Greetings,

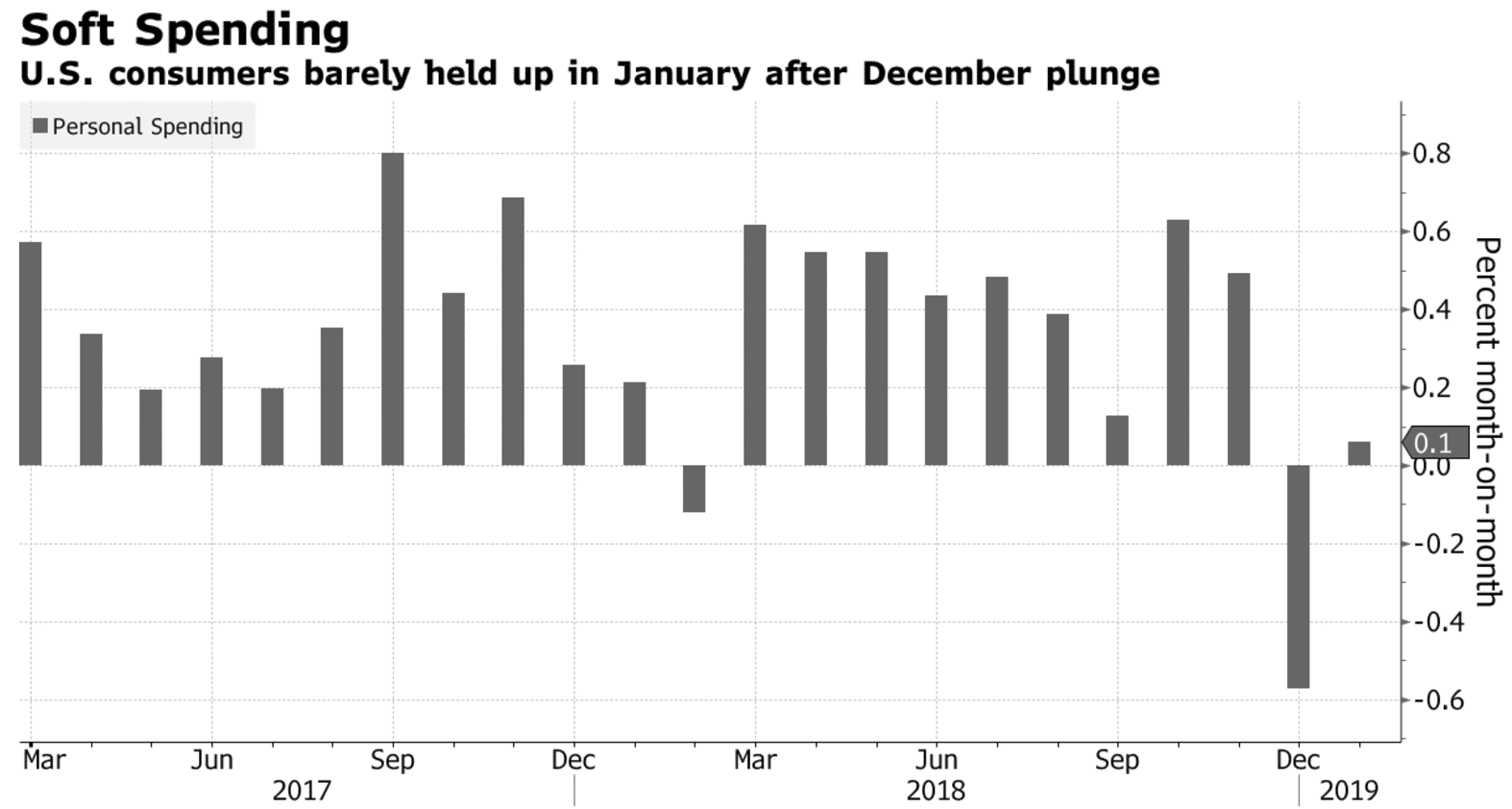

US 4th quarter GDP growth slowed to 2.2%, as what is shaping up to be the largest expansion in US economic history starts to lose steam. Consumer spending also slowed in January, rising by just 0.1% MoM. The Fed’s preferred inflation gauge, PCE, rose by just 1.4% YoY, justifying the Fed’s decision to keep rates on hold. Overall signs point to a slowing economy in the late stages of an expansion.

Source: Bloomberg, PeerIQ

The OCC has laid out the mechanism for FinTechs with a national charter to engage in broader activities such as deposits. The OCC envisions a scenario where a FinTech can apply for deposit insurance and become a full-service bank. The FinTech charter continues to be opposed by the NY State Department of Financial Services and the Conference of State Bank Supervisors.

In earnings news, Prosper reported that 2018 Net Revenue declined by 10% YoY to $104 Mn. Net loss for 2018 was $40 Mn, down from $115 Mn in 2017. Originations were slightly lower at $2.84 Bn. Adjusted EBITDA improve substantially from $5.4 MM to $9.4 Bn.

