OCC’s BNPL Guidance; House Nullifies SMB Data Rule; January Raises $12Mn

By Cole Gottlieb

December 10, 2023

Happy Sunday,

Hiring has slowed and job openings declined, in a welcome sign for Fed policy makers. The OCC released an advisory bulletin for banks offering BNPL. The House voted to nullify the CFPB’s small business data collection rule. Collections startup January raised $12Mn. Treasury Prime and Effectiv partner. AI may be able to help banks more intelligently de-risk. Klarna chooses Adyen for merchant acquiring. Best Egg seals $150Mn debt facility with Cross River.

Stay tuned next week for our Q3 Consumer Lending Review – in the meantime, if you missed our Q2 Report, you can find it here.

New here? Subscribe here to get our newsletter each Sunday. For even more updates, follow us on Linkedin (PeerIQ by Cross River).

Hiring Slows

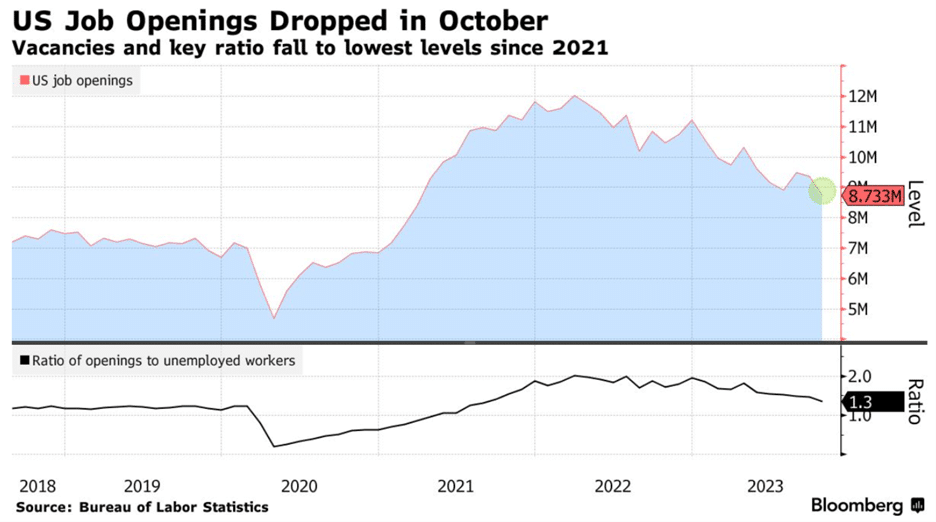

Hiring slowed in November, a development sure to be welcomed by the Fed. According to ADP’s stats, private payrolls grew by just over 100,000 in November, and October’s reading was revised down. Leisure and hospitality, which have been a major driver of job growth since the pandemic, saw job cuts for the first time since 2021. Open roles also declined, with vacancies for October revised down from 9.4Mn to 8.7Mn, according to the Bureau of Labor Statistics JOLTS data. That marks the lowest level of job openings since early 2021.

Image: Bloomberg

OCC Releases Bulletin on BNPL

The OCC last week released a guidance bulletin for banks offering buy now, pay later financing products. The bulletin specifically addresses BNPL repayable in four or fewer installments that don’t carry a finance charge, often referred to as “pay in four” or “split pay.” While the bulletin points out that such products can be beneficial to consumers as a low-cost financing option to manage cash flow, it points out unique risks banks offering such products should be aware of in order to manage effectively. Examples of risks the OCC highlights include that BNPL borrowers may have limited credit history, making them difficult to underwrite; that BNPL products lack clear, standardized disclosures; that merchandise returns or disputes may be difficult to manage; and that third-party relationships, including with merchants, may expose banks to heightened operational and compliance risks.

House Votes to Nullify Small Biz Data Collection Rule

The House voted last week to nullify the CFPB’s small-business data-collection rule. As the Senate passed an identical measure in October, the legislation now goes to President Biden, who is expected to veto the measure. The measure would require small business lenders, including both banks and fintechs, to collect information on loan applicants, including gender, race, and other demographic data points. Advocates of the measure argue that the data will enable better analysis of who does and doesn’t have access to credit. Opponents argue the rule is overly burdensome and will discourage lending to small businesses.

Debt Collection Startup January Raises $12Mn Series B

January, a fintech company that seeks to “humanize” debt collection, announced it has raised a $12Mn Series B. The round was led by existing investor IA Ventures, with participation from Brewer Lane Ventures, Reciprocal Ventures, Third Prime, and numerous strategic angel investors. The additional capital comes after January raised a $10Mn Series A in 2022. The company’s collections and recovery platform seeks to help its clients “rehabilitate” relationships with their borrowers in order to reduce risk and improve net recoveries. Since its Series A, January has quadrupled its revenue and client count, including working with top fintechs, credit unions, banks/card issuers, and debt buyers.

