More Trouble in Bonds Backed by Peer-to-Peer Loans

By Vy Phan

March 14, 2016

Bloomberg by Tracy Alloway & Matt Scully (March 14, 2016)

In mid-December, shortly before Christmas, Moody's Investors Service gave a gift to investors in the fast-growing marketplace-lending space: the chance to buy a junior slice of a securitization of "peer-to-peer" loans with a credit rating and a spread of 6 percent over benchmark swaps.

Eight weeks later, investors found Moody's in a much less generous mood. The rating agency announced it was considering downgrading the riskiest portion of the deal, along with the junior tranches of two similar securitizations that had been previously sold to investors.

The reviews for downgrade were "prompted by a faster buildup of delinquencies and charge-offs than expected," Moody's said in a statement dated Feb. 11.

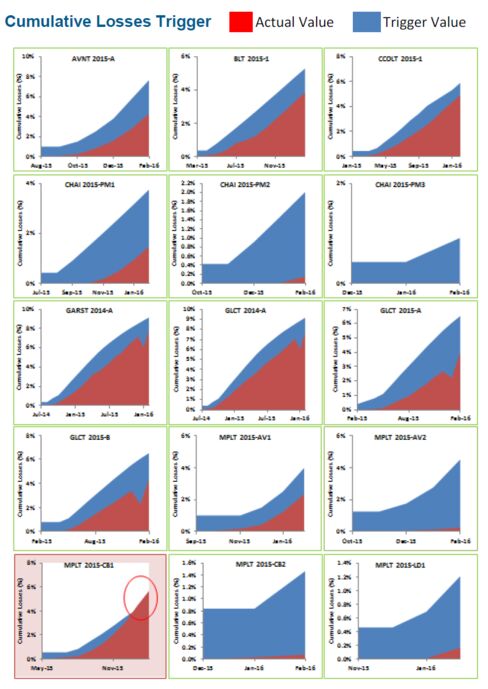

The move by Moody's and the deteriorating fortunes of some other marketplace-lending deals, including one in which losses have overwhelmed their so-called trigger value, have spurred fresh worries about the health of one of financial markets' newest asset classes.

Marketplace, or "P2P," lenders seek to use online platforms to directly connect borrowers with lenders, often at cheaper rates than those available at banks -- and at significantly increased returns for investors. The higher yields on offer from investing in the asset class have drawn interest from Wall Street, with asset managers, hedge funds, and banks participating in the space as they buy or bundle P2P loans into bonds that can be sold to investors. Sales of bonds backed by marketplace loans, which are asset-backed securities (ABS), have been a particularly bright spot for bankers seeking new sources of revenue and for P2P platforms aiming to diversify their funding away from more skittish individual investors.

However, recent events in the space have led some to worry that the asset class is showing early signs of deterioration. The question now is whether P2P loans prove to be the vanguard of a wider downturn in consumer lending, or simply riskier than more traditional forms of credit.

"Sentiment has changed dramatically [between] last year and now," said James Wu, the founder and chief executive of MonJa, a company that evaluates loan quality and performance for investors buying such debt. Economic factors may be playing some role in the weakening loan performance, but "the story is in the underwriting," he said.

The bonds under review for downgrade by Moody's are known asCiti Held for Asset Issuance, or CHAI. Consisting of loans originated through Prosper Marketplace Inc., the second-biggest P2P lender in the U.S., following LendingClub Corp., the bonds were put together by Citigroup Inc. and are three of the 40 or so P2P securitizations currently outstanding, according to data from Morgan Stanley.

"Marketplace lending has been growing exponentially over the last few years. As institutional investors have gotten more involved securitization has become an increasingly important vehicle for funding," Morgan Stanley said in research published late last week. "In the face of a weakening financial market, many investors are concerned that the marketplace lending universe will be among the first to feel the heat. Hence, it is imperative for us to track their performances closely."

Losses on a $126 million deal of loans originated through CircleBack Lending Inc. and put together by Jefferies Group LLC have already overwhelmed the trigger value embedded in the bonds, according to data from Morgan Stanley. That would normally mean cash flows due to investors in the lower tranche of the deal are diverted to more senior bondholders, the bank suggested.

Richard Khaleel, a spokesman for Jefferies, and CircleBack Lending CEO Michael Solomon, declined to comment.

Nervousness in credit markets is said to have made it more difficult to sell P2P deals in recent weeks. Delinquencies in riskier auto and credit card loans are also increasing, raising the prospect of a wider downturn in credit.

"There is a slowdown in securitization activity, although the primary driver is a widening in credit spreads -- impacting all credit markets -- and this is translating into increased funding costs and deals getting pushed down the calendar," said Ram Ahluwalia, founder and CEO of PeerIQ, which provides risk management services for P2P investors and platforms.

He added: "We think the apprehension is overstated. Investors today will make money. Most ABS investors simply are not familiar with marketplace lending. There are great opportunities for ABS investors that can analyze the risk and separate the signal from the noise."

P2P lenders including LendingClub and Prosper have already been raising borrowing rates for the riskiest lenders on their platforms. That may encourage investors in the asset class. Meanwhile, CircleBack has been shuttering underperforming loan acquisition channels and tightening its credit guidelines, according to people familiar with the moves.

"It's a bump in the road," said Ahluwalia. "The last few months are a dress rehearsal ahead of a credit cycle turn.'

[Original article available here. Subscription required.]