SumUp Scores €285Mn; Apex Files For IPO; Amazon and Venmo Call It Quits

By Cole Gottlieb

December 17, 2023

Happy Sunday,

The Fed held rates steady. Inflation cools slightly. Canopy raises $15.2Mn. Canapi Ventures scores $750Mn for new fintech-focused fund. SumUp announces €285Mn haul. Apex clearing looks to IPO in 2024. Amazon and Venmo call it quits. Stretched holiday shoppers turn to BNPL. Upgrade announces secured card offering. Trustly fuels RTP network adoption.

If you missed our Q3 consumer lending review last week, you can find it here.

New here? Subscribe here to get our newsletter each Sunday. For even more updates, follow us on Linkedin (PeerIQ by Cross River).

Fed Holds Rates Steady

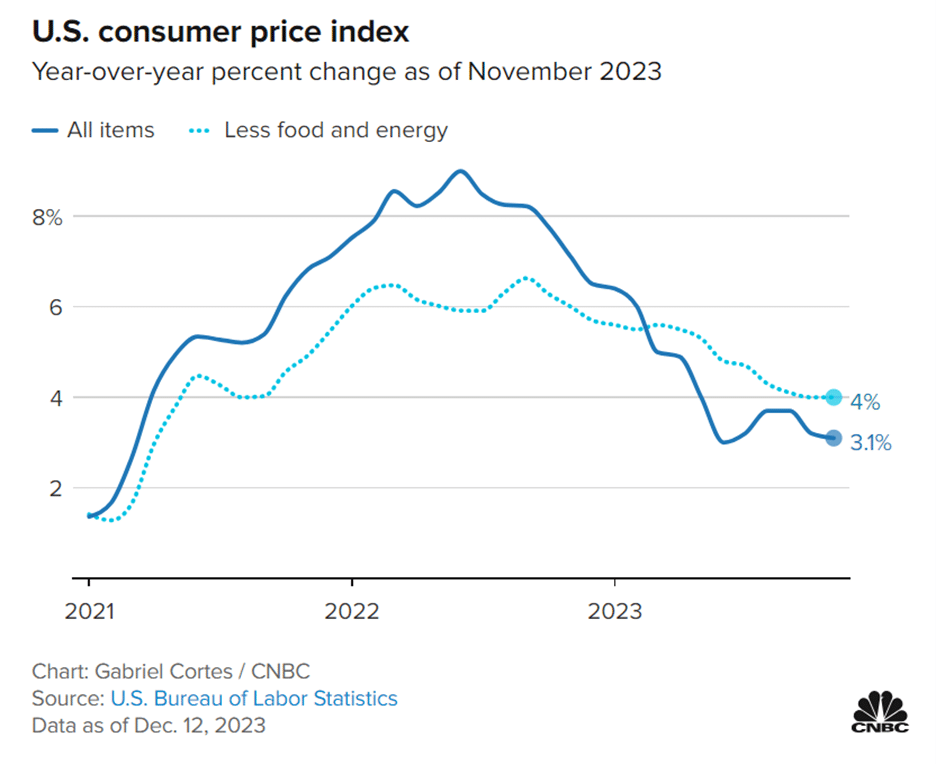

As anticipated, the Fed held rates steady at its meeting last week. And while officials didn’t rule out further rate hikes, expectations are already turning to rate cuts sometime in 2024. Meanwhile, inflation in November slowed, with prices up 3.1% year over year. While much progress has been made, inflation still remains materially above the Fed’s 2% target.

Image: CNBC

Canopy Servicing Raises $15.2Mn

Loan servicing software startup Canopy announced it has raised a $15.2Mn Series A1. The company last raised funds in August 2021, at a time when the fundraising market was in a significantly different place. At that time, Canopy raised $15Mn at a $63Mn post-money valuation. The Series A1 valued that company at $50.2Mn on a post-money basis – not bad, considering how the wider fintech market has fared in the intervening two years. Canopy told Techcrunch it expects to increase its ARR by 2.5-3x in 2024 and is aiming to hit $10Mn in recurring revenue in the next 15 months.

Canapi Ventures Announces New $750Mn Fund

Canapi Ventures, which focuses on fintech and adjacent verticals, announced it has raised a new $750Mn fund. Including the freshly raised capital, Canapi now has some $1.4Bn in assets under management. In its prior fund, Canapi invested in areas like real-estate tech, credit, payments, fraud, and identity, including in companies like Alloy, Codat, and Nova Credit. With the new fund, Canapi is looking to broaden its investing horizon to include companies focused on responsible use and governance of AI and those working at the intersection of financial and climate tech.

SumUp Raises Nine-Figure Round

A nine-figure fundraise for a fintech in 2023? Yes, you read that right. SumUp, roughly the European version of Square, announced it has raised €285Mn (approximately $310Mn) to continue growing its business around POS card acceptance and related offerings like business bank accounts, loyalty, invoicing, and more. With a hefty war chest, the company is also considering growing through acquisitions. It’s broadly considered to be a buyers’ market, with the fundraising market remaining tight and valuations down considerably vs. the frothy times of a few years ago. Six Street Growth led the round, with participation from Fin Capital, Liquidity Group, and Bain Capital.

