U.S. Credit Downgraded; FDIC’s Toxic Workplace; Imprint Raises $75Mn

By Cole Gottlieb

November 19, 2023

Happy Sunday,

U.S. downgraded by Moody’s. Consumer spending in October fell. FDIC’s toxic workplace culture. Enova hit with new CFPB order. Zelle now refunding some defrauded users. Blockchain startup Fnality raises $95Mn. Cobrand card platform Imprint raises $75Mn. Blockchain.com announces $110Mn Series E. JPMC was biggest winner from SVB’s collapse. Blue Ridge suspends dividend, must raise fresh capital.

New here? Subscribe here to get our newsletter each Sunday. For even more updates, follow us on LinkedIn (PeerIQ, a Cross River Company).

U.S. Credit Rating Downgraded

The U.S. Government’s credit rating got downgraded. Ratings agency Moody’s cited risks to the country’s fiscal strength in reducing its rating from “stable” to “negative.” Political polarization in Washington and repeated deadlocks over the debt ceiling and funding the government contributed to the decision.

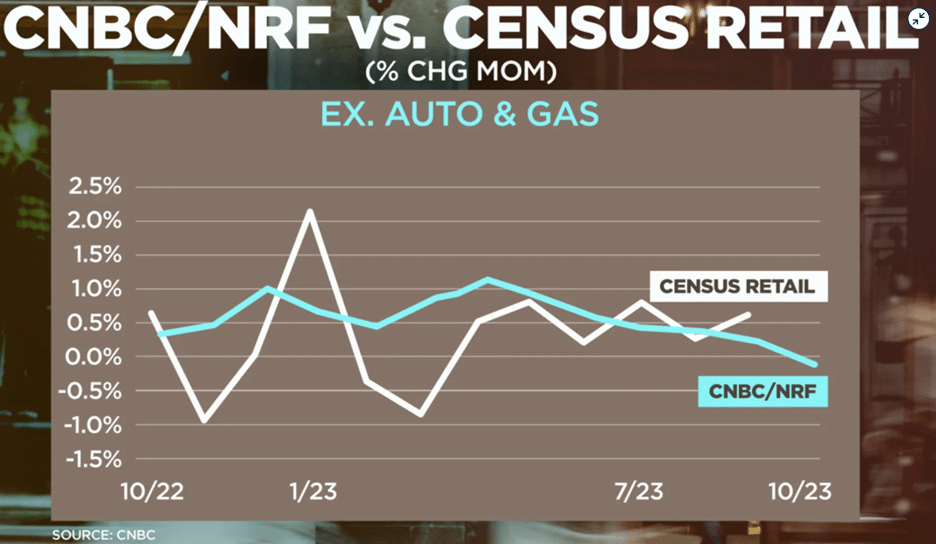

Meanwhile, consumer spending fell in October. According to a new measure from CNBC and the National Retail Federation, retail sales, excluding auto purchases and gasoline, fell by 0.08% vs. the month prior. The consumer pullback comes as credit card debt hits a record high. Total outstanding revolving balances reached $1.079T, up $154Bn vs. last year. With interest rates up as well, debt service may be beginning to crowd out other spending for some consumers.

Image: CNBC

FDIC Accused of “Toxic” Workplace Culture

An explosive report by the Wall Street Journal documents employee allegations of a toxic work environment. The WSJ report, based on interviews with over 100 current and former employees, describes a “boys’ club” culture where excessive drinking, sexism, and sexual harassment were commonplace. Female employees complained of consistently being given fewer opportunities to advance than their male counterparts. And a perception that complaints to management went unheeded and that those raising concerns were retaliated against discouraged staff from raising concerns to management. Instead, many employees chose to leave the FDIC altogether, contributing to heightened turnover and a shortage of examiners. The turnover problem is also expensive, with training for a commissioned examiner running to some $400,000 over a four-year period.

The report is drawing renewed scrutiny of current FDIC Chair Martin Gruenberg’s behavior. Gruenberg has been at the FDIC for nearly two decades, including a previous stint as Chair. He has a reputation for having an explosive temper and was previously the subject of an internal investigation after berating a senior female FDIC official.

Enova Hit With $15Mn CFPB Penalty

Enova, a non-bank online lender, reached a consent order with the CFPB that will see the company provide restitution to as many as 111,000 consumers and pay a $15Mn civil monetary penalty. The current order stems from allegations Enova withdrew funds from borrowers’ bank accounts without their consent, that it canceled loan extensions it had previously granted, that it deceived borrowers by failing to inform them partial payments would result in the cancellation of previously granted extensions, and by failing to provide consumers with signed copies of debit authorizations. The company was previously subject to a CFPB enforcement action for similar problems in 2019.

In addition to the $15Mn penalty and paying restitution, the order prohibits Enova from offering close-ended loans of less than 45 days for a period of seven years and to reform its executive compensation policies.

