Stripe Finalizes Tender Offer; Pipe Launches “CaaS”; Mercury Launches Consumer Banking

By Cole Gottlieb

April 21, 2024

Happy Sunday,

IMF upgrades U.S. growth forecast. Consumer spending in March exceeds expectations. Fed signals it will give rate policy more time to work. FlexWage gets carve out in Vermont. Stripe finalizes tender offer deal. Ramp raises $150Mn. Pipe announces capital-as-a-service. Klarna revamps U.S. card product. Mercury launches consumer banking. TransUnion consumer credit data. Bank earnings continue.

New here? Subscribe here to get our newsletter each Sunday. For even more updates, follow us on LinkedIn (PeerIQ by Cross River).

Consumer Spending Blows Past Expectations

The U.S. economy is performing well, perhaps too well. The IMF upgraded its GDP growth forecast for the U.S. to 2.7% this year, an increase of 0.6pp from its forecast at the start of the year. While the U.S. is significantly outperforming its peer group, the IMF’s chief economist the economy “remains overheated.” Continued strong consumer spending is helping to drive the growth. Retail sales, which includes gas and food, blew past expectations in March, growing 0.7% instead of the expected 0.3% month over month.

With the strong performance in mind, it should be no surprise Fed Chair Powell has signaled its “appropriate” to give current rate policy more time to work, saying the Fed can keep rates where they are for “as long as needed.” The Fed’s Daly and Jefferson echoed Powell’s comments. New York Fed Chief Williams said he still expects rate cuts to begin sometime this year.

FlexWage Gets Reprieve From VT Licensing

Employer-integrated earned wage access platform FlexWage has won a reprieve from the state of Vermont, allowing it to operate without lending or money transmitter licenses in the state. Vermont cited that FlexWage caps fees, doesn’t offer a subscription service, and doesn’t charge for “instant” delivery in OK’ing the firm to operate without certain licenses. FlexWage won a similar concession in Connecticut earlier this year.

Stripe Raises $694Mn to Provide Employees With Liquidity

Fintech heavyweight Stripe has been a bright spot in what has been a fairly gloomy fintech fundraising market lately. The company said last week that it had raised $694Mn as part of a tender offer it announced back in February. The transaction valued Stripe at $65Bn, down from its previous high of $95Bn set back in 2021, but a 30% bump from its most recent mark of $50Bn. Stripe will use the funds to buy back shares from employees in order to provide them with liquidity.

Ramp Raises $150Mn, Valuation Jumps to $7.65Bn

In other fintech fundraising news, expense management and charge card startup Ramp announced it has raised another $150Mn in funding. Khosla Ventures joined existing investor Founders Fund to co-lead the round, which included participation from new investors Sequoia, Greylock, and 8VC. The fundraise is an extension of the company’s Series D, though at a $7.65Bn valuation vs. the $5.8Bn mark it previously raised at. Ramp has over 25,000 customers, and, according to the firm, venture-backed startups make up a “minority” of its customer base.

Pipe Announces “Capital-as-a-Service”

Revenue-based financing startup Pipe announced its new embedded “capital-as-a-service” for small businesses last week. The move into SMBs marks an expansion from Pipe’s historic focus on Software-as-a-Service firms with recurring revenue. The new lending offering will be distributed through third-party partners, which include Priority, Infinicept, and Boulevard at launch. The typical loan size is expected to be $30,000-$50,000 with a repayment period of six to 12 months.

Klarna Announces Revamped Card Product

Sweden-based Klarna announced it is launching a revamped card product in the U.S., through a partnership with WebBank. Klarna founder and CEO Sebastian Siemiatkowski described the offering as “transparent with no hidden fees” and as giving consumers greater flexibility in how they choose to pay for purchases. The card enables users to leverage Klarna’s BNPL features at any online or brick and mortar merchant that accepts Visa. Like a typical credit card, users can pay their balance in full each month and accrue no interest or pay a specific transaction early with no interest. Users can also choose to move a purchase due date to the following month or pay over 3 or 6 months for eligible purchases, at interest rates ranging from 14.99% to 33.99%. Although some are referring to it as a “credit card,” Klarna’s release describes it as not being revolving credit, and the features, taken together, function as something of a hybrid charge card/credit card.

Mercury Launches Consumer Offering

Business neobank Mercury announced it is expanding into offering personal accounts. The company, founded in 2017, partners with Evolve Bank & Trust and Choice Bank to serve over 100,000 businesses. While there are plenty of consumer neobanks, most focus on lower-income and under-served consumers, not “power users” who want features like wire transfers or multiple users, Mercury CEO Immad Akhund told TechCrunch. The offering carries a $240 per year subscription fee and offers 5% APY on savings, free domestic wire transfers, and up to $5Mn in FDIC insurance via Choice’s sweep program.

