Q4 2021 Review | Consumer Lending

By Cole Gottlieb

February 27, 2022

As we kick off the new year with increased volatility amidst continuing inflationary pressures and anticipation of more, faster rate hikes, catch up on the latest trends we see emerging in the consumer lending space: differences between fintech and bank performance, growing acceptance and potential implications of account-to-account payments, and the latest in BNPL.

To stay on top of the latest news and trends in the consumer lending space, subscribe to our weekly newsletter here.

Consumer Loans Returning to Normal, Fintechs Drive Comeback

Unsecured personal loan originations completed their pandemic comeback, exceeding pre-pandemic levels in the third quarter (originations reported through Q3 due to reporting lag). With the rebound in growth, we have seen a marginally higher amount of subprime and near prime originations, 68.3% of total compared to 67.1% in 3Q20. Although we saw a slight increase in delinquencies (90+ DPD), to 1.78% in Q4 from 1.71% in 4Q20, these levels remain well below pre-pandemic levels.

Source: TransUnion

Source: PeerIQ

While we have seen an increase in originations through the second half of the year, there has been a notable increase in net charge-offs on both a year-over-year and sequential basis. However, it is important to remember that levels of NCOs were historically low during the pandemic, and management has been guiding towards an increase as origination growth returned and pandemic restrictions were lifted. While NCOs are not a cause for concern yet, an increasing concentration of near- and subprime loans will be something to keep an eye on.

Source: PeerIQ

Bank’s consumer loan book growth was mixed, with leaders Citizens (+1.3% QoQ) and JPMorgan (+0.8% QoQ) able to capitalize on mortgage and auto loans as prepayments slowed. PNC (+0.1% QoQ) and Wells Fargo ((0.0)%), were unable to grow their consumer loan books much, pointing to lower refinance activity, home equity and auto loans for the lack of growth.

Bank charge-offs rose from the third quarter, with credit beginning to normalize as expected. Bank NCOs rose less than fintech lenders, as banks have lent to a greater percentage of prime and super prime customers.

Source: PeerIQ

Consumers continued to put cash in the bank, as deposits continued to grow across the board from the third quarter (Morgan Stanley +6.0%, JPMorgan +3.5%, Bank of America +2.6%, Wells Fargo +1.9%, Citizens +0.7%, Citi +0.5%). The increase in deposits may be attributed to a hot labor market paired with increased savings due to inflation worries.

MPL Securitizations Still Strong

The MPL securitization market eased off its record Q3 highs but still posted a strong fourth quarter, with yields remaining low. The market remains active, with 13 deals totaling $4.2Bn closing during the quarter. Upstart ($791Mn), Garrison Investment Group ($512Mn), Oportun ($500Mn), Lendmark ($400Mn), Conns ($378Mn), and Republic Finance ($350Mn) were among the most active players during the quarter.

While new issuances eased off their record third quarter, the first quarter is off to a hot start, with $2.9Bn in volume through February 3. If we see this pace continue, we could see record, or near-record, quarterly new issuance volume.

Source: PeerIQ

For weekly updates on the consumer lending space, subscribe here to our newsletter.

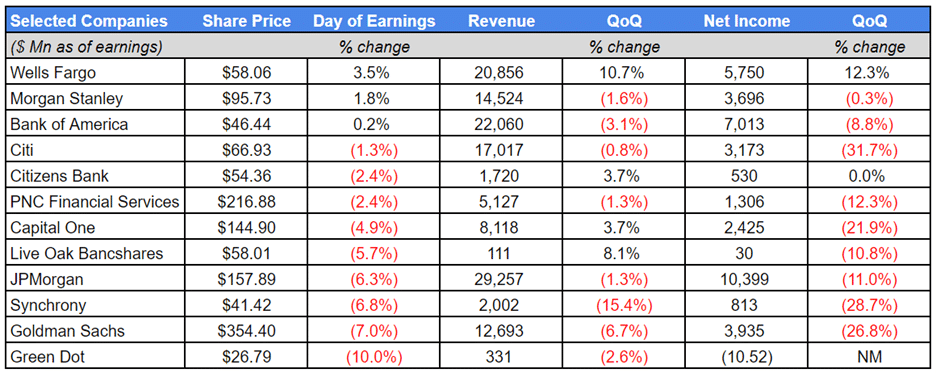

Bank and Fintech Lender Earnings Summary

Source: PeerIQ

Source: PeerIQ

The Rise of Alternative Payment Methods

In the past year, we have seen a growing acceptance of account-to-account (“A2A”) payments, both from merchants and consumers. A2A payments are executed via bank rails, with an increasing share of the transfers executed on real-time payment (“RTP”) rails. A2A transfers can often be faster and cheaper than credit card payments, with data showing that interchange fees for U.S. credit card payments average 1.8% and 0.3% on U.S. debit card payments. With the rollout of P2P payment service Chuck, community banks will be able to support A2A as a payment choice for their customers.

Source: American Banker

Notably, BNPL giant Klarna will work with GoCardless to offer U.S. consumers A2A payments for purchases made with Klarna. Adding this functionality can create a more seamless BNPL experience, as consumers do not need to enter card details multiple times. Linking their app to consumers’ bank accounts and debit cards may help to drive loyalty and convert a greater number of sales for merchants. Additionally, adding A2A should benefit Klarna’s bottom line, as Klarna would not need to pay the high interchange fees required to process user repayments.

