the President" included a chapter on digital assets and "economic principles", and stated “many [cryptocurrencies] do not have a fundamental value.”

Pay Transparency Laws Present Challenges to Fintechs (American Banker, 3/17/2023) Employees having more access to information allows them to make more informed decisions in negotiating compensation.

Amazon to Cut 9,000 More Jobs After Earlier Layoffs (Wall Street Journal, 3/20/2023) Amazon CEO Jassy pointed to an uncertain economy to justify layoffs and announced the cuts would be completed by mid- to late April.

Silicon Valley Bank Customers Deluged with Scams (American Banker, 3/17/2023) Many cybercriminals have set up fake bank websites, phishing campaigns in the wake of bank collapses.

Sweep up my Money, there is a Bank Run: Sweep Networks for Banks and Fintech (Tearsheet, 3/20/2023) Sweep networks help depositors break their funds into pieces that can be insured.

Lighter Fare:

Don’t Miss Eclipses: NASA Releases New Map of Upcoming Solar Eclipses (SciTechDaily, 3/19/2023) New map shows where you can catch the solar eclipse this year and next.