CPI Below Expectations; Bank Earnings; Latest on Cagney's Provenance

By Vy Phan

April 14, 2019

Greetings,

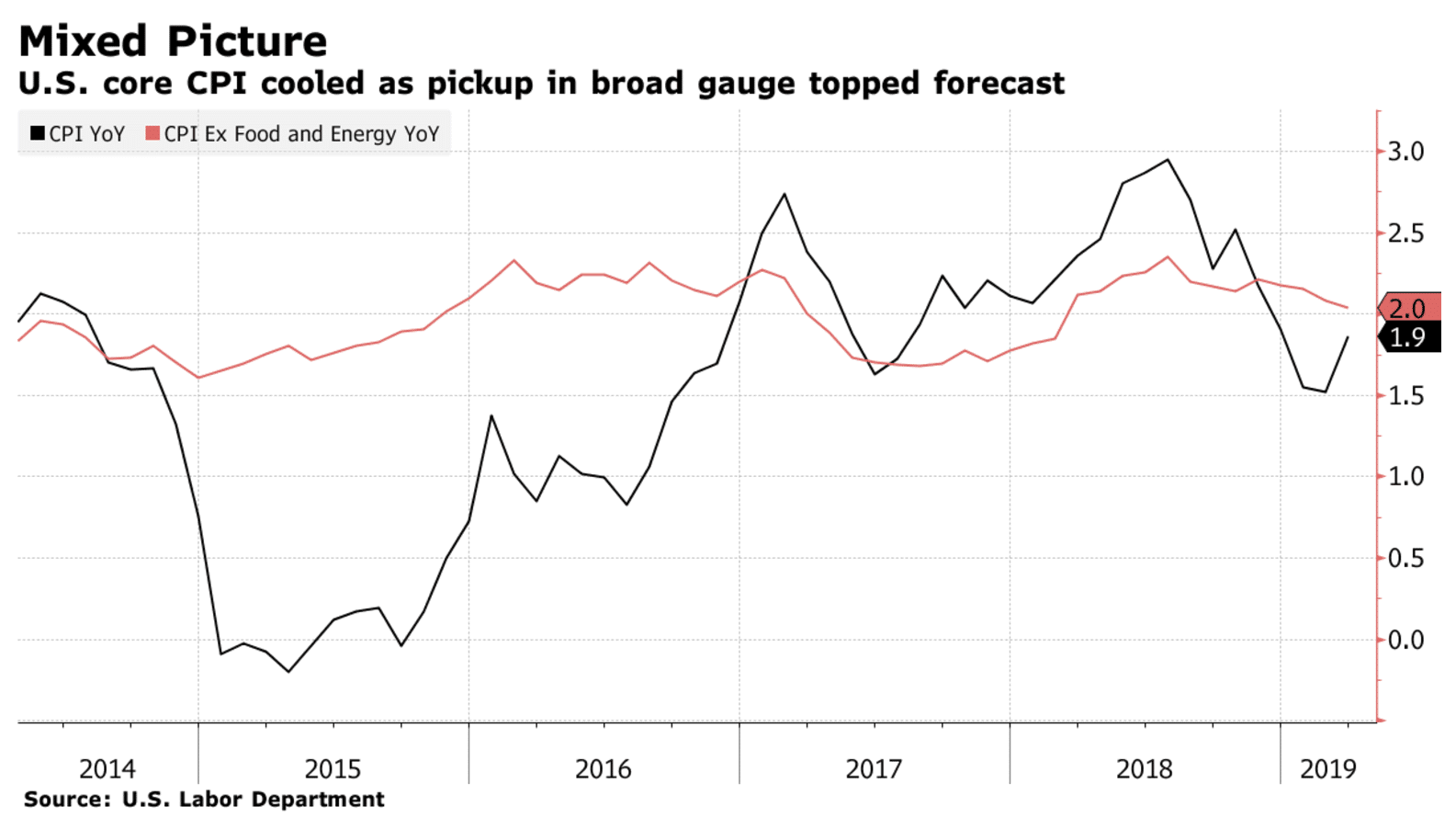

US Core CPI rose by 2% YoY, slightly below expectations. The price level is now a whopping 5% below the Fed’s intended price path since the financial crisis due to persistently low inflation readings.