TransUnion Releases March Consumer Credit Data

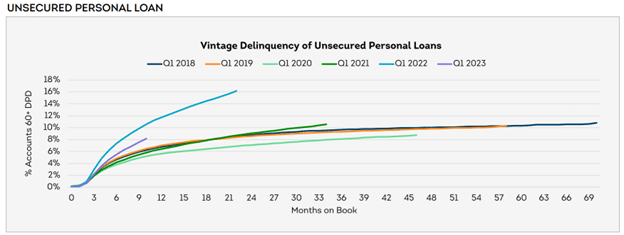

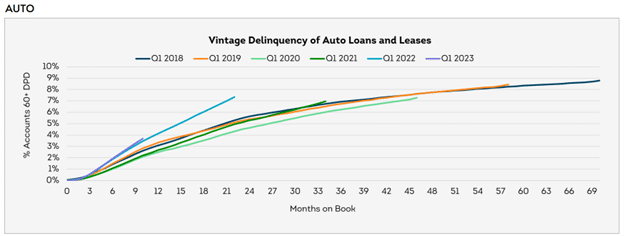

TransUnion just released its monthly credit snapshot for March, revealing that 60+ DPDs declined (MoM) across the board. TransUnion attributed the decline to seasonality as Unsecured Personal Loans ("UPLs") fell (25)bps, Bankcard (21)bps, Auto (18)bps, and Mortgage (8)bps. This marks the 1st month of declines for Mortgage, Auto, and Bankcard after 7 consecutive months of DPD increases and 2nd month of declines for UPL 60+ DPDs in the past 8.

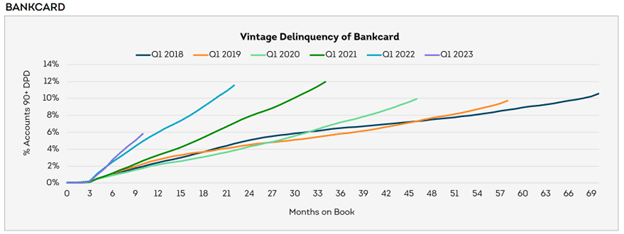

Looking at bankcard, 90+ DPDs fell (13)bps MoM, breaking an 8-month streak of increases and 30+ DPDs fell for a 2nd straight month, down (33)bps MoM. Q1 2023 vintage DPDs continue to track higher than Q1 2022 and well above Q1 2018-2021 vintages. Average bankcard balances fell (0.8)% MoM, to $6,189.

Source: TransUnion

Turning to originations, we got information on UPL origination volume for the December 2023 – January 2024 period (lag due to reporting time). January fintech UPL originations rose for prime and above risk tiers, with super prime +20.9%, prime plus 17.8%, and prime 14.1%, while near prime (2.2)% and subprime (13.9)% fell on a MoM basis. Super prime originations rose +6.3% YoY while all other risk tiers remained below January 2023 levels, with prime plus (14.1)%, prime (32.4)%, near prime (38.9)%, and subprime (41.7)%.

Credit unions reported declines for prime plus (7.1)%, prime (16.6)%, near prime (29.9)%, and subprime (35.3)% while super prime rose 11.7% MoM. On a YoY basis, super prime +4.5% originations were above 2023 levels, while prime plus (9.9)%, prime (7.2)%, near prime (6.3)% and subprime (5.9)% lagged.

Finance companies MoM UPL originations declined for super prime (5.3)%, prime (12.5)%, near prime (16.9)%, and subprime (18.5)% while reporting growth for prime plus +8.4%. On a YoY basis, super prime (33.2)% and prime plus (21.6)% remained below January 2023 levels, while prime +11.7%, near prime +13.0% and subprime +12.3% were above.

Banks reported January growth across super prime +19.7% and prime plus +14.1%. Prime (11.1)%, near prime (3.2)%, and subprime (2.8)% reported declines. Bank originations were higher than January 2023 levels for super prime +10.7%, near prime +10.4%, and subprime +24.0%, while prime plus (4.6)% and prime (13.4)% lagged 2023 levels.

In March, finance companies re-took the lead in UPL balances from fintechs, with 29.1% of the total, compared to 27.1% for fintechs. Banks accounted for 23.6% and credit unions for 20.2%. Average UPL balances per consumer rose +0.2% on a MoM basis, to $11,989 in March.

Overall, delinquencies remain elevated, though improved from a month prior due to seasonality (60+ DPDs declined across the board). Average bankcard balances declined for the third straight month.

UPL’s Q1 2023 vintage continues to perform better than Q1 2022, likely due to mid-2022 credit tightening. At the same time. Q1 2023’s bankcard vintage is performing worse than 2022, while auto’s is at comparable levels. Both bankcard and auto vintages for 2022/23 are performing worse than historic cohorts (2018-2021).