Clashes between payment rails and merchants could lead merchants to seek out alternative payment methods, like A2A. During the fourth quarter, Amazon U.K. announced it would pull the ability for U.K. customers to pay with Visa credit cards, due to disagreements over interchange fee hikes. In January, Amazon U.K. decided to put the plan to stop accepting Visa on hold, but further clashes could push merchants towards BNPL services and A2A payments.

In fact, Amazon has already made moves to accept alternative payment methods, allowing consumers to link a personal checking account to pay and plans to enable payment via Venmo this year. Pay with Venmo provides a payment method that allows Amazon to bypass interchange fees, increasing their overall profit margins.

Discover isn’t going to be cut out of A2A payments, hopping into the space by partnering with Buy It Mobility Network to allow consumers to pay from their bank accounts over Discover’s network. Adding the ability for consumers to pay with their checking accounts increases the arsenal of payment options the Discover network supports. The move comes after Discover partnered with SplitIt in October to enable consumers to spread any purchase over time that was made with a Discover card.

While Discover doesn’t have close to the market share of card transactions that Visa or Mastercard does, it has quite widespread merchant acceptance, with over 11 million U.S. merchant locations.

With rising inflation driving margins lower, the push to move to a cheaper form of payment may seem even more attractive to U.S. merchants, who pay a significantly higher interchange rate (often close to double) than their European counterparts. While some may argue that some U.S. consumers may still prefer to utilize credit cards to take advantage of generous rewards programs, debit and alternative payment types have begun to roll out purchase incentives. For example, Amex recently launched a debit card linked to its new digital consumer checking account that earns membership rewards points.

Consumers are already embracing alternative payment methods, with use of mobile wallets at U.S. checkout growing 60% in 2021. Mobile wallets are a digital way to store and use credit, debit, gift cards and loyalty cards on one’s smartphone.

Super apps dominated the fintech news cycle in 2021, with a multitude of companies vying to be the “one-stop financial shop” for consumers. Affirm, Block, Chime, MoneyLion and PayPal are merely a few that have expanded their core offerings to offer services such as bill pay, crypto, BNPL, and savings accounts.

By offering a wide breadth of financial products centered in one place, super apps represent a powerful cross-selling strategy that should provide synergies for aspiring fintechs.

Follow our coverage of alternative payment methods by subscribing to our weekly newsletter.

BNPL Sees Increased Attention from Regulators, Acceptance from Credit Bureaus

CFPB Scrutiny

As we covered in our weekly newsletter, the CFPB opened an inquiry into BNPL credit in mid-December, asking Affirm, Afterpay, Klarna, PayPal, and Zip to submit information so that the CFPB “can report to the public on industry practices and risk”. The CFPB was particularly concerned about the accumulation of debt, regulatory arbitrage, and data harvesting.

Going forward, we expect greater scrutiny from regulators. Working closely with regulators and helping them to understand the new product should reduce the concerns they hold and the potential for a crackdown on split pay. We hope regulators can come to the conclusion that BNPL can provide a lower-cost, less-risky option to consumers than traditional credit cards and revolving loans.

While BNPL has become increasingly popular and drawn the attention of regulators, community bank executives aren’t yet hopping on the bandwagon. A recent IntraFi survey showed that 81% of community executives had little or no interest in BNPL lending. Of the rest of the group surveyed, 14% would be interested in offering BNPL with a fintech partner, and only 2% currently or planned to offer the installment loan. This comes in contrast to major banks, card issuers, and card networks like JPMorgan, Goldman Sachs, Citizens, Capital One, Visa, and Mastercard who have looked to embrace the product.

Credit-Reporting Developments

While BNPL may face increased regulatory attention, it is gaining credibility with major credit reporting agencies. Equifax and Experian both launched plans to incorporate BNPL financing data into consumers’ credit reports. TransUnion says they are “well on their way” to a solution that includes BNPL data.

Equifax plans to formalize its process to include BNPL on traditional credit reports. Experian differs in that it plans to launch a BNPL-specific bureau to track data of the popular installment loans.

TransUnion’s partnership with Sezzle allows consumers to establish credit based on their repayment history with Sezzle, allowing those with thin or even no credit history the opportunity to build their credit.

Credit reporting agencies and lenders have expanded consumer’s borrowing capabilities by allowing credit reports and scores to be based solely on alternative data.

Experian announced that it would allow consumers to create their own credit reports by linking recurring non-debt bills, such as utility or cellphone payments, to establish a credit record. This can help to open up the largely untapped lending market of 28Mn Americans who don’t have credit reports with the major bureaus.

Fintechs like Upstart have incorporated alternative data, including inputs that may help young adults saddled with student debt access credit, such as college, area of study, and employment history.

TransUnion and Spring Labs are rolling out a feature that will let consumers give blockchain companies access to their personal credit data. Current crypto borrowing options often require loans to be fully or over-collateralized by crypto. With this new initiative, the partnership aims to increase “hodlers” of crypto’s access to credit, while potentially decreasing or even eliminating the need for collateral.

Our take is that 15% of American adults, roughly ~45Mn people, have thin or no credit history, which can severely impair their ability to access financing from mainstream lenders. By expanding the ability to build credit, consumers can improve their financial well-being and avoid getting caught in debt traps from often predatory payday or other high-cost loans. With over half of Americans living paycheck to paycheck, a difference in financing costs can make or break a family’s budget.

Consumers' pocketbooks are further stretched by inflation rates not seen in decades. Facing higher prices, and higher rates on variable rate products like credit cards, consumers may find BNPL solutions even more attractive, given their fixed or no fee structures. While BNPL margins could come under pressure due to rising rates, increased BNPL volume may still drive higher earnings.

Stay up to date with the latest developments in BNPL by subscribing to our weekly newsletter.