The Fed minutes showed that members remain flexible and are attuned to incoming data.

Source: US Labor Department, PeerIQ

Bank earning season has begun well with both JP Morgan and Wells Fargo beating expectations. JPM’s revenue increased by 5% YoY to $29.9 Bn and net interest income rose to a record $14.5 Bn. Trading revenue disappointed again declining by 17% YoY to $5.5 Bn.

Wells Fargo’s revenue declined by 1.4% YoY to $21.6 Bn, beating analysts’ expectations. Net income increased by 14% to $6 Bn, the highest in 5 years. PeerIQ will cover the earnings of bulge-bracket banks in detail next week after all banks have reported for the quarter.

Small Banks Start to Rebel Against Core?

The WSJ’s Telis Demos and Rachel Ensign published an article that made the rounds this past week: “Frustrated by the Tech Industry, Small Banks Start to Rebel”. Community banks are staring down the threat of online digital banking from large bank incumbents, and the prospect of Big Tech companies such as Amazon and PayPal competing for their customers.

Small banks often lack rely in-house technology and rely on core providers such as FIS, Fiserv and Jack Henry. The article argues that small banks are not happy with the services provided by these companies.

FinTechs sense opportunity. OnDeck, Avant, Upstart and others are packaging their offerings into digital banking technology.

How the Provenance Blockchain Is Applied to Financial Services

Mike Cagney provided a keynote at LendIt this week and laid out how Blockchain is poised to transform financial services. We recommend the attached whitepaper from Provenance if you want to dig in more.

The whitepaper addresses the “solution chasing a problem” critique of blockchain by detailing thru use-cases spanning origination, securitization, loan trading and servicing.

The paper describes how “big intermediation is in financial services” and shows a table of the top custodians and large market caps (the implication that their days are numbered). The paper also identifies exchanges as a provider of liquidity and presumably also ripe for disintermediation.

Left unsaid in the paper – does Provenance view investment banks and trading desks – the parties necessary in the early days to usher in this transformation – as ripe for disintermediation?