SoFi CEO Anthony Noto provided an in-depth interview with LendIt’s Peter Renton. You can find the transcript here. Some of the highlights include:

- An IPO is not a priority and is not on the plans for 2019

- SoFi is focused on broadening its product mix and has launched SoFi Money, a checking account, and SoFi Invest, a brokerage service

- Major revenue drivers continue to be student and personal loans but SoFi is looking to grow its mortgage business as well

- SoFi Money, SoFi Invest and student loan refinancing are expected to have an equal number of members in 2020

- SoFi is not actively seeking an ILC or a national bank charter as of now

PeerIQ’s Consumer Credit Digest

PeerIQ’s Consumer Credit Digest, powered by TransUnion data, is a detailed market report that analyzes credit supply, credit demand, and performance across trillions of loans. The report enables investors and risk officer to stay on top of US consumer credit trends and questions such as:

- How have originations and outstanding balances trended over time? (page 4)

- How do delinquencies differ between borrowers who get a loan from a bank and those who get a loan from a FinTech company? (page 30)

- How has the credit card utilization of borrowers with a personal loan changed over time? (page 56)

Our first issue, on Consumer Unsecured Term Loans, is available now for free preview here! The preview covers Jan 2014 – June 2016. The paid report covers all loans from June 2000 to present. Contact us to learn more.

Source: PeerIQ

Apple’s New Credit Card

Apple has relaunched Apple Card – a co-branded credit card issued by Goldman Sachs – a newcomer to the co-brand card market (historically dominated by large consumer banks such as Citi, Chase, and American Express). The Apple Card is meant to be used primarily through Apple Pay. There is a physical card available as well, for use when Apple Pay is not accepted.

Both GS and Apple are trying to expand into the payments and credit card businesses. Apple is luring users with no annual, late or international fees and with the iPhone’s embedded privacy and security features.

Credit card wars have also heated up among ride-share competitors. Uber launched a co-branded credit card with Barclays last year, and now Lyft wants to give its drivers free debit cards and bank accounts to better manage their finances. While Uber’s credit card is targeted towards consumers, Lyft is using its debit card to improve driver retention. The debit card will offer drivers up to 4% cashback.

Conferences:

PeerIQ’s CEO Ram Ahluwalia will be speaking at the LendIt conference on the What are the Data Points Telling us about the Current Credit Market panel on Monday 4/8 at 4 pm PDT.

Ram will also be speaking on the Ocrolus Fight Fraud with Fintech panel on Tuesday 4/16 at 6:30 pm EDT. Fraud experts will discuss cutting edge solutions to fight fraud, technology trends and industry insights. You can RSVP here to attend the panel discussion.

Industry Update:

- Fourth-Quarter Growth Revised Down to 2.2% From 2.6% (Bloomberg, 3/28/19) US 4th quarter GDP growth slowed to 2.2%, as what is shaping up to be the largest expansion in history starts to lose steam.

- Consumer Spending Misses Forecasts as Inflation Eases (Bloomberg, 3/29/19) Consumer spending also slowed in January, rising by just 0.1% MoM. The Fed’s preferred inflation gauge, PCE, rose by just 1.4% YoY.

- Buffett on the economy: ‘It looks like things have slowed down’ (CNBC, 3/28/19) Buffett noted that economy seemed to be slowing down based on a slowdown in his railroad company BNSF.

- NY Fed Creates FinTech Advisory Group (pymnts.com, 3/29/19) The NY Fed has created Fintech Advisory Group to bridge the communication gap between the FinTech industry and consumer organizations.

- Considering Charter Applications from Financial Technology Companies (OCC, July 2018) The OCC has laid out the mechanism for FinTechs with a national charter to engage in broader activities such as deposits.

- Fintech in Brief: Update on Legal Challenges to OCC Fintech Charter (JDSupra, 3/27/19) The FinTech charter continues to be opposed by the NY State Department of Financial Services and the Conference of State Bank Supervisors.

- Podcast 193: Anthony Noto of SoFi (LendAcademy, 3/29/19) SoFi CEO Noto spoke about the company’s growth plans and his focus on SoFi Money and SoFi Invest.

- Apple unveils new no-fee credit card: The Apple Card (CNBC, 3/25/19) Apple has relaunched Apple Card – a co-branded credit card issued by Goldman Sachs as both companies look to push into the payments and credit card spaces.

- Lyft wants to give free bank accounts and debit cards to drivers (The Verge, 3/26/19) Lyft is using its debit card to improve driver retention. The debit card will offer drivers up to 4% cashback.

- Equifax, FICO join forces to give banks one-stop analytics product (American Banker, 3/27/19) Equifax and FICO have partnered to create Data Decisions Cloud for banks that combines consumer data with analytical software.

- Citi urges incumbents to grow their own challenger brands as new entrants shrink the market (FinExtra, 3/29/19) Incumbent banks must develop their own digital offshoots to prevent a nearly 30% revenue loss caused by challenger banks.

- John Mack & Mary Meeker Depart LendingClub Board of Directors (CrowdFund Insider, 3/30/19) John Mack and Mary Meeker have left LC’s board of directors after 7 years.

- SoFi Refreshes Home Loans, Making Home Buying Painless and Paperless (PR NewsWire, 3/27/19) SoFi is relaunching SoFi Home Loans as a digital mortgage product.

Lighter Fare:

- The race to make a lab-grown steak (MIT Tech Review, 2/27/19) Plant-based meat and meat cultivated with cellular agriculture could come close to mimicking the true taste of a juicy burger.