Zelle Begins Refunding Users for Select Fraud Disputes

Banks, facing increasing pressure from regulators, have begun refunding customers who were duped into sending money to fraudsters via peer-to-peer payment service Zelle. The service, which is operated by bank-owned consortium Early Warning Services, began reversing some disputed transactions as of June 30th, but EWS chief fraud and risk officer characterized the decision as “well above existing legal and regulatory requirements.” The service disclosed the decision to reimburse certain types of fraud at the end of August, but was reluctant to provide specific details, for fear of encouraging fraudsters to take advantage of the policy shift by making false claims.

Blockchain Startup Fnality Raises $95Mn

Blockchain firm Fnality announced it has raised $95Mn from investors, including Goldman Sachs, BNP Paribas, DT&C, Euroclear, Nomura, and Wisdom Tree. The company originated from a UBS-led blockchain effort and was officially founded in 2019. Its focus is on building digital versions of major currencies that can be used in transactions involving digital securities and for wholesale payments. Fnality plans to use the funding to build out the operations and functionality of its platform for the British pound.

Imprint Raises $75Mn For Cobrand Card Platform

Cobrand credit card platform Imprint announced it has raised $75Mn in new funding. The Series B funding was led by Ribbit Capital, with participation from Kleiner Perkins, Thrive, and Moore Specialty Credit. The new funding brings Imprint’s total equity raised to $127Mn since it got started in 2020. Imprint works with consumer brands to create and operate cobranded programs, including names in the grocery and travel sector like retailer H-E-B, Holiday Inn Club Vacations, and Westgate Resorts. The company plans to use the new funding to continue building out its tech capabilities and expand the verticals in which it operates.

Blockchain.com Raises $110Mn

Blockchain.com announced a massive new funding haul. The company raised a $110Mn Series E. The round was led by Kingsway Capital, with participation from Coinbase Ventures, Lakestar, LSVP, and Baillie Gifford. The company started out as a blockchain explorer tool and later launched what has become one of the most widely used crypto wallets. The company claims to have grown its revenue by some 1,500% over the last four years, despite the “crypto winter.”

JPMorgan Chase Was Biggest Winner from SVB Collapse

With banks increasingly struggling to grow (or even hold on to) deposits, the collapse of SVB earlier this year set off a race to land startup clients of Silicon Valley’s one-time go-to bank and their deposits. The biggest winner? The country’s largest bank by assets: JPMorgan Chase. According to an analysis by an account consulting firm that works with startups, since SVB’s collapse, the number of companies it works with that have an account at the bank grew from 12% to 52%. Other “too big to fail” banks, like Bank of America and Wells Fargo, also saw an uptick, but Chase was the clear winner. Meanwhile, the rebooted SVB, now part of North Carolina-based First Citizens BancShares, is trying to win back clients that sought the safety of the country’s largest institutions during this spring’s banking crisis.

Blue Ridge Must Raise Capital on OCC Requirement

Blue Ridge, which once operated a sprawling set of fintech partnerships, has looked to streamline and simplify its portfolio in the wake of its consent order last year. Now, the bank has revealed it is looking to raise fresh capital, after being told by the OCC to establish minimum capital ratios “that are higher than those required for capital adequacy purposes generally.” The OCC is calling for the bank to meet a 10% leverage ratio and 13% total capital ratio requirement. Blue Ridge posted a loss of more than $41Mn in the third quarter, driven in part by a $26.8Mn non-cash goodwill impairment charge. The bank has also suspended its dividend as it seeks to preserve capital.

In the News:

While All Inflation Feels Bad, Housing Inflation Is the Worst (Wall Street Journal, 11/15/2023) For some, unaffordable housing costs hurt more than high food and gas prices.

The Elusive Soft Landing Is Coming Into View (Wall Street Journal, 11/15/2023) The Fed just might pull off a soft landing, as inflation moderates and the job market remains strong.

Fed: Supervisory problems on the rise for banks of all sizes (American Banker, 11/10/2023) Governance issues accounting for two-thirds of findings of Fed exams at large banks.

Carta starts third round of layoffs in 2023 (AltFi, 11/14/2023) Turmoil at cap table management startup Carta continues.

BNPL companies face grim outlook, Moody’s says (Payments Dive, 11/13/2023) Competition, losses, and regulatory pressure weigh on BNPL companies’ futures.

Failed Crypto Lender Celsius Network Cleared to Exit Bankruptcy (Bloomberg, 11/9/2023) Celsius, now owned by its creditors, will exit bankruptcy and function as a bitcoin mining firm.

Fiserv tests a hub approach to embedded finance (American Banker, 11/10/2023) Fiserv hopes to use Finxact to advance its embedded finance strategy.

British fintech Wise reports 280% jump in profit as higher interest rates boost income (CNBC, 11/14/2023) Wise’s total income is up 58% year over year, thanks to rising interest rates.

Adyen and Plaid Partnership: What it Means (PaymentsJournal, 11/13/2023) Adyen and Plaid team up for pay-by-bank capability.

Lighter Fare:

Time-Traveling Tremors: Some of Today’s Earthquakes May Be Aftershocks From the 1800s (SciTechDaily, 11/15/2023) The U.S. may still be experiencing aftershocks from earthquakes that took place centuries ago.