Coronavirus Panic; Intuit Acquires Credit Karma; Yields Hit Record Low

By Tito Donis

March 1, 2020

Greetings,

In macro news, capital markets were rattled due to the continued spread of the Coronavirus to U.S. markets. Former Fed Chair, Janet Yellen, has indicated that it is “conceivable” that the covid-19 virus could throw the U.S. economy and Europe into recession. Former Fed governor, Kevin Warsh, expects a global coordinated central bank response.

The market’s VIX fear index hit 47 - a level seen during the depths of the 2008 financial crisis. 10-year Treasury yields dropped to a record low of 1.16% (a whopping ~50 bps lower than a GS Marcus savings account).

The effects are starting to ripple into U.S. lending and payments markets. Small to medium-sized businesses in China, South Korea, and increasingly Japan, are at risk due to supply chain disruptions. Here in the U.S., Mastercard shares dropped 3% due to the expected impact of the coronavirus on 2020 revenue.

M&A Spree Continues: Intuit Buys Credit Karma for $7 Bn

Last week, we saw multiple announcements following the “on your mark, get set, go” sparked by Charles Schwab’s acquisition of TD Bank.

Overall, the theme of major incumbents is to acquire established FinTechs: Visa/Plaid (Jan) and Morgan Stanley/E-Trade. We also have the “man-bites-dog” LendingClub buys Radius Bank deal, motivated by deposits and fee savings.

In another blockbuster deal, Intuit announced a deal to acquire lead-gen firm, Credit Karma for $7 Bn. Credit Karma was last valued at around $4 billion two years ago and publicly traded Intuit is valued at around $77 billion.

Intuit continues to not-so-quietly build a lending juggernaut. Intuit has a natural reach into both small businesses and consumers with its captive acquisition channel and unique data assets (QuickBooks, TurboTax, Mint, and other products). Maybe JP Morgan should buy Intuit?

Jamie Dimon announced JPMorgan Chase is on the hunt for its next big non-depository acquisition. Dimon commented that:

- Takeovers could be in adjacent business lines like the last two deals the bank did — payment firms InstaMed and WePay — or it could be in new areas.

- Targets could be anywhere in financial services and technology, with the exception of another deposit-taking bank, which would be prohibited by regulators.

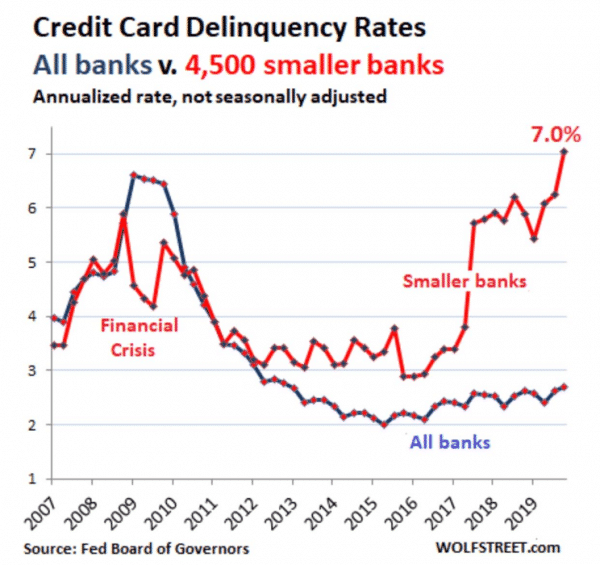

Credit Card DQ Rates - All Banks vs. 4,500 Small Banks

Annualized, Not Seasonally Adjusted

Source: Fed Board of Governors, PeerIQ

In this week’s “Chart of the Week,” we look at the delinquency rates of all banks vs. small community banks. Community banks are reaching for yield and at the same time taking on more risk. Reach out to PeerIQ to learn more about using the TransUnion dataset to evaluate performance, losses, and other metrics by originator type across various cohorts and risk bands.

Challenger Bank Mega Financings Continue

In financing news, digital banks continue to shine. Digital Bank Revolut triples valuation to $5.5 billion. Revolut, led by CEO, Nikolay Storonsky, raised $500 million in a funding round led by TCV and also attracted backing from existing investors Ribbit Capital, DST Global, Lakestar and GP Bullhound. The latest round takes Revolut’s total amount raised up to $836 million.

Founded in 2015, Revolut initially gained popularity by letting users spend money abroad without paying steep fees. Its competitors include British firms Monzo and Starling, as well as German rival N26, which recently said it would leave the U.K. due to Brexit.

PeerIQ New Hire:

Rohan Tandon. Rohan is a Backend Software Engineer on the CFM and metrics team at PeerIQ. After completing his bachelor’s degree in Computer Science at the University of Massachusetts, Rohan moved to NYC to work in the FinTech industry. In his free time, he watches soccer and cricket. Rohan is also a fan of the Arsenal Football Club and loves to play the guitar.

Industry News:

- Yellen Says Coronavirus Could Throw U.S. Economy Into Recession (Yahoo Finance, 02/26/2020) Former Fed Chair, Janet Yellen, believes that the Coronavirus could have a significant economic impact on Europe, which could lead to a recession in the U.S.

- The Ugly Side to the Booming U.S. Economy, in one Telling Chart (MarketWatch, 02/24/2020) Delinquency rates for smaller banks spiked to 7.05% in Q4 2019, while the delinquency rate for the biggest 100 banks was at 2.48%.

- SEC Rethinks Approach to Conflicts Among Bond-Rating Firms (WSJ, 02/24/2020) SEC is seeking industry input on how to combat rating inflation as the 2010 fix weakens.

- UPDATE 1-U.S. Bank Profits Down 1.5% in 2019 - FDIC (Reuters, 02/25/2020) According to the FDIC, U.S. Banks collectively made $233.1 billion in profits in 2019, which is a 1.5% decline year-over-year.

- Intuit to Acquire Credit Karma for $7 Billion (Lend Academy, 02/24/2020) Intuit to acquire FinTech startup, Credit Karma, for $7 billion in cash and stock.

- Why Credit Karma Shouldn’t Sell To Intuit (Forbes, 02/24/2020) Intuit’s track record of integrating acquisitions could complicate things for Credit Karma.

- Jamie Dimon says JPMorgan Chase is on the hunt for its next big acquisition (CNBC, 02/25/2020) Chase CEO, Jamie Dimon, said that Chase plans on being more aggressive with acquisitions and will target financial services and technology.

- New LendingClub Account Performance – Q4 2019 (Lend Academy, 02/27/2020) Returns for LendIt’s new LendingClub account came in at 4.40% for Q4 2019.

- Who Should Decide The Fate Of Digital Banking — The Markets Or The Regulators? (Forbes, 02/24/2020) Banking markets outside of the U.S. have the same end goal when it comes to better digital connections and personal information controls, but they are using a regulatory-driven path to get there.

- Financial Identity As A Service (FiDaaS), The Prerequisite For Financial Inclusion (Forbes, 02/21/2020) According to a report by FinTech startup, Juvo and Oxford Economics, developing ‘Financial Identity as a Service’ (FiDaaS) could add $250 billion to global GDP.

- With New Digital Bank, RBC Joins Crowded Field (American Banker, 02/24/2020) RBC announced that it plans to roll out a direct-to-consumer bank in the U.S. later this year.

Lighter Fare:

- AI Deception - When AI Learns To Lie (IEEE Spectrum, Feb 2020). What are the technical defenses to an AI that violates reps & warranties on an on-chain (crypto) securitization?