Strong US GDP Growth; JPM Offers Personal Loans; Mixed FinTech Earnings

By Vy Phan

March 3, 2019

Greetings,

The U.S. economy grew by 2.6% in 4Q2018. Growth was driven by business investment indicating faster growth in the future. The Fed has adopted a patient approach to raising interest rates and will watch incoming data to make future rate hike decisions.

There was a wave of new product offerings this week. JP Morgan launched “My Chase Plan” and “My Chase Loans” – a point-of-sale financing alternative and a personal loan product respectively – that will be offered to its existing credit card customers. JPM is following in Citi’s footsteps with these products, leaving Morgan Stanley as the only top bank without an unsecured personal loan offering.

SoFi continues to evolve into a tech-oriented full services financial firm. The company launched 4 ETFs, 2 of which will have their management fees waived for the first year. SoFi is encroaching on the territory of BlackRock, Vanguard, and State Street in launching the ETFs; although the focus appears to be on diversifying the offering rather than building an index behemoth. SoFi has also partnered with CoinBase to offer trading in cryptocurrencies.

Affirm, a point-of-sale financer, has partnered with Wal-Mart to offer POS financing of up to $2,000. The loans will also be offered on walmart.com.

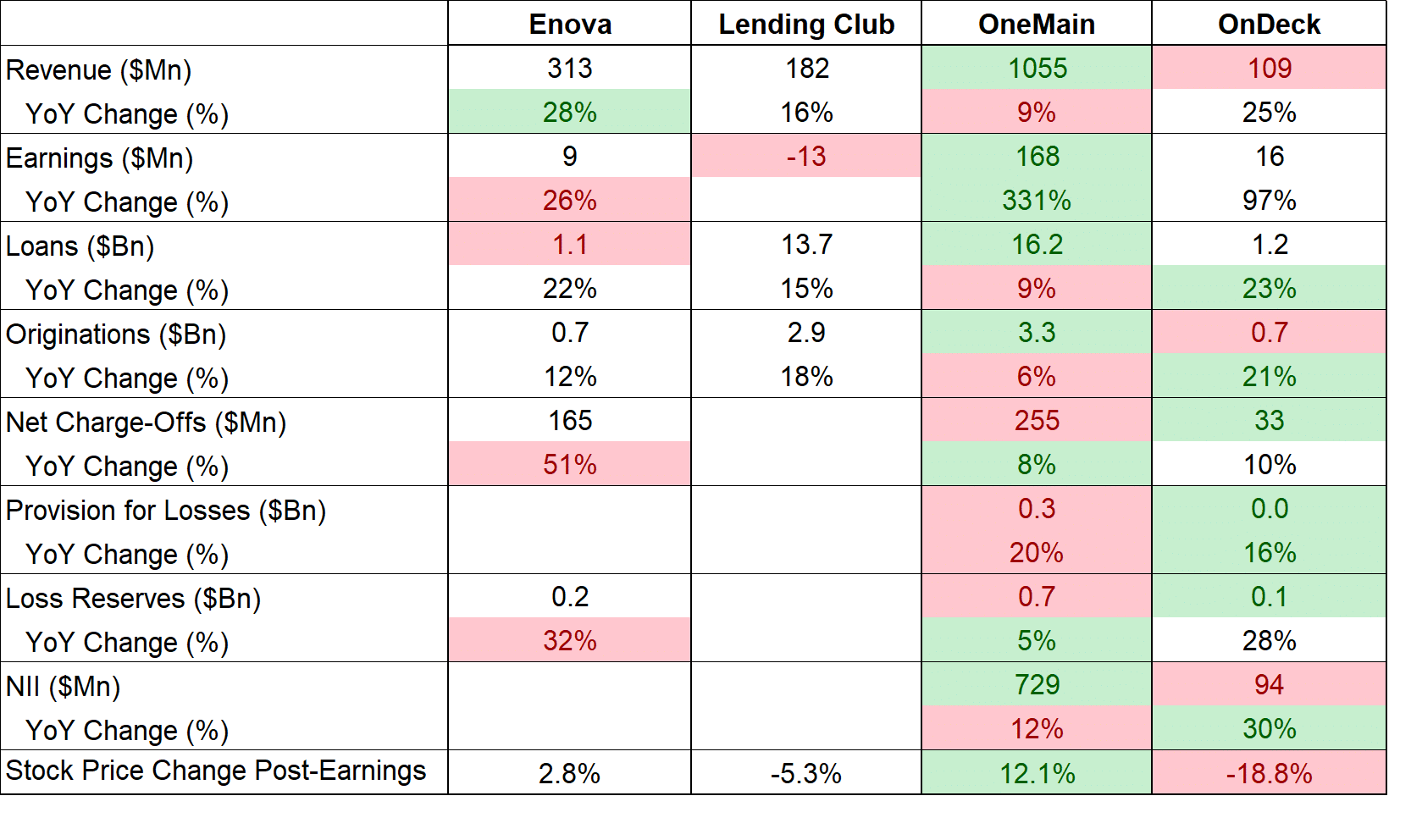

Mixed FinTech Earnings

FinTech issuers saw double digit revenue growth. All issuers except LendingClub also saw earnings growth. Pace of loan growth remained strong as originations grew by double-digit percentages except at OneMain. Below we look at individual earnings in detail. We will publish our 2019Q1 Lending Earnings Insights report shortly after GreenSky reports its earnings next week.

