Visit PeerIQ at LendIt; Highlights from Jamie Dimon’s Annual Letter

By Vy Phan

April 7, 2019

Greetings,

This week, Jamie Dimon published his widely followed Chairman’s Letter. We deep-dive into this special topic in this newsletter.

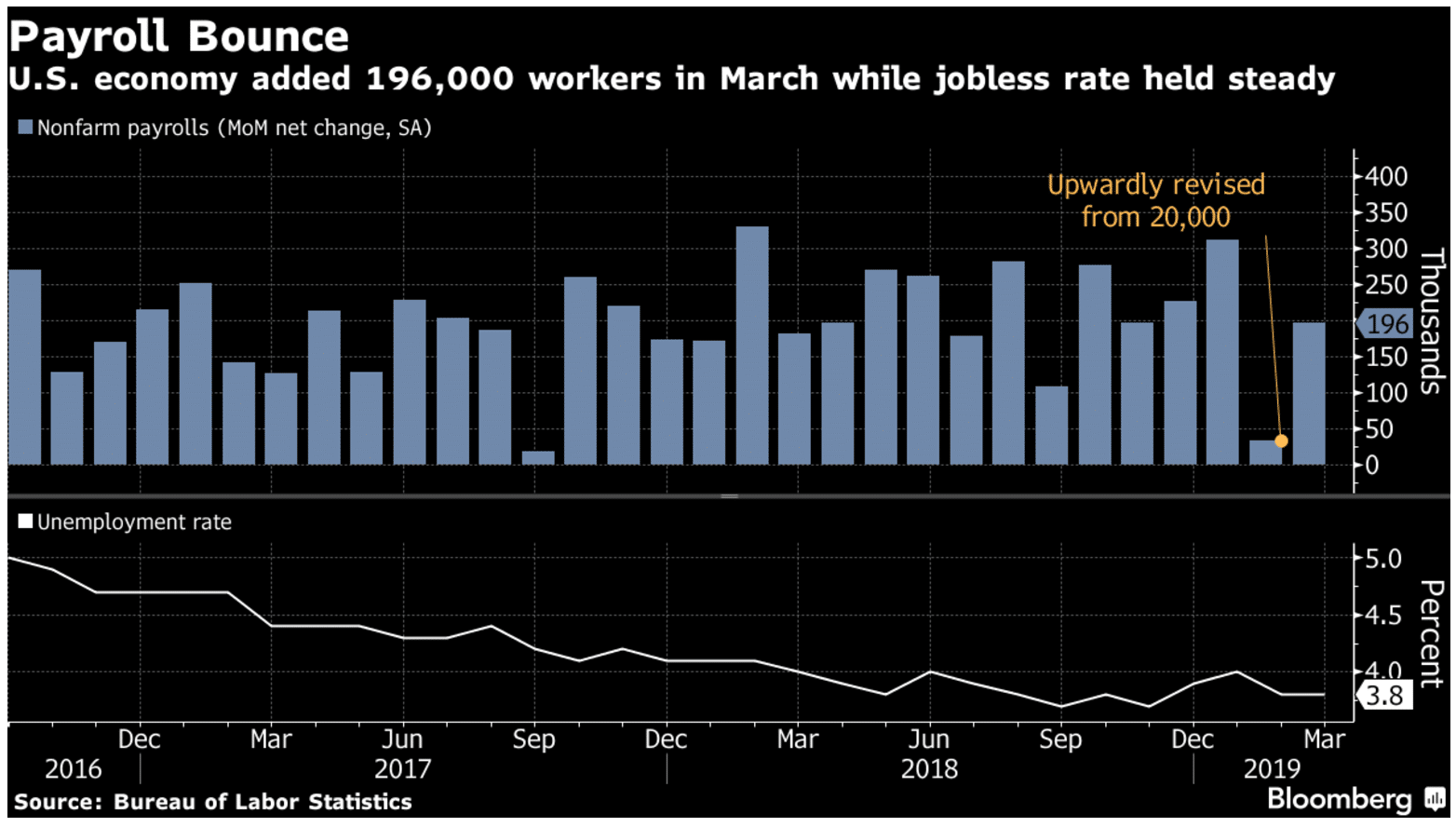

US payrolls rose by 196 k in March and the unemployment rate remained at 3.8%. The data signal that the labor market is steady even if job gains are moderating from last year’s pace.

In regulatory news, the heads of the OCC and the FDIC have indicated that they could complete CRA reform by early next year. Read our prior analysis on CRA reform and its implications here.

FinTech fund raising and M&A continues. TradeWeb has raised $1.1 Bn in its IPO. TradeWeb also obtained a $500 Mn credit line and plans to use the proceeds for technology acquisitions.

Affirm, a point-of-sale credit provider, has raised $300 Mn in a Series F round led by Thrive Capital. Affirm has raised $800 Mn in equity funding so far and originated $2 Bn in loans in 2018.

