Revolut Raises $800Mn; Child Tax Credit Begins; Exec Order on Competition

By Cole Gottlieb

July 18, 2021

Greetings,

The economic recovery continues, with unemployment claims improving but the inflation outlook unclear. Child tax credit checks begin rolling out. Biden’s executive order may put the brakes on bank M&A activity.

Revolut raises a war chest, while Apple and Goldman plan to buy now, pay later. Blue Ridge partners on Income Share Agreements. Bank earnings are a mixed bag.

New here? Subscribe here to get our newsletter each Sunday.

Unemployment Claims Improve, Inflation Outlook Uncertain

Initial claims for unemployment hit a new pandemic low, coming in at an expected 360,000 last week. Meanwhile, inflation in June rose at a faster than expected rate of 5.4% vs. the year prior. Increases in the prices of used autos continue to be a driving factor, contributing about a third of the increase in the CPI.

There’s some concern among economists that long running trends that held down inflation, like increasing globalization, favorable demographics, and the growth of ecommerce, may now be reversing.

Timber! It’s not all bad news on prices, with the cost of lumber, a key driver of cost in new housing, normalizing as supply disruptions ease, inventory levels increase, and demand from large retail stores drops. This should be welcome news for those working on pandemic-inspired log cabins.

Child Tax Credit Payments to Begin

Payments of $250 - $300 per month, per child, will begin going out to American families in the coming days. The terms of the temporary, one-year program allow all but the most affluent families to get payments, with 9 out of 10 children qualifying. With many families flush with cash from previous stimulus payments and reduced spending during the pandemic, the added payments could contribute to banks’ ongoing anemic loan growth.

Exec Order Throws a Wrench in M&A, Encourages Open Banking

President Biden’s sweeping executive order designed to promote competition across the American economy may put the brakes on bank M&A activity just as it was ramping up. Last week’s order highlighted that the US has 10,000 fewer banks than it did 20 years ago, with many of those closures owing to mergers and acquisitions. The order instructs the Department of Justice and key banking regulators to scrutinize mergers more closely.

With growth and cost savings through mergers a potentially less viable route, it is even more imperative for smaller banks to partner with fintechs to achieve wider distribution and drive efficiencies.

Who Owns the Data? The EO also directed the CFPB to progress with rulemaking to implement part 1033 of Dodd-Frank, which calls for financial service providers to give consumers access and control over their financial data. Data portability could improve competition by making it easier for consumers to switch providers. It has additional use cases, like for cash-flow based underwriting, which can expand access to credit for underserved populations.

In Europe, open banking regulations require banks to offer APIs to securely share customer data and initiate payments, which has encouraged innovation and competition in the sector. While companies like Plaid have built robust data sharing infrastructure in the US, regulatory clarity around who ‘owns’ the data and what information must be shared will benefit data aggregators, banks, and consumers alike.

Banks See Increased Consumer Spending, but Lending is Still Down

Bank stocks report a huge jump in consumer spending as the economy reopens. Although the rise in consumer spending has not yet translated to loan growth, net charge-offs and delinquencies have fallen as the hot job market and continued stimulus spending bolsters consumer balance sheets.

Bank stocks surpassed profit estimates, with Citi, JPMorgan, and Wells Fargo earnings aided by billions of dollars of reserve releases. As JPM CFO Jeremy Barnum noted, “We released $3 billion this quarter as we grow increasingly confident about the economy in light of continued improvement in COVID, especially in the U.S.” Bank of America released $834Mn while Goldman released only $92Mn.

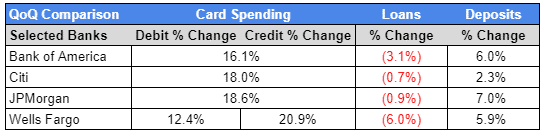

Debit and credit card spending was up significantly QoQ, as states reopened. Additionally, banks saw deposits continuing to grow during the quarter.

Source: PeerIQ, Company Earnings, Consumer Segment Only

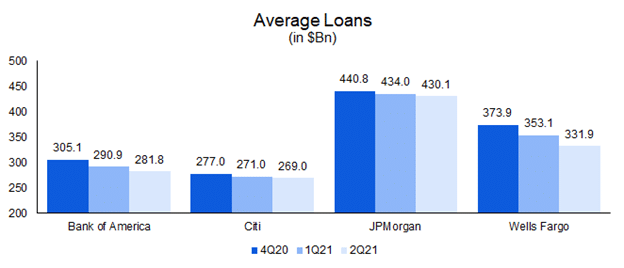

Although spending was up, the consumer has not yet re-levered, and loan growth has not bounced back. Many bank executives have begun to see positive signs, with Brian Moynihan, CEO of Bank of America noting, “Card loans grew with increased spending even as customer payment percentages remained high.” In Q2, banks have largely reported flat or decreases in consumer loans.

