Toyota’s $60Mn Settlement; Binance’s $4.3Bn AML Agreement; Arch Raises $20Mn

By Cole Gottlieb

November 26, 2023

Happy Sunday and Happy Thanksgiving weekend,

Initial unemployment applications dropped. Consumer inflation expectations rise. Toyota reaches $60Mn CFPB settlement. Arch raises $20Mn Series A. Monzo in talks with Alphabet for fresh funding. Binance reaches $4.3Bn AML settlement. OpenAI and Altman reach agreement for his return. Visa deepens partnerships with Remitly, Paysafe. OneMain to acquire subprime auto lender.

New here? Subscribe here to get our newsletter each Sunday. For even more updates, follow us on Linkedin (PeerIQ, a Cross River Company).

Unemployment Applications Drop

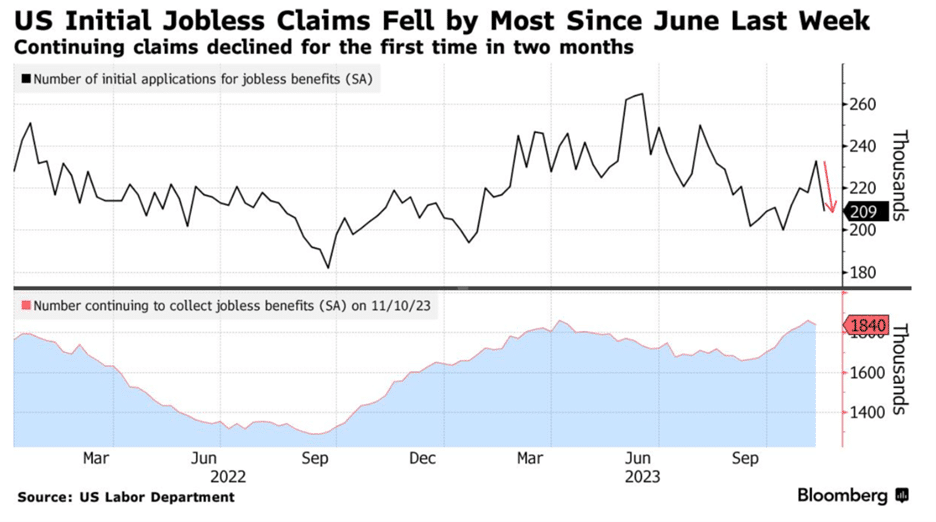

Initial applications for unemployment benefits dropped the most since June. Claims dropped 24,000 to 209,000 for the week ending November 18th. The data point suggests employers are seeking to hold on to employees, despite a softening labor market.

Meanwhile, despite cooling inflation, consumers’ expectations of future price increases climbed in November. Consumers expect prices to rise by 4.5% over the coming year. Over the next 5-10 years, Americans expect prices to rise by 3.2% on an annualized basis.

Image: Bloomberg

Toyota Hit With $60Mn CFPB Enforcement Action

Toyota reached a consent order with the CFPB that will see the automaker pay a $12Mn penalty and $48Mn in consumer redress. According to the CFPB complaint, Toyota made it unreasonably difficult to cancel financing add-on products, withheld and delayed refunds, and knowingly reported false information to credit bureaus. Customers who attempted to cancel add-on products, such as extended warranties, were directed to a hotline where representatives were instructed to attempt to talk them out of canceling. Consumers had to request to cancel such products at least three times before being informed that they would have to mail in a request to cancel the optional products. The consent order also requires Toyota to cease tying employee compensation to the sale of such add-on products.

Private Investment Management Platform Arch Raises $20Mn

Private investment management platform Arch announced it has raised a $20Mn Series A. The round was led by Menlo Ventures, with participation from Quiet Capital, Craft Capital, Citi Ventures, Carta, and others. Archs’ platform simplifies operations and reporting for financial professionals, including issuing K-1 statements. Arch aggregates data across investments, eliminating the need for clients and advisors to access third-party portals. Centralizing the data in a single UI enables users to better track and manage their investments. Arch plans to use the new funding to continue to enhance its product and to expand its team.

Alphabet in Talks to Lead Monzo Fundraise

U.K. neobank Monzo is in talks with Alphabet’s venture arm, Capital G, for a funding round that would value the company at around £4Bn, Skynews is reporting. The deal would see Monzo get more than £300Mn in fresh capital. The new funding and increase in valuation would mark a significant turnaround in Monzo’s fortunes, after posting a £115Mn loss for 2020/2021, causing its auditor to issue a warning about the company’s ability to remain a “going concern.” Monzo is expecting to post a profit this year, and the new funding round, if completed, is expected to be the last before the company seeks an IPO.