Source: TransUnion

Source: TransUnion

Let’s talk fintech: Fintech UPL originations remain well below 2022 levels, especially for the prime and below contingent (down (30)%+ YoY for prime and below risk tiers). As a reminder, fintechs pursued more aggressive growth from 2021-1H22, expanding credit access to more consumers. At this point, they have yet to return to those levels of origination. Despite MoM gains in originations prime and above, fintechs lost the lead in UPL balances in March from finance companies.

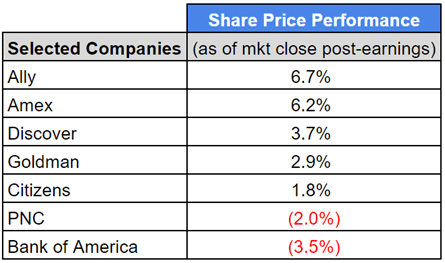

Banks Continue to Report Earnings

Source: Yahoo Finance

We continue our earnings season coverage, with more banks reporting results. Looking at average consumer loans books, Amex +2.4%, Discover +1.4%, and Citizens +0.8% grew their consumer loan books on a QoQ basis, while PNC (0.6)% and Bank of America (0.1)% reported declines. Goldman’s credit card loan book was flat QoQ, and it has now sold off the remainder of its GreenSky (installment loan) portfolio.

Turning to credit, average NCOs rose on a QoQ basis for Goldman - Consumer +140bps, Discover +81bps, Amex +20bps, Bank of America - Consumer +17bps, and PNC +3bps. Average NCOs declined for Ally (22)bps QoQ and Citizens - Retail (2)bps QoQ. Bank of America’s rise in NCOs was largely driven by credit card.

Banks continued to grow deposits with period end deposits rising on a QoQ basis for Goldman +3.0%, Citizens +2.6%, Discover +1.4%, Bank of America +0.9%, and Ally +0.3%. At the same time, banks have reduced pricing, in anticipation of Fed rate cuts. Ally reduced deposit pricing by (75)bps on its 12-month CD, (15)bps on money market accounts and (10)bps on savings accounts. Citizens’ Head of Consumer Banking Brendan Coughlin explained that the bank, “Had $3 billion in CD rollover in March alone that were priced around 5%. We’ve retained 75% of those as they’ve flipped over at materially lower prices between 3% and 4%.” And Discover’s CFO John Greene noted that, “Our direct-to-consumer balances grew $3 billion in the period. We have started to decrease pricing on our deposit products ahead of any potential moves in reference rates.”

On the heels of strong March retail sales figures, we saw Amex +5.1% YoY and Bank of America +4.5% YoY report increases in spend volume. In contrast, Discover Card sales volumes were (1.6)% lower YoY. Auto originations came in at $9.8Bn for Ally, up from $9.5Bn a year prior and $9.6Bn a quarter prior, while auto originations of $6.6Bn at Bank of America were lower from the $7.0Bn a year prior but above the $6.1Bn originated in Q4.

In the News:

The CFPB's proposed data sharing rule: How banking insiders are reacting (American Banker, 4/15/2024) As 1033 inches toward the finish line, how industry insiders are thinking about it.

New twists in suit over CFPB's $8 late fee favor credit card industry (American Banker, 4/11/2024) The 5th Circuit Court of Appeals is widely expected to side with business trade groups fighting the Bureau’s fee cap.

Fed's instant payments network gains momentum among community lenders (American Banker, 4/11/2024) More than 600 institutions, including smaller banks, are using FedNow.

Fintech Nexus is pursuing a sale of its assets (Fintech Nexus, 4/15/2024) The fintech-focused publication is up for sale.

UK digital bank Zopa turns profit as it eyes IPO (FT, 4/15/2024) Softbank-backed Zopa hit profitability in 2023 and looks to IPO.

How Barclays and Carnival Cruise revived a waterlogged card program (American Banker, 4/12/2024) Carnival Cruise revamped its onboard enrollment process to boost its cobrand card program.

JPMorgan and Codat Team to Drive Virtual Card Adoption (PYMNTS, 4/16/2024) JPMorgan Chase is partnered with business data API provider Codat.

Bankjoy and Pinwheel Partner to Simplify Direct Deposit Setups (PYMNTS, 4/16/2024) Bankjoy has partnered with Pinwheel to help financial institutions offer their customers an easier way to switch direct deposits.

Lighter Fare:

Next total solar eclipse will hit these 2 popular travel destinations (Seattle Times, 4/15/2024) Pack your bags, you can view the next eclipse in Iceland or Spain in 2026.