The Mercurial Nature of P2P lending

By Vy Phan

May 23, 2016

Where to find creditors

Even if the platform gives out its own money, acting as a balance sheet lender, for successful growth it will need to attract external debt financing as working capital. But it is becoming increasingly more difficult to do that. A year ago there were a lot of funds in the market ready to provide both equity and borrowed funds to almost any platform with a good team and a reasonable idea, whereas now the market has changed completely. Even big players like Prosper,Marlette Funding and Avant are experiencing problems with attracting creditors and are cutting their marketing costs because they can’t fund all the loan applications they receive. This is because of the decline of the excitement that existed around online lending and the increased appetites of investors in terms of yield. Thus, during the last securitization of loans, Prosper’s investors demanded much higher yields (5 percentage points higher than a year ago). To show the whole picture, it should be noted that this yield increase was observed only in the junior tranches of securitization, whereas the senior tranches had much lower growth rates. However, this clearly illustrates the shift of investor interest in the sector and the need for alternative lending to compete with other classes of higher-yielding assets. For example, in March, we observed in the U.S. record-high demand for “junk” bonds: more than US$11.5 billion just in the second half of February and the first half of March. Unfortunately, because of the novelty of the alternative lending industry, not all the players see the difference between “junk” bonds and loans issued by Prosper, which have an underlying average FICO score of more than 700. The latter are the loans issued to prime borrowers, which implies a fundamentally lower risk compared to junk bonds. For instance, One Main Financial observes an increased interest of investors to the loans issued by the company, although those are loans to the poorest part of the U.S. population. That again demonstrates that investors are chasing yields and are not into in-depth analysis of credit quality. Financial markets always go through cycles. Toward the end of each of the credit cycles many asset managers, in pursuit of higher yield, shift more and more to the right on the risk axis, and that is exactly what we see now. Those who do it may look like geniuses now, providing superior returns for their portfolios, but in a couple of years they might suffer significant losses, whereas loans issued to prime borrowers are likely to remain profitable even in a times of crisis. Thus, in terms of attracting lenders, a new player will have to compete not only with the existing large platforms, which have already earned their reputation, but also with other high-risk, high-yield assets. This competition for lenders’ capital is as strong as ever.We are not afraid of competition

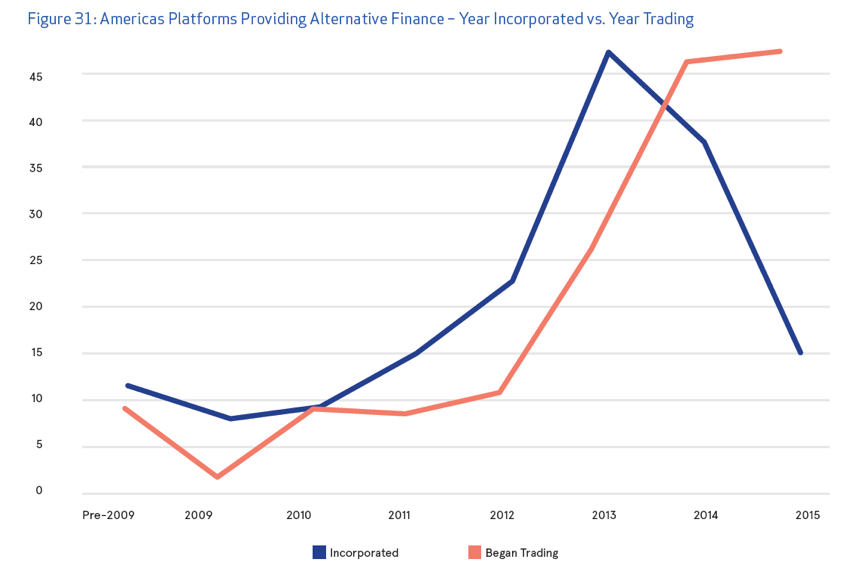

Another thing that cannot promote optimism among those who invest in the new online lending platforms is the competition in the sector. Along with a number of very strong and well-capitalized players, right now the market features a large number of new platforms set up a few years ago. Each of these platforms will try to attract both venture capital and lenders/borrowers. This creates additional pressure on those who are just starting their business.

How to attract borrowers

Despite the difficulties with attracting creditors, the companies are still competing for borrowers. Such business as Credit Karma receive significant profits by selling applications for loans to lending platforms. Eventually, the winners among the platforms are those with the best scoring model and a larger marketing budget. I strongly doubt that the second wave of companies will be able to produce significantly better scoring models, as the market leaders have worked on theirs for almost 10 years. To overcome the leaders with brute force, i.e. marketing budget, will also be difficult: Lending Club has more than $600 million in its accounts, Prosper has more than $100 million and SoFi, less than a year ago, attracted $1 billion in venture capital investments. I regularly communicate with a large number of new online lending platforms, and more and more often I hear the idea that big players are missing on some niches, whereas focusing on these niches enables one to build a stable and profitable business. But we should not delude ourselves, as there is a serious problem with this approach: The most promising niches (large margin, low competition from banks/state, low credit risk) have already been divided among the existing players; these are consumer and mortgage loans, small business loans, student loans, factoring. Of course, you can try to take a new, narrow niche, but will you be able to define it and “fence” it well enough to create a really strong competitive advantage? Even if it is successful, it will hardly be big enough to set up a multi-billion dollar company. Nevertheless, it may be sufficient to create a medium-sized family business, which is a good idea, but not the case for venture capital. An excellent article by Frank Rotman elaborates on the points made above.We’ll go to other markets