Binance Reaches $4.3Bn AML Settlement

Binance, the world’s largest cryptocurrency exchange, and its founder and CEO, will plead guilty to violating anti-money-laundering and sanctions requirements. The Binance CEO, Changpeng Zhao, popularly known as CZ, will step down from his role at the company and will be prohibited from holding any executive role at Binance. But he will retain his majority ownership of the company. Binance itself will also plead guilty to criminal charges and pay a $4.3Bn settlement, which includes costs tied to a settlement of civil allegations made by U.S. regulators. The deal announced last week notably doesn’t include a settlement with the SEC, which sued the exchange and CZ this June, alleging violations of investor protection regulations.

Altman And OpenAI Reach Agreement for CEO to Return

The boardroom drama at ChatGPT creator OpenAI has come full circle, sort of. The saga has been filled with twists and turns: after the board dismissed OpenAI CEO Sam Altman, he agreed to join OpenAI investor Microsoft – before the board reversed course and came to an agreement that would see Altman return to OpenAI. Now, the board itself is out, with a new initial board that will include Salesforce CEO Bret Taylor, former Treasury Secretary Larry Summers, Quora CEO Adam D’Angelo. The new board and Altman have agreed to an independent investigation into Altman’s conduct that led to the dustup with the prior board. While the move to reinstate Altman would seem to resolve the immediate crisis, questions linger about what led the board to fire Altman and what the lasting damage to the company from the dramatic events may be.

Visa Deepens Partnerships with Remitly, Paysafe

Visa and fintech remittance company Remitly are expanding their partnership. The two have been working together since 2021 to simplify cross-border money movement. The expanded partnership will enable Remitly users in more than 15 countries, including the U.S., U.K., and Canada, to disburse funds directly to recipients’ bank accounts via their Visa debit cards. The companies cautioned it’s still “early days” in the efforts to modernize international payments. Remitly has captured only a 2% share of the approximately $1.6Tn in annual cross-border remittances.

Meanwhile, Visa and Paysafe are expanding their partnership to offer merchants tokenization services. Visa Network Tokens allow for the processing of payments over the Visa network using a token in place of a cardholder’s credit or debit account number. Such tokenization approaches provide increased security and reduce the risk of card data being compromised or used for fraud.

OneMain Plots Auto Lending Expansion

OneMain, best known as a non-bank lender offering small installment loans, is expanding its auto lending efforts. The company announced its plan to acquire Foursight Capital, a small subprime auto lender, for $115Mn. The deal is expected to close in the first half of 2024. Foursight offers financing through a network of car dealers. It currently has a loan book of nearly $1Bn vs. OneMain’s outstanding receivables of some $20Bn. The Foursight acquisition will enable OneMain to enter the “indirect” auto lending market, in which loans are facilitated through dealers’ financing departments.

In the News:

US Mortgage Rates Fall for Third Week, Dropping to 7.44% (Bloomberg, 11/16/2023) Mortgage applications ticked up slightly as mortgage rates dropped.

Home sales fell to a 13-year low in October as prices rose (CNBC, 11/21/2023) Existing home sales fell by 14.6% vs. the year prior.

US SEC sues Kraken crypto exchange over failure to register (Reuters, 11/21/2023) Kraken intends to defend itself against the SEC lawsuit, which was filed in San Francisco federal court.

Microsoft maneuvers to a prime role with banks in OpenAI upheaval (American Banker, 11/20/2023) Microsoft, a major investor in OpenAI, has sought to carefully navigate the drama at the company.

Blue Ridge Bank begins offboarding at least a dozen fintech partners (American Banker, 11/17/2023) Once a major player in BaaS, Blue Ridge is seeking to reduce its fintech footprint.

Is FinTech Eating the Bank's Lunch? (IMF, 11/17/2023) This academic paper analyzes how fintechs impact banks’ financial performance.

Startup adds the one thing many BNPL loans lack: credit visibility (American Banker, 11/20/2023) Cushion offers a dashboard to help overstretched consumers manage BNPL payments.

'Just the beginning': Two Wells Fargo branches file for union election (American Banker, 11/20/2023) Wells Fargo is bracing for employee efforts at two of its branches to unionize.

Nearly 40% of FinTechs Offer Mobile Check Deposit but Only 12% of Consumers Use It (PYMNTS, 11/21/2023) Most fintech users don’t need mobile check deposit.

Ex-Revolut leaders build digital wallet (Finextra, 11/21/2023) Former Revolut staffers launch Zeal, a wallet for crypto and web3 apps.

Lighter Fare:

Earth Just Received A Laser-Beamed Message From 16 Million Kilometers Away (IFLScience, 11/21/2023) A NASA spacecraft used a laser to beam a message back to earth, in a major achievement for space communications tech.