Source: Bloomberg, PeerIQ

Revenues at Enova grew by 28% YoY to $313 Mn to record levels.

- Earnings were $9 Mn, up by 26% YoY.

- Enova’s originations grew by 12% YoY to $0.7 Bn. The loan book now stands at $1.1 Bn, larger by 22% YoY.

- Loss reserves increased by 32% YoY to $0.2 Bn. Growth in reserves significantly outpaced loan growth.

- Charge-offs have been growing from a low base. Net charge-offs increased by 51% YoY to $165 Mn.

- Enova remains focused on near-prime and subprime borrowers for future growth. The company is also looking to ramp up Enova Decisions, its Analytics-as-a-Service platform, as a new revenue stream.

LendingClub’s revenues grew by 16% YoY to $182 Mn.

- Originations grew by 18% YoY to $2.9 Bn. Loans outstanding grew by 15% YoY to $13.7 Bn.

- LC held $840 Mn in loans at the end of 2018 for future transactions.

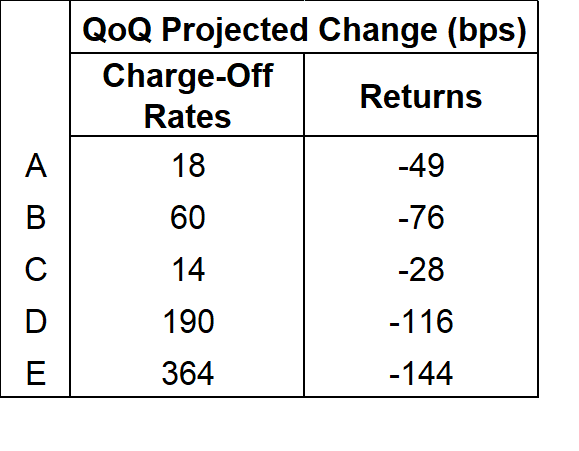

- LC’s projected charge-off rates increased significantly this quarter leading to lower expected returns across grades. Projected returns decreased by between 28 bps on Cs to 144 bps on Es QoQ.

OneMain showed impressive earnings growth.

- Earnings grew by 331% YoY to 168 Mn while revenues grew by 9% YoY to $1.1 Bn.

- NII grew by 12% YoY to $0.7 Bn.

- Originations grew by 6% YoY to $3.3 Bn and the loan book grew by 9% YoY to $16.2 Bn.

- Provision for credit losses increased by 20% YoY to $0.3 Bn, while total loss reserves increased by 5% YoY to $0.7 Bn.

- Net charge-offs increased by 8% YoY to $255 Mn.

- OneMain increased its undrawn credit facilities to $6 Bn and achieved a 48% secured funding mix at the end of 2018.

OnDeck delivered another quarter of record net income.

- Revenue grew by 25% YoY to $109 Mn. Earnings were $16 Mn, up by 97% YoY.

- NII grew by 30% YoY to $94 Mn.

- Originations grew by 21% YoY to $0.7 Bn and the loan book grew by 23% YoY to $1.2 Bn.

- Provision for credit losses increased by 16% YoY to $40 Mn, while total loss reserves increased by 28% YoY to $140 Mn, in line with loan growth.

- Net charge-offs increased by 10% YoY to $33 Mn.

- OnDeck noted that there was demand from both large and small banks for its ODX, Lending-as-a-Service platform.

Industry Update:

- GDP Grows at 2.6% Pace as Business Spending Accelerates (Bloomberg, 2/28/19) The U.S. economy cooled by less than expected as business investment picked up.

- Student-Loan Delinquencies Hit Record (Bloomberg, 2/22/19) Past-due debt reached $166 billion in the fourth quarter, but may be understated.

- Banking regulator fights NY lawsuit over fintech charters (Reuters, 2/27/19) The OCC has asked a Manhattan federal court to dismiss a lawsuit by the New York financial regulator over its plan to issue banking charters to fintech companies, saying the lawsuit is premature.

- JPMorgan Chase to offer online loans to credit card customers (American Banker, 2/26/19) JPMorgan Chase is the latest bank to offer personal loans to existing credit card customers.

- Walmart teams with Affirm to offer point-of-sale loans (American Banker, 2/27/19) The deal marks the first time that the retail giant will enable its customers to use fixed-rate loans, rather than credit cards, for big-ticket purchases in its stores and online.

- Millennial online lender SoFi to launch zero-fee index ETFs, a fund industry first (CNBC, 2/25/19) SoFi is diversifying its product offerings by adding zero-fee ETF trading.

- Fintech Startup SoFi to Roll Out Crypto Trading Via Partnership With Coinbase (Cointelegraph, 2/26/19) SoFi is partnering with Coinbase to support crypto trading.

- SoFi founder Mike Cagney’s new company, Figure, just raised another $65 million (TechCrunch, 2/27/19) Figure has raised $120 million to date to provide HELOCs online.

- HSBC: Fintech deal will provide access to midsize businesses in U.S. (American Banker, 2/26/19) HSBC will get access to Neptune’s customers providing a $1.5 Tn opportunity.

Lighter Fare:

- Scientists Finally Figured Out Why Grapes Spark in the Microwave (Popular Mechanics, 2/19/19) The enduring mystery of our time, why do grapes catch fire in a microwave, has been solved and has national security implications.