PayPal Bets on Crypto; Loan Demand Is Hot; Divvy Series C; Loan Depot IPO

By Tito Donis

February 9, 2021

Greetings,

This week, we look at the tremendous demand for loans - a 180 turnaround from the onset of Covid.

We also discuss PayPal’s focus on crypto and POS lending. PayPal appears to have its sight on Affirm and Amazon - read on for more.

Let’s get to it.

January Jobs Report; Biden Administration Wants “Full Employment”

January’s jobs report showed a small gain of 49,000 jobs in the US, indicating that the country has a long path to economic recovery. The unemployment rate dropped to 6.3% in January compared to 6.7% the prior month.

Acting Head of the CFPB Signals Tougher Stance Toward Financial Institutions

Acting Head of the CFPB Dave Uejio, wants to revive the “disparate impact” standard to hold lenders accountable for unintentionally discriminating against minorities.

Most banks and mortgage lenders think disparate impact is an unfair way to analyze the legality of financial institutions’ credit policies that determine lending decisions — specifically credit scores, loan-to-value ratios, and borrower’s income. These long-standing credit measures are said to have a disproportionate effect on minorities.

Loan Demand is Hot - Evidence from Upstart’s Securitization

Buyers are scrambling for marketplace loans.

Loan buyers have increased demand for loans in the market so much that rating agencies, issuers, and investors alike are willing to consider loans that were previously not included (modified loans, Colorado, Madden) in securitizations.

Upstart’s recent securitization is a recent example.

Here are the drivers:

- The OCC and FDIC have issued final rules to provide clarity on Madden-Midland loans

- The Colorado court settlement in Aug 2020 with MPLs, CRB and WebBank, allows MPLs to take advantage of the settlement’s protection

- Modified loans, which were perceived to have higher credit risk during Covid have also proven to be surprisingly resilient, and this has given the investors the confidence to purchase such loans

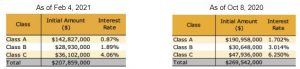

Yields across all classes of notes in this deal are also lower than the prior deal in Q4 2020 (see below). Prices are bid up owing to the increased demand and tighter credit spreads.

Source: Kroll Bond Rating Agency, PeerIQ

Earnings Season Continues - PayPal Bets the Future on Crypto

PayPal: PayPal positioned itself as the full-service “Super App” for Digital Consumer Banking. The company is developing new business lines competitive with Affirm and Coinbase, as PayPal seeks new avenues of growth (slower pace of customer growth 13% projected in 2021, vs. 24% 2020).

The company had rapid product development focused on extending its digital wallet product in crypto and e-commerce in 2020 (e.g., wish lists, price monitoring, deals, coupons, and rewards for use in the physical and digital worlds).

AmazonPay and PayPal are increasingly looking like they are on a collision course to compete for the consumer wallet share. We also note that Visa’s CEO, Al Kelly, has indicated that the payments company may add cryptocurrencies to its network.

Financial highlights:

- Strongest year in history; record growth in net new active customers, volume, revenue, operating income, earnings, and free cash flow

- Revenue of $21.5 Bn in FY 2020, up 22% YoY

- Total Payments Volume (TPV) in FY 2020 was $936 Bn, up 31% YoY. TPV in Q4 2020 was $277 Bn, with Venmo’s share at $47 Bn, up 60% YoY. This is driven by the acceleration in the adoption of contactless payments during COVID

- Free Cash Flow (FCF) of $5 Bn in FY 2020, up 48% YoY. For every $1 of revenue, PayPal generated an impressive 23 cents in FCF

- Headwinds from e-Bay slower volumes; volume contribution continues to decline, revenues much lower as well

Key Innovations in 2020 - QR Code, BNPL, Crypto Buy/Sell

Source: PayPal, PeerIQ

Enova: Despite its acquisition of OnDeck back in October 2020, originations were down 18% YoY. Enova reported $536 MM in originations, compared to $656 MM in Q4 2019. Interestly enough, originations more than tripled QoQ. Charge-offs net of receivables in the consumer loan segment were down 80% YoY, while the business loan segment almost tripled, but this is most likely due to the OnDeck acquisition that occurred during the fall.