Apex Clearing Preps For IPO

There are signs that fintech IPOs may return in 2024. Apex, a clearing, custody, execution, and routing platform has filed confidential paperwork to IPO. The firm had planned to go public via a SPAC offering back in 2021 in a deal valued at $4.7Bn, but it ultimately fell through. Apex’s client base includes other fintechs with stock trading offerings, including SoFi, eToro, and Webull. Per Apex’s website, the firm currently has some $115Bn in assets under custody.

Amazon and Venmo Split

Amazon and Venmo aren’t meant to be, it seems. Amazon informed customers that, come January, it would no longer accept Venmo as a payment option, in a setback to PayPal’s ambitions for Venmo to grow into being a popular payment method. The relationship originally launched back in October 2022, but it seems customer uptake has been slow. That’s not too surprising, given frequent Amazon shoppers most likely already have stored payment credentials. For diehard Venmo users, I suppose you can always use your Venmo debit or credit card to pay for your Amazon purchases.

Stretched Consumers Turn to BNPL

Consumer spending is showing signs of slowing, and household budgets are increasingly stretched, with consumer credit delinquencies rising. That’s not stopping holiday shoppers from trying to stretch their budgets, and many are turning to BNPL services to do just that. Per Adobe Analytics, use of BNPL on Cyber Monday soared 42% vs. last year to $940Mn.

Even Google is looking to get in on the BNPL action. The company announced a partnership to offer Affirm and Zip as options via its Google Pay wallet at select merchants. If users choose Google Pay as a payment option, they’ll see a banner offering Affirm and Zip at select merchants. The approach is notably different than Apple, which built its own BNPL offering as part of Apple Pay/Apple Wallet, which can be used at any merchant that accepts Apple Pay.

Still, there are signs regulators are worried. Just last week, the OCC issued a bulletin to banks it oversees warning of risks of the “pay-in-four” product, including of consumer over indebtedness.

Not all financial institutions are excited about the product category, however. Per a recent PYMNTS survey, nearly 40% of credit unions said they did not plan on offering their customers BNPL-style installment loans.

Upgrade Announces Secured Card Offering

Upgrade is getting into the credit building game. The company announced a secured version of its Upgrade OneCard, which enables users to build credit while also earning cashback rewards. Like the unsecured version, the secured OneCard lets users choose to “pay now” (basically, debit) or pay later. The secured card will offer a smaller credit line that is collateralized by funds held in a savings account, which will accrue interest.

Trustly Leads RTP Adoption

Trustly, a fintech specializing in open banking payment solutions, announced that it has become one of the largest originators on the RTP network, accounting for nearly 10% of the network’s total transaction volume. Trustly’s RTP transaction volume grew 29% QoQ and payment value grew 31% QoQ.

Trustly, in partnership with its banking partner Cross River, launched instant payouts in 2021. Cross River was an early participant in the RTP network and was the second largest RTP originator in November.

Want to partner with a top RTP originator? Get in touch to learn how we build financial technology solutions powering today’s fastest growing fintechs.

In the News:

The payment companies making virtual cards big business (American Banker, 12/8/2023) Virtual cards, an old tech (relatively speaking), are having a moment.

Block furthers Bitcoin foray with new hardware wallet (American Banker, 12/8/2023) Despite crypto turmoil, Block is plowing ahead with its plans for a hardware wallet.

Check fraud on pace for another record year: Fincen data (American Banker, 12/10/2023) Per FinCEN data, check fraud is tracking towards another record this year.

Fintech Bridge expands borrower network with Chipotle deal (Banking Dive, 12/8/2023) Bridge, spun out from Citi, is partnering with Chipotle to provide financing to the restaurant’s suppliers.

A Spot Bitcoin ETF Is Easy. What Comes Next Could Get Dangerous. (Wall Street Journal, 12/11/2023) A rush of institutional money into crypto could have unanticipated consequences.

US payments trends seen gaining ground in 2024 (Tearsheet, 12/11/2023) Interoperability, generative AI, and digital identity are all on trend for 2024.

Synovus expects fee-income boost with GreenSky partnership (American Banker, 12/7/2023) With GreenSky no longer part of Goldman, Synovus looks to boost fee-income by partnering with the home improvement lender.

Why banks may still face pain on deposit costs next year (American Banker, 12/11/2023) With rate hikes maybe done, deposit cost pressure is easing, but it’s not over yet.

X’s Money Movement Push Comes as Regulators Warn of Non-Bank Financial Risks (PYMNTS, 12/11/2023) Will X (formerly Twitter) end up in the regulators’ cross hairs?

BlackRock's Bitcoin ETF Now Invites Participation From Wall Street Banks (Coindesk, 12/12/2023) A change to BlackRock’s proposed ETF would enable participation from Wall Street banks.

Major fintech layoffs in 2023 (American Banker, 12/12/2023) A summary of fintech layoffs this year.

Lighter Fare:

Gigantic skull of prehistoric sea monster found on England’s ‘Jurassic Coast’ (CNN, 12/11/2023) The skull of a prehistoric sea monster was discovered in Dorset in southern England.