Treasury Prime Partners with Fraud Detection Vendor Effectiv

Banking-as-a-Service platform Treasury Prime announced a partnership with fraud prevention platform Effectiv. Effectiv offers a risk, fraud, and compliance platform that can be used both during onboarding of new customers and for ongoing fraud and transaction monitoring. By partnering with Treasury Prime, Effectiv will be available to both the banks and fintech clients in Treasury Prime’s network.

Can AI Help Banks “De-Risk” Smarter?

Bank account closures have been in the news lately. After receiving numerous complaints from innocent customers who had their accounts closed for seemingly no reason, a New York Times piece profiled a handful of the scenarios that led to such closures, including a bar owner making cash deposits and a user who received funds from a family member in Nigeria.

With banks increasingly looking to improve efficiency through automation, the detection, analysis, and decision to close accounts are often made by software in line with pre-set rules. The problem, some in industry argue, is those rules are outdated and do little to catch actual financial criminals. Instead, innocent customers get caught up and have their accounts closed, typically with little explanation and no chance to appeal.

A possible solution? More advanced AI. Instead of the simplistic, rules-based systems, an AI-powered tool can operate more like a human investigator to understand the specifics of the customer, their history, and the transaction in question in order to make a risk assessment. Still, there are risks in such an approach that need to be understood and mitigated. AI, like other advanced analytics models, is trained on existing data sets. Care needs to be taken to ensure that AI tools are trained in a way that is explainable and doesn’t lead to discriminatory outcomes.

Klarna Partners with Adyen for Merchant Acquiring

Klarna is teaming up with Adyen to serve as its global merchant acquiring bank, which will gather payment card details from customers, both in-person and online, and deliver them to retailers and merchants. The move builds on the pair’s existing relationship, in which Adyen makes Klarna available as a payment method to merchants that use Adyen as a payment processor. Now, Adyen will function as the acquiring bank, on behalf of Klarna, beginning in Asia, Europe, and North America, starting in 2024. Partnering with Klarna should simplify card payment processing for Klarna’s 150Mn users and half million merchants.

Best Egg Inks $150Mn Debt Facility with Cross River

Cross River Bank and Best Egg announced a new $150Mn credit facility for the fintech lender. The facility will enable Best Egg to further scale its Best Egg Flexible Rent program, which allows landlords to offer renters the option to pay their rent on their own schedule, at no additional cost to property managers. For example, a renter who is paid twice a month might opt to break their rent payment in two chunks aligned with those pay dates. Best Egg Flexible Rent can help improve landlords’ on-time payments and reduce bad debt.

In the News:

Digital Payments Are Having a Jolly Holiday (Wall Street Journal, 12/2/2023) A strong Black Friday/Cyber Monday was some much-needed good news for digital payment processors.

Staunch Supporter of Crowdfunding, Fintech, Congressman Patrick McHenry Announces He Will Not Seek Re-Election (Crowdfund Insider, 12/5/2023) McHenry, current chair of the House Financial Services Committee, will not seek reelection.

Breaking down capital requirements (Banking Dive, 12/4/2023) A prime on bank capital requirements.

Mine Raises $30 Million to Expand Data Privacy Offering (PYMNTS, 12/5/2023) Data privacy firm Mine raised a $30Mn Series B, led by Battery Venture.

Lineage Blindsided By Activists' Board Coup (Fintech Business Weekly, 12/3/2023) Tennessee-based Lineage, a player in the BaaS space, is experiencing some board room drama.

2024: The Beginning Of The End Of Bank-Fintech ‘Partnerships’ (Forbes, 12/4/2023) Bank-fintech arrangements are client-vendor, not “partnerships,” Ron Shevlin argues.

Is Early Warning's Paze wallet security pitch enough to woo consumers? (American Banker, 12/1/2023) Do consumers care enough about security to try out bank-consortium-owned Paze?

The Role of Fintech in Unsecured Consumer Lending to Low- and Moderate-Income Individuals (New York Fed, 11/2023) Fintechs may be able to help enable lower-cost lending to thin/no file and subprime borrowers.

Assumable mortgages are having a moment. Will it last? (American Banker, 12/4/2023) With rates high, a niche product has jumped in popularity.

BNPL appeals to broad spectrum of users: report (Fintech Nexus, 12/5/2023) Nearly 30% of consumers used BNPL in a 90-day period, as payment method shows broad appeal.

Citrix software bug leads to outages at 60 credit unions (American Banker, 12/5/2023) A ransomware attack on Citrix is impacting at least 60 credit unions that use its software.

Goldman Sachs-backed ZestMoney, once valued at $450M, to shut down (Techcrunch, 12/5/2023) ZestMoney, an India-based BNPL startup, is shutting down.

Lighter Fare:

Geminid meteor shower will be bright enough to be seen in NYC this month (Gothamist, 12/3/2023) On December 13th, those in New York will be able to see as many as 120 shooting stars per hour (if the skies are clear!)