CURO: Loan balances were down 20% YoY ($598 MM vs $743 MM in Q4 2019). Provision for loan losses increased by 26% QoQ. CURO reported $69 MM compared to $55 MM in Q3 2020

Investors Expect Coinbase to Reach $100 Bn Valuation

Coinbase investors are anticipating the crypto exchange to have a market valuation of $100 Bn. According to a person familiar with the company’s finances, Coinbase’s annualized revenue in 2020 was $2.3 Bn, which is about $600 MM per quarter.

Note that Coinbase would be the 4th fintech (after Rocket Mortgage, Upstart, and Affirm) to go public that is powered by Cross River.

Valuations for recently public fintechs like Affirm and Bill.com have skyrocketed, trading significantly over their past-year sales. If Coinbase had an annualized revenue of $1 to $2 Bn coupled with a market value of $100 Bn in 2020, the company could trade between 50 and 100 times its past-year sales.

Another Milestone in Cypto - Switzerland Passes “Blockchain Act”

Switzerland has passed a law that grants legal certainty to digital assets transferred through a blockchain. The law allows tokenized assets to have the same legal protection as traditional assets.

This law is a new milestone in the crypto space and makes Switzerland a prominent hub for the asset class.

Divvy Secures $110 MM in a Series C Round

Divvy, led by CEO Blake Murray, raised $110 MM in Series C funding. Divvy offers customers a unique, lease-to-buy experience in home ownership. The company buys homes for its customers, rents it to them, and utilizes 25% of the rent money towards a downpayment for customers to ultimately purchase the home.

The company will use the funding to expand into four more markets and expand its current team of 80 employees. The round was led by Tiger Global Management. GGV Capital, Moore Specialty Credit, JAWS Ventures among others.

LoanDepot Makes its Market Debut

LoanDepot, led by CEO Anthony Hsieh, is hoping to raise $300 MM in its market debut this week. The data-driven mortgage lender is looking at a $6.2 Bn valuation if everything goes according to plan. Deal underwriters for the proposed offering include Morgan Stanley, Bank of America, Goldman Sachs, and Credit Suisse.

Here is a link to the Loan Depot blog post if you’d like to learn more.

In the News:

- PPP Loans Reach $72.7 Billion in New Round with Big Lenders (American Banker, 2/2/2021) The SBA approved 891,044 PPP loans during the third week of pandemic relief, which is more than double the amount from the second week.

- How Millennials and Gen Z Could Reinvent the Banking Industry (Forbes, 2/3/2021) With Millenials and Gen Z now being the largest generational demographic in the US, they have the leverage to revamp the banking industry.

- Fed More Bullish on Launch of Real-Time Payments Service (American Banker, 2/2/2021) The Fed has seen a lot of progress in its real-time payment system, and now anticipates the launch of FedNow in 2023.

- QR Codes Gain Momentum as Consumers Demand Socially Distanced Payments (FinLedger, 2/2/2021) According to Juniper Research, the number of consumers that use QR codes as a form of payment are expected to surpass 2.2 Bn in 2025.

- PayPal CEO Touts ‘Superapp’ as Company Posts Record Quarter. Shares Rise 6% (Fortune, 2/3/2021) PayPal experienced historical growth in Q4 2020.

- BofA’s Goal for Digital Banking: No Customer Left Behind (American Banker, 2/1/2021) Bank of America reported that 40 MM out of their 66 MM customers use the big bank’s online and mobile banking services.

- The GameStop Stock Frenzy is Turning Into a Cautionary Tale for Fintech. (Forbes, 2/1/2021) What fintech could learn from the GameStop trading fiasco.

- Challenger Bank Chime Reaches the 12 Million Customer Mark (Forbes, 2/1/2021) According to a study from Cornerstone Advisors and StrategyCorps, neobank Chime, has an estimated 12 MM customers.

- LoanDepot Expected to IPO This Week Raising Over $300 Million (Crowdfund Insider, 2/2/2021) LoanDepot, led by CEO, Anthony Hsieh, updated its S-1 with the SEC and increased its share price to $21.

Lighter Fare:

- Elon Musk Has Sent the CryptoCurrency Soaring (Yahoo Finance, 2/4/2021). Elon Musk sends DogeCoin to Space.