Pagaya, an AI-powered asset manager, has raised $25 Mn in a Series C round led by Oak HC/FT to branch out into real estate, corporate credit, mortgages, and other asset classes.

Novo, an SME bank, has raised $4.8 Mn in its seed round to launch free business checking accounts.

|

Join PeerIQ at LendIt! PeerIQ will be at LendIt, Stop by Booth 1640! PeerIQ, the leading risk and liquidity management platform in consumer credit, is showcasing its latest analytics tools for both whole loan investors and originators, including: • Valuation of “pass-through” CUSIPs made up of marketplace loans • Stress test scenario calculator to forecast cash flows in many future states • Curve extraction from TransUnion market data or originator-specific history • Automated benchmarking to quantify portfolio alpha PeerIQ’s CEO Ram Ahluwalia will be speaking at the LendIt conference on the What are the Data Points Telling us about the Current Credit Market panel on Monday 4/8 at 4 pm PDT. Please stop by Booth 1640 or request a meeting! |

Highlights from Jamie Dimon’s Letter to Shareholders

Jamie Dimon published his annual letter to shareholders. We look at some highlights below:

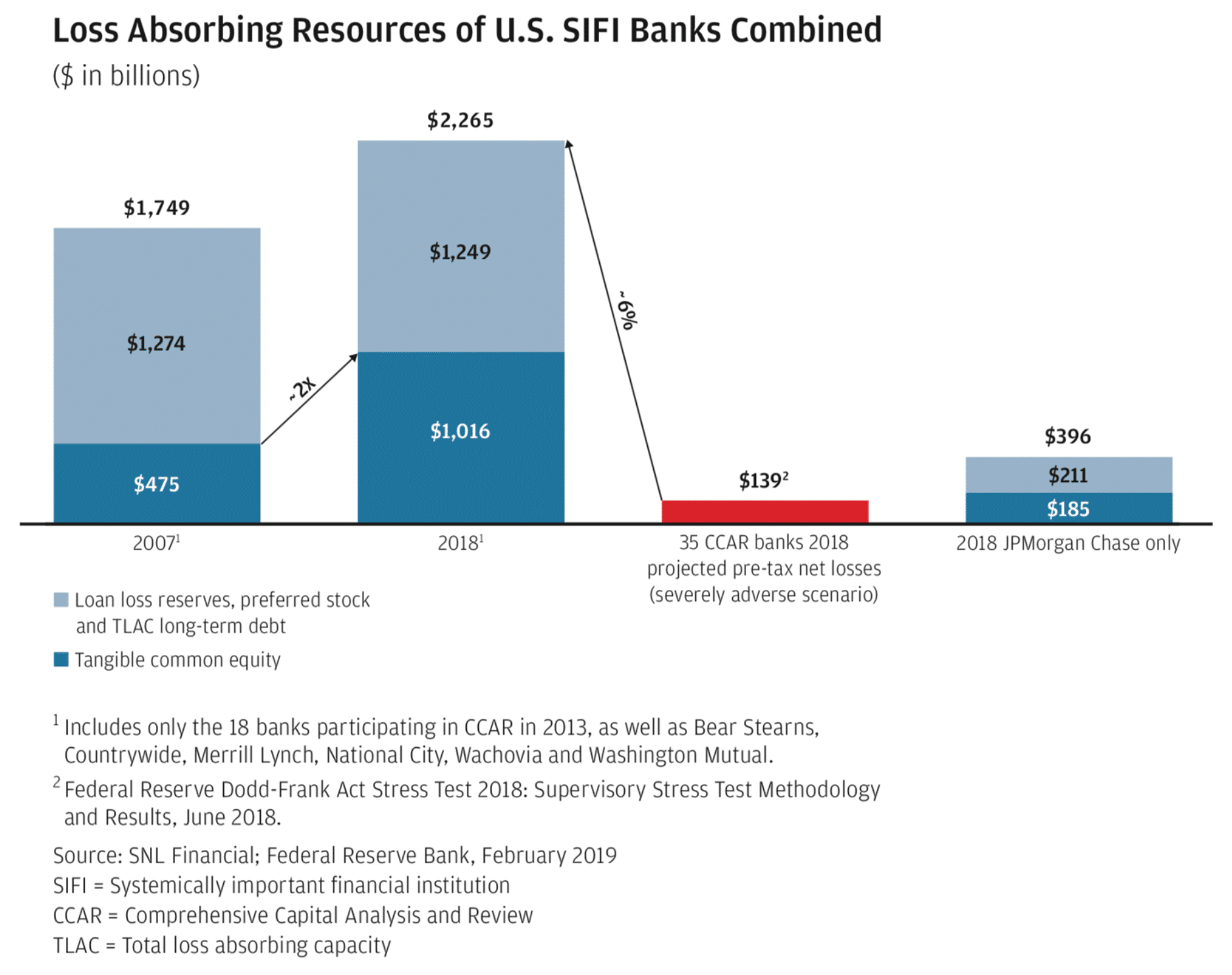

- The banking system, and JPM in particular, is over-capitalized - Under the Fed’s most extreme stress-testing scenario, where 35 of the largest American banks bear extreme losses (as if each were the worst bank in the system), the combined losses are about 6% of the total loss absorbing resources of those 35 banks. The observation suggests capital can be deployed into lending or returned to shareholders but is tied up in regulatory capital.

