Money 2020 Highlights, Jobs Report, Markets Doubt Fed

By Tito Donis

November 3, 2019

Greetings,

We saw a flurry of product and financing announcements at Money 2020 this week. Before we dig in though, we’ll start with macro news.

The Fed cut rates for the 3rd time this year. Fed Chief Powell signaled the central bank is done cutting rates, but markets expect more tricks-and-treats to come… Fed funds futures imply a 54% chance of at least one more rate cut by April 2020. Also, the Fed has now moved from a “one-off adjustment” positioning of their initial rate cut to a trendline.

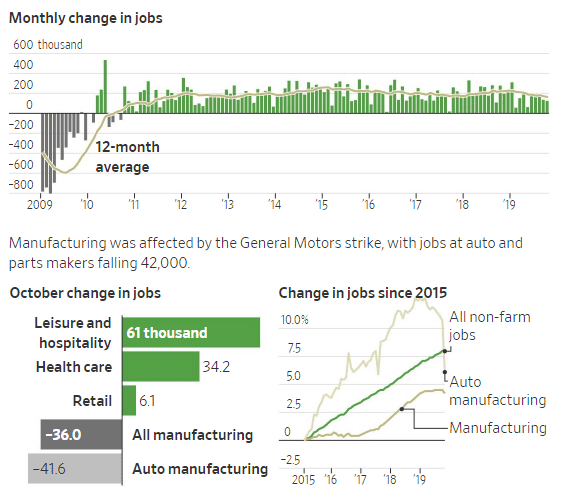

The healthy Friday jobs report supports the ‘wait and see’ Fed view (although it is a backward looking indicator). The report indicated growth in employment of 128K in October and a tick-up in unemployment to 3.6%.

Gains were driven by the service sector – hospitality, retail, and healthcare. Manufacturing remains in a recession but at a smaller share of the overall economy.

Source: WSJ, Labor Department, PeerIQ

What’s Hot and What’s Not at Money 2020?

Attendance was at record levels. Here’s our view on the areas attracting the most attention at Money 2020:

- Lending-as-a-Service: lenders that enable non-banks, banks and credit unions originate loans (e.g., loan origination software, digital experience, bank workflow software, etc.). Examples: Better, nCino, Happy Money (backed by CUNA Mutual), Alchemy, Splash Financial, Blend, Roostify

- International Lending: Non-banks expanding access to credit, particularly in the LatAm markets. Examples: CrediJusto (Mexico SME), Addi (Colombia POS), Nova Credit

- Underwriting infrastructure: Reducing OPEX or fraud risk thru automation. Examples: Ocrolus, Feedzai

Nova Credit, led by CEO Misha Esipov, touches on two of the above themes. The startup announced a partnership with American Express to open access to credit-worthy borrowers with data on international bureaus. Lend Academy has a nice write up on the offering here.

POS lending also has some buzz, though there seems to be a race-to-the bottom dynamic in underwriting standards emerging. Exhibit A: One lender that will go nameless was ‘differentiating’ by offering a 100% approval rate on applications in a bid to win merchants.

In Financing news, PeerStreet, led by co-founders, Brew Johnson and Brett Crosby, raised $60 million in Series C funding round. The round was led by Colchis Capital and featured participation from prior investors A16Z, ThomVes, and others. This latest round of funding will help the company continue to scale PeerStreet’s two-sided marketplace — the first and largest of its kind for investing in real estate debt.

Product announcements at Money 2020

Blend, a FinTech startup led by CEO Nima Ghamsari, launches its new auto loan product. This is another datapoint in the ‘convergence’ theme (e.g., infrastructure companies spanning multiple lending products, lenders bolting on deposit capabilities, challenger banks adding lending, etc.).

Blend powers banks such as Wells Fargo and U.S. Bank, with an online mortgage application platform. They are now applying their mortgage success product to auto lending.

BlueVine, a leader in providing online working capital for small businesses, announced its new banking service. BlueVine now provides the BlueVine Business Debit Mastercard as a way to manage everyday finances. Business owners get 1% back on their balance if it exceeds $1,000.00. This makes BlueVine Business Banking one of the nation’s highest yield business checking accounts. Customers can have an unlimited number of transactions with zero fees.

Uber makes its debut into the financial services industry with their new division called Uber Money. Uber aims to house their efforts by creating a digital wallet and upgraded debit and credit cards.

Uber will give 4-million-plus drivers on their platform and couriers around the world access to a mobile bank account with the goal of retaining drivers. Uber will release a debit card with an “instant pay” service, which has been tested in the U.S. and other markets. More than 70% of driver payments are made using instant pay.

Instant pay is a no-fee banking account with the debit card in the U.S. It seems that the real winner in the announcement seems to be Green Dot, a leading prepaid debit card issuer, which is powering Uber’s new offering.

Industry News:

- Americans Aren't Using Their Homes as Piggy Banks Anymore (Bloomberg, 10/28/2019) Fed data shows that HELOC now accounts for less than 2% of the Nation’s banking assets.

- Rajeev Misra Built SoftBank’s Huge Tech Fund. Now He Has to Save It. (Wall Street Journal, 10/31/2019) CEO of SoftBank Investment Advisors, Rajeev Misra, faces challenges at the Vision Fund.

- Treasury Prepares Another Debt Deluge as Fed Wades into Market (Bloomberg, 10/28/2019) Treasury releases the next stage in their strategy as 2019 deficit reaches 7-year high.

- US Treasury Says It Is Gearing Up to Issue a 50-Year Bond (CNBC, 10/30/2019) The U.S. Treasury is considering possible additions to the current suite of Treasury securities, which include 20-year and 50-year nominal coupon bonds.

- SEC Fix for Conflicts of Interest at Credit-Ratings Firms Has Failed (Wall Street Journal, 10/29/2019) SEC’s post-crisis approach of regulating credit-rating agencies did not eliminate conflict of interest with bond issuers.

- PeerStreet Announces a $60MM Series C Fundraise and $4.25 Billion in New Capital Commitments (Business Wire, 10/28/2019) PeerStreet, led by co-founder and CEO, Brew Johnson, raises $60 million in Series C funding round.

- Blend Adds Auto Lending to Suite of Consumer Banking Products (prnewswire.com, 10/28/2019) San Francisco-based FinTech startup, Blend, launches new Auto Loans product.

- Inside the Groundbreaking Nova Credit-American Express Partnership (Lend Academy, 10/29/2019) American Express teams up with Nova Credit to make credit cards more accessible to immigrants.

- BlueVine Introduces BlueVine Business Banking, Designed for Today’s Small Businesses (Yahoo Finance, 10/28/2019) BlueVine, a FinTech startup, which provides working capital to small businesses, announced the launch of their new business banking product.

- Uber Announces Deeper Push Into Financial Services With Uber Money (CNBC, 10/28/2019) Uber makes its debut into the financial service industry with Uber Money.

- The Meteoric Rise and Spectacular Fall of Peer to Peer Lending in China (Lend Academy, 10/23/2019) Peter Renton talks about the amazing growth and sudden decline of peer to peer lending in China.

Lighter Fare:

- Data Fallacies to avoid (Geckoboard.com) Fifteen data fallacies to avoid, courtesy of Geckoboard.