Greetings,

Q4 is off to a brisk start. The jobs report released this past Friday shows 114K in net new jobs (vs expectations of 120K), generally flat wages, and a drop in the unemployment rate to 3.5%. This week, we share the latest consumer macro, regulatory news, a few notable financings and the latest at Marcus.

We at PeerIQ are pleased to introduce a set of new hires we’ll be introducing in our newsletters over the next few weeks. If you’re at Money 2020 this year, reach out if you’d like to connect.

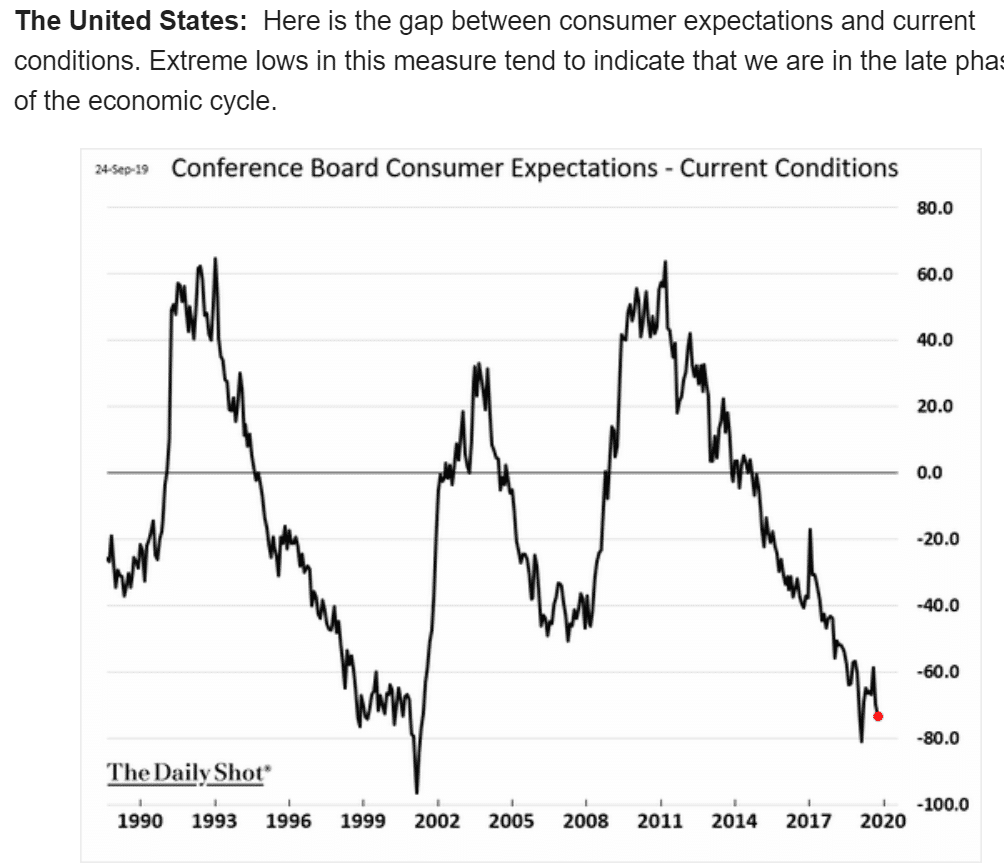

The US economy enters the retail sales heavy Q4 with mixed news. On the one hand, the US economy is near ‘stall speed’ – around 1 to 1.5% growth rate. A significant gap has emerged between consumer expectations and current macro conditions which is another late stage signal.

Source: PeerIQ, The Daily Shot, Conference Board

On the other hand, consumer balance sheets are strengthening. House prices are expected to rise 5.8% over the next year due to low mortgage rates.

One of the articles making the rounds this week is WSJ’s Peter Rudeggair’s latest view into Marcus. The article notes that GS has invested $1.3 Bn since Marcus launch in 2016 – comparable to LendingClub’s market cap today.

Although Marcus has far reaching ambitions to build a large consumer bank, it stand to reason that a regional bank looking to round out its consumer offerings might simply acquire a large non-bank lender, or partner, and avoid the expensive build-out and carry cost. Also noteworthy is the $50 Bn in deposits gathered making GS a top 5 bank and formidable competitor to the new crop of neo-banks.