Source: PeerIQ, Company Earnings, Consumer Segment Only

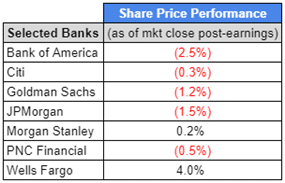

Despite strong bottom lines, most bank stocks reporting this week largely closed down, as investors indexed on top line declines. Exceptions were Wells Fargo and Morgan Stanley, which closed up 3.98% and 0.18% respectively as they posted revenue increases YoY.

Source: PeerIQ, Google Finance

Apple and Goldman Team Up Again for “Apple Pay Later”

Bloomberg is reporting this week that Apple and Goldman Sachs are working to launch a buy now, pay later service that is internally being referred to as Apple Pay Later. The service will offer a split pay option, where a user can make four interest-free payments every two weeks, or a longer-term, interest-bearing payment option.

The move puts Apple and Goldman squarely in competition with BNPL companies like Affirm, Quadpay, and Sezzle, and could put downward pressure on pricing and margins in the sector.

Blue Ridge Bank and MentorWorks Partner on ISAs

Income share agreements have been around for decades, but haven’t caught on as a widespread alternative to student loans, in part because of regulatory uncertainty around the category. Recently, Blue Ridge Bank entered into a first-of-its-kind arrangement with ISA originator MentorWorks Education Capital, where the bank will fund financing packages developed by MentorWorks. Critics argue that ISAs lack consumer protections; proponents of the product say that banks’ involvement can help the category mature and improve compliance.

Any product innovations that promote access and inclusion with appropriate consumer protections, particularly for funding higher education, are worth serious consideration.

Revolut Raises $800Mn at $33Bn valuation

With the raise, Revolut has become the most highly valued private tech company in the UK and is worth more than NatWest, a top four British bank.

America, land of opportunity? Revolut said part of the funding would go to ramp up efforts in the US, where the company currently offers a prepaid card through partner Metropolitan Commercial Bank. Revolut has already begun the process to obtain a California state bank charter and the FDIC insurance necessary to hold insured deposits and operate on its own in the United States.

Revolut faces plenty of competition, with home-grown challengers like Chime and Varo already boasting millions of users.

The Future Looks Bright as Sunlight Financial Begins Trading

Sunlight Financial, a specialty lender focused on financing home solar energy systems and batteries, completed its SPAC process and began trading on the NYSE under the ticker SUNL last week. Congrats to CEO Matt Potere and the entire Sunlight team!

In the News:

Governments World-Wide Gorge on Record Debt, Testing New Limits (Wall Street Journal, 07/12/2021) An enormous pile of savings and low interest rates have allowed countries to borrow heavily without worrying about inflation.

Finance Chiefs Weigh the Impact, and the Odds, of a Global Minimum Tax (Wall Street Journal, 07/14/2021) International support for a global minimum corporate tax could result in a tax rate of at least 15% for large international corporations.

Regulators Propose Joint Guidance on Managing Third-Party Risk (American Banker, 07/13/2021) The Fed, OCC and FDIC release guidance that using third parties may present elevated risk to banking organizations and their customers.

We’re Officially a Unicorn: Announcing our Series E (M1 Finance, 07/14/2021) M1 Finance raises $150Mn at a valuation of $1.45Bn, in a Series E round led by SoftBank's Vision Fund 2.

Ex-NYSE President Tom Farley’s SPAC to Merge With Bullish to Bring Planned Crypto Exchange Public (CNBC, 07/09/2021) Farley’s regulatory ties should prove helpful when he serves as CEO of Bullish, the Thiel-backed startup that plans to launch a regulated crypto exchange later this year.

Investment in Fintech Booms as Upstarts Go Mainstream (The Economist, 07/12/2021) VC is on a fintech frenzy, investing $34Bn in 2Q21. One in every five dollars invested by VCs went to fintech in 2021.

Digital Mortgage Lender Better Acquiring Goldman Sachs-backed Fintech Ahead of Public Listing (CNBC, 07/12/2021) Better makes its first expansion overseas with the acquisition of U.K. mortgage and insurance broker Trussle for ~$9Mn.

GreenSky Facilitated Loans Without Borrowers’ Consent: CFPB (American Banker, 07/12/2021) GreenSky fined for allegedly allowing its merchant partners to take out loans on behalf of customers who hadn’t authorized the financing.

Lighter Fare:

How to Watch the Perseids — the Best Meteor Shower of the Year (CBS, 07/12/2021) Trying to wish upon a star? Learn how to watch up to 100 meteors an hour in the coming month.