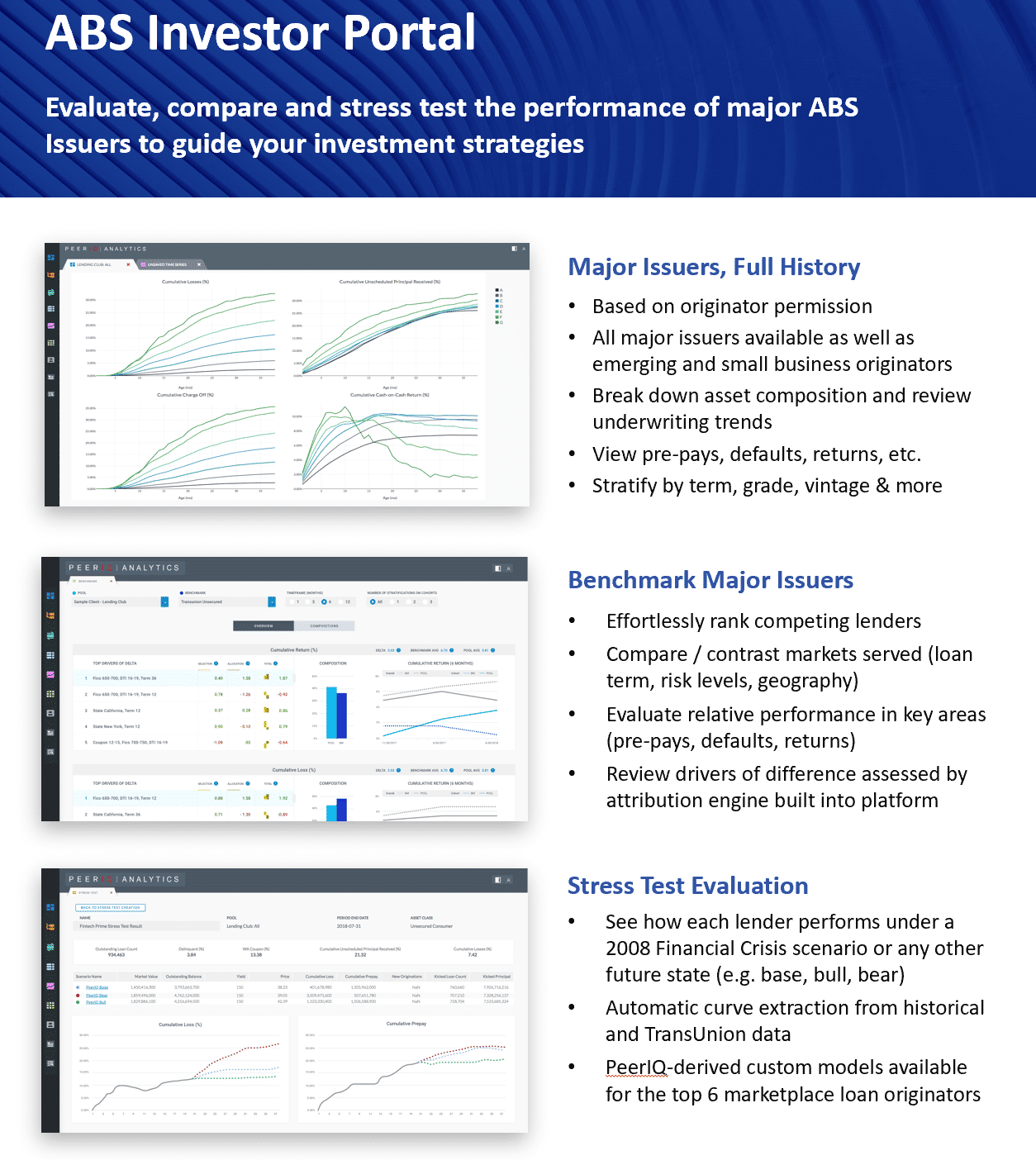

PeerIQ’s ABS Investor Portal

PeerIQ’s ABS Investor Portal allows user to analyze and benchmark the loan-level collateral of major ABS issuers. Users can perform Stress Test scenarios, such as the 2008 global financial crisis, on each originator and project cash flows. Reach out to learn more!

Conferences:

PeerIQ’s CEO Ram Ahluwalia will be speaking on the Ocrolus Fight Fraud with Fintech panel on Tuesday 4/16 at 6:30 pm EDT. You can RSVP here to attend the panel discussion.

Industry Update:

- Core Inflation Cools Amid Shift in Data Methodology (Bloomberg, 4/10/19) US Core CPI rose by 2% YoY, slightly below expectations.

- Fed Minutes Show Some Rate Flexibility During Year of Patience (Bloomberg, 4/10/19) Policymakers are grappling with “significant uncertainties”

- JPMorgan Gets One More Boost Off Rate Hikes Before Fed Pause (Bloomberg, 4/12/19) JPM’s revenue increased by 5% YoY to $29.9 Bn, trading and bond revenues worsened.

- Wells Fargo Profit Surprise Offers Respite After Tough Start (Bloomberg, 4/12/19) Wells Fargo delivered the best quarter in five years, beating analyst expectations.

- Frustrated by the Tech Industry, Small Banks Start to Rebel (WSJ, 4/11/19) Small banks are moving away from core providers and partnering with FinTechs.

- Amount Announces Cloud-Based Account Verification Platform (kake.com, 4/9/19) Avant’s subsidiary Amount offers digital banking solutions for banking and loan products.

- Need a loan for Tax Day? According to Lending Club data, you're not aloan... er, alone (thinknum.com, 4/10/19) LC made $159 Mn in personal loans leading up to tax day.

- Upstart raises $50 million and partners with banks to expand its AI lending business (venturebeat.com, 4/8/19) Upstart has raised $50 Mn in a series D round led by Progressive Investment Company, Healthcare of Ontario Pension Plan, and First National Bank of Omaha.

- OnDeck Offers Same Day Funding (ondeck.com, 4/5/19) OnDeck will fund loan amounts up to $25 k on the same day

Lighter Fare:

- Earth Sees First Image of a Black Hole (NPR, 4/10/19) A 29-year old scientist, Dr. Kate Bouman, produces the first visual representation of a black hole.