Two major financing announcements this week. FinTech lender, Oportun, led by CEO Raul Vazquez, ends its Nasdaq debut with an 8% gain. The debut is notable as it represents a positive shift in the sentiment to the reception of lenders to the IPO market.

Also, nCino, a SAAS infrastructure startup powering banks and credit unions, raised $80 million in equity from T. Rowe Price Associates, Inc. and SalesForce Ventures. In a press release, nCino, led by veteran CEO Pierre Naudé, states that it plans to use the proceeds to invest in sales and product. nCino. nCino’s rapid growth is part of the “Empire Strikes Back” trend whereby banks are renting digital technology to compete with digital non-bank lenders. nCino’s growth presents a risk to non-banks that are focused on high quality credits and do not have a captive customer acquisition channel.

In regulatory news, dynamic FDIC Chief Jelena McWilliams is encouraging bank and fintech partnerships. McWilliams expressed the importance of bank innovation at a conference held at the Federal Reserve Bank of St. Louis.

New Hires:

PeerIQ is pleased to announce hiring Tito Donis to fill the role of Customer Success Manager. As part of PeerIQ’s client delivery team, Tito helps manage quality business relationships with clients and helps support ongoing sales activities. Tito has worked in Customer Success and Financial Operations for high-growth FinTech startups. Tito Earned his B.A. in Business Administration at the National Hispanic University in San Jose, CA.

PeerIQ Conferences:

- PeerIQ will be at Money 2020 Oct 27th to Oct 29th. Reach out if you’d like to connect!

Industry News Update:

- Goldman Sachs Tries Banking for the Masses. It’s Been a Struggle. (Wall Street Journal, 9/28/2019) Marcus loses $1.3 billion since the launch of Marcus in 2016.

- U.S. Slowdown Spurs Concern Economy Is Near Stalling (Bloomberg, 10/01/2019) With the U.S. economy growth rate slowing down, some economists believe that the U.S. might be able to manage 1%-1.5% of expansion.

- Manhattan Resale Home Prices Drop Most Since 2011 (Bloomberg, 10/2/2019) As resale home prices in Manhattan drop to their lowest point in the last 10 quarters, Jonathan Miller, President of Miller Samuel, believes the market could be going through what he calls “a reset.”

- CoreLogic says U.S. home-price gains will accelerate through 2020 (Housingwire, 10/2/2019) CoreLogic’s Chief Economist, Frank Nothaft talks about mortgage and unemployment rates being at their lowest since World War II and how this will impact home-price gains in 2020.

- Peloton IPO Disappoints, But Fintech Lender Oportun Gains 8% In Nasdaq Debut (Forbes, 9/27/2019) Oportun offered 23% of outstanding shares with no signs of slowing down as market closing hours approached.

- Founded By Bankers For Bankers, North Carolina-based Fintech Startup nCino Raises $80M (Crunchbase, 10/02/2019) Startup providing financial institutions with a cloud-based bank operating system raised $80 million in equity from T. Rowe Price Associates, Inc. and SalesForce Ventures.

- Upstart banking company Dave is now worth $1 billion, as Norwest puts in $50 million (September 30, 2019) Fintech startup focusing on helping consumers avoid overdraft fees raised $50 million in equity from Norwest Venture Partners.

- Regulators can be the glue in bank-fintech partnerships: FDIC chief (American Banker, 10/02/2019) FDIC Chief, Jelena McWilliams, talks about the importance of cooperating with banks and fintech companies as they transition to using new technologies.

- Treasury to allow Fannie Mae, Freddie Mac to retain $45 billion in capital (Housingwire, 9/30/2019) GSEs inch closer to leave conservatorship as the Department of Treasury and FHFA allow them to retain more capital.

Lighter Fare:

- Title: A Nobel-Winning Economist Goes to Burning Man (New York Times, 9/5/2019) Nobel Prize winning economist and former chief economist of the World Bank, Paul Romer, visits BlackRock City and finds that the Burning Man Festival’s make-shift-city’s grid structure can become a template for future urbanization.