Source: JPM, PeerIQ

Here are some of the Chairman’s highlights:

- Good regulation can help America grow and improve its financial stability. Jamie’s policy recommendations include:

- Boost economic growth via mortgage reform: Reducing onerous and unnecessary origination and servicing requirements would dramatically improve the cost and availability of mortgages to consumers – boosting GDP 20 bps a year.

- Stress-testing needs rationalization: Stress testing matters. However, The CCAR testing framework and stress testing assumptions (e.g., continuation of dividend payments) are arbitrary and unnatural.

- Non-Banks need to be monitored and may struggle to lend during a recession

- The growth in non-bank mortgage lending, student lending, and consumer lending is accelerating and is not yet a systemic risk – but must be monitored. Jamie expresses concerns that non-bank will struggle to lend during difficult times leaving borrowers “stranded”.

- JPM is investing billions in technology to compete – the cloud, AI, ML and digital banking

- JPM is refactoring its applications to embrace the cloud – a turnaround in JPM’s position from a few years ago.

- JPM customers can now open a bank account online in under 5 minutes and can reduce their mortgage closing times to 3 weeks.

- The bank now has 49 Mn active digital customers, including 33 Mn active mobile customers

- JPM is looking at fintechs in the US and in China as not just opportunities but also looming competition.

Conferences:

PeerIQ’s CEO Ram Ahluwalia will be speaking at the LendIt conference on the What are the Data Points Telling us about the Current Credit Market panel on Monday 4/8 at 4 pm PDT.

Ram will also be speaking on the Ocrolus Fight Fraud with Fintech panel on Tuesday 4/16 at 6:30 pm EDT. Fraud experts will discuss cutting edge solutions to fight fraud, technology trends and industry insights. You can RSVP here to attend the panel discussion.

PeerIQ Mentions:

- Inflated Credit Scores Leave Investors in the Dark on Real Risks (Bloomberg, 4/7/19) Credit scores have been migrating higher and are underestimating default risk.

Industry Update:

- Payrolls Top Estimates With 196,000 Rise as Wages Cool (Bloomberg, 4/5/19) US payrolls rose by 196 k in March and the unemployment rate stayed at 3.8%.

- OCC and FDIC chiefs signal progress on CRA reform (American Banker, 4/3/19) The heads of the OCC and the FDIC have indicated that they could complete CRA reform by early next year

- A payday lender in disguise? New York investigates the Earnin app (American Banker, 4/3/19) The NYDFS is investigating Earnin, an early wage access provider, over concerns it may be skirting state lending laws.

- Jamie Dimon’s Letter to Shareholders (JP Morgan, 4/4/19) Dimon’s annual letter talked about regulatory issues and public policy along with an overview of the banks performance.

- Tradeweb Jumps 27 Percent in Debut After $1.1 Billion U.S. IPO (Bloomberg, 4/4/19) TradeWeb has raised $1.1 Bn in its IPO. TradeWeb also obtained a $500 Mn credit line and plans to use the proceeds for technology acquisitions.

- Max Levchin’s Affirm Raises $300 Million Series F (CrowdFund Insider, 4/4/19) Affirm, a point-of-sale credit provider, has raised $300 Mn in a Series F round led by Thrive Capital.

- OnDeck merges Canadian ops with Evolocity (FinExtra, 4/3/19) OnDeck, a small business lender, has merged its Canadian operations with Evolocity, a Canadian small business lender.

- AI-Powered Asset Manager Pagaya Goes After Real Estate (Institutional Investor, 4/3/19) Pagaya has raised $25 Mn in a Series C round led by Oak HC/FT to branch out into real estate, corporate credit, mortgages, and other asset classes.

- New $4.8m funding for SME bank Novo (Banking Tech, 4/1/19) Novo, an SME bank, has raised $4.8 Mn in its seed round to launch free business checking accounts.

- BBVA loan links interest rate to digital milestones (FT, 4/1/19) The interest rate on BBVA’s loan to Olam will decrease if Olam achieves a set of digital targets.

Lighter Fare:

- The Animal-AI Olympics is going to treat AI like a lab rat (MIT Tech Review, 4/1/19) Animal-AI Olympics will pit today’s leading AIs against each other to see if they can master basic tasks that animals can perform.