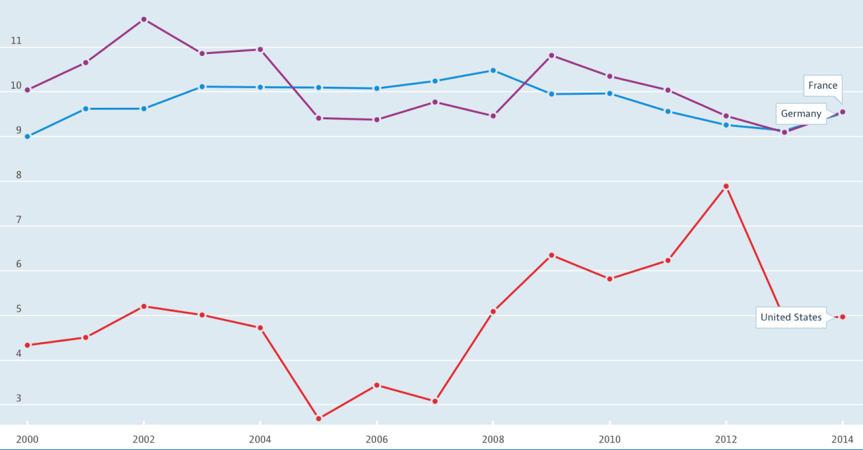

But what happens if there are no competitors yet? There are other markets apart from the American and British markets: In other regions, alternative financing is not so highly developed yet. The idea of transferring a business model in another country is good, as such, but there are also some pitfalls. The lending industry is extremely different between countries, especially if we compare, for example, the United States and continental Europe. To a large extent, Americans live on credit. According to a Bankrate.comsurvey, more than 60 percent of Americans will not be able to cover from their own funds unforeseen expenses in the amount of $1,000. A lending business, which developed very successfully in such a favorable market, may face a number of unforeseen difficulties upon moving to a country with a different culture and a different attitude to savings and loans. This is exactly what we see, for example, in Germany, as the graph below clearly demonstrates. This makes it obvious why alternative lending is developing much more slowly in Europe. Also important to consider are the differences in the regulation of the industry. Europe has a much more rigorous approach to the regulation of interest rates than the U.S. Some successful business models from the U.S. may be unsustainable in Europe. The alternative loans sector is developing at such a high rate not only because it has lower costs per loan because of the transfer of the processes from offline to online, but also because it benefits from the intricacies of regulation.

By combining high credit quality (because certain borrowers are not eligible for cheap loans because of the imperfections of the regulatory system) and relatively high interest rates, alternative lending is a very interesting asset class for investors. When the interest rate ceases to be sufficiently high, or when the majority of people in the economy can easily obtain a bank loan (e. g. in Germany), alternative lending ceases to grow rapidly.

Also important to consider are the differences in the regulation of the industry. Europe has a much more rigorous approach to the regulation of interest rates than the U.S. Some successful business models from the U.S. may be unsustainable in Europe. The alternative loans sector is developing at such a high rate not only because it has lower costs per loan because of the transfer of the processes from offline to online, but also because it benefits from the intricacies of regulation.

By combining high credit quality (because certain borrowers are not eligible for cheap loans because of the imperfections of the regulatory system) and relatively high interest rates, alternative lending is a very interesting asset class for investors. When the interest rate ceases to be sufficiently high, or when the majority of people in the economy can easily obtain a bank loan (e. g. in Germany), alternative lending ceases to grow rapidly.

The moment’s gone

Every other week I get at least one request for investment from newly established lending platforms either in Europe or the U.S. The emerging online lending platforms are so numerous that they have to make cold calls to venture capital funds trying to get some funding. For investors, this is a sign that you should not invest in new players in the industry, as all the new players will face the problems described above, and lending is a business that requires substantial capital. However, there are still a lot of opportunities to make a profit in the alternative lending industry; the following are just some of them:- New players will find it very difficult to succeed. This is bad news for new players, but good for the market leaders. Companies like Lending Club, Prosper andFunding Circle will provide more and more loans. By using their brand, reputation, quality scoring and a strong investor base, they will be able to solve the problems that the industry is facing and get through it, becoming even stronger. Mergers are quite likely, with the top players taking over smaller ones whose value will be estimated in a way that is beneficial for the acquiring company.

- Competition for lenders inevitably leads to an increase in interest rates. This is great news for those who invest in loans. The largest platforms are safe and profitable, their rates have already been increased and this is just the right moment to invest one’s funds in loans. The expected return is between 7.5-12 percent per annum in U.S. dollars, and, as the history and stress tests show, these investments are unlikely to be unprofitable, even in the event of a recession. As far as I know, there is no other class of assets that may give you a similar yield with such a low level of risk.

- For those who still want to invest in the alternative lending market players at their early stage, I recommend they take a closer look at the companies that serve the industry of alternative lending; during a gold rush it may be more profitable to sell jeans to artisan miners than to mine for gold. There are many companies like that, for example: Orchard, DV01, Monja, PeerIQ and Blackmoon; they all represent different solutions, each of them being interesting in their own way.

[Original article available here.]