Wages Outpace Inflation; Block Sues Visa/MC; Karat Scores $70Mn in Funding

By Cole Gottlieb

July 23, 2023

Happy Sunday,

Wage gains outpace inflation. Retail sales up (slightly). TransUnion credit data. Block sues Visa and Mastercard. New capital rules and rising rates impact bank lending. Private markets startup Anduin raises $15.6Mn. Construction worker EWA startup emerges from stealth. Creator financial platform Karat announces new funding. Customers Bancorp’s crypto customers. Has the banking “crisis” just begun? Earnings season coverage.

New here? Subscribe here to get our newsletter each Sunday. For even more updates, follow us on Linkedin (PeerIQ, a Cross River Company).

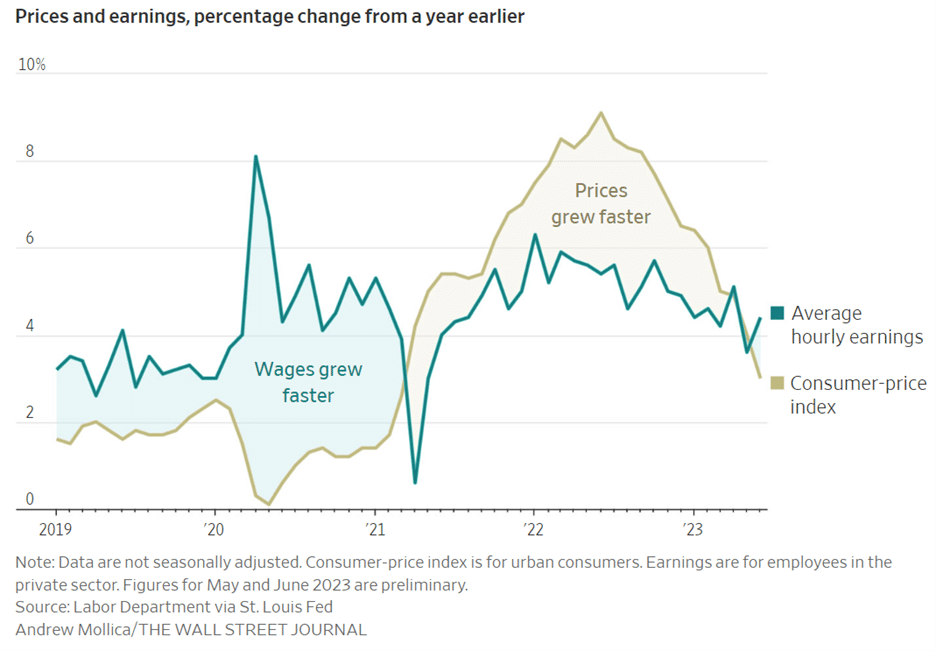

Wage Gains Outpace Inflation for First Time In Two Years

Consumers are finally seeing some relief from persistent inflation. For the first time in two years, workers saw their wages grow more quickly than prices. In June, inflation-adjusted hourly wages rose by 1.2% vs. the year prior. Not adjusting for inflation, wages in June were up 4% vs. the year prior, outpacing the 3% hike in prices in June. The news is bolstering hopes for a “soft landing,” in which the Fed gets inflation under control without causing a recession.

Retail sales were up slightly in June. The measure rose more slowly than in May or April, coming in at a seasonally-adjusted 0.2%.

Image: Wall Street Journal

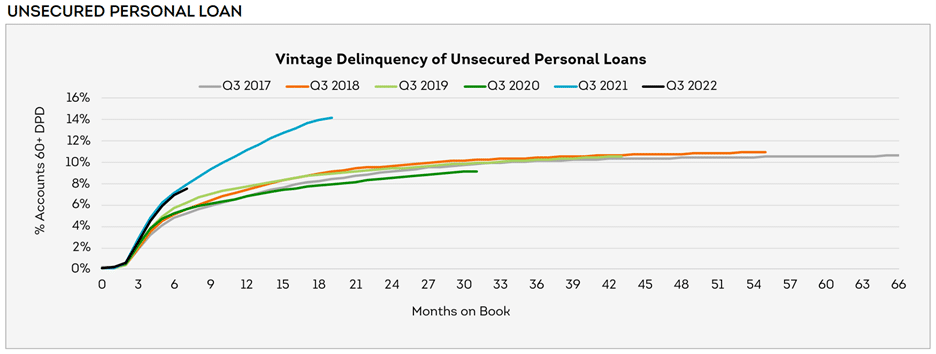

TransUnion Releases Consumer Credit Data for June

TransUnion released its monthly credit snapshot for June, with data showing that average balances for bankcard, mortgage and UPLs rose, driven by a mix of consumer spending and high inflation.

While in May, Bankcard and Mortgage 60+ DPDs declined ((7) bps MoM and (5) bps MoM, respectively), and in April, all consumer credit product 60+ DPDs declined, in June, all consumer credit product 60+ DPDs increased. Auto increased 8 bps, Bankcard increased 7 bps, Mortgage increased 2 bps and Unsecured Personal Loans ("UPLs") increased 2 bps.

Turning to originations, we got information on UPL origination volume for the March 2023 – April 2023 period (lag due to reporting time). After a strong March, April UPL originations took a step back, with the highest portions of the credit spectrum reporting declines in originations and the lower portions reporting slower origination growth.

After a bump in originations for March, April fintech UPL originations slid for most risk tiers, with super prime (4.1)%, prime plus (12.8)%, prime (7.6)%, and near prime (3.8)% on a MoM basis. However, subprime originations continued their upward trend, increasing +10.9% MoM (though still (68.4)% below Apr 22 levels).

Credit union UPL originations reported April MoM declines for super prime (0.9)% and prime plus (3.4)%, while reporting more modest increases in the prime +1.3%, near prime +0.3% and subprime +6.0% segments. Credit Union UPL originations were mixed on a YoY basis, with super prime and prime plus above Apr 22 levels, and prime, near prime and subprime below Apr 22 levels.

Finance companies reported MoM UPL origination increases in March of prime plus +14.2%, prime +7.7%, near prime +8.5%, and subprime +9.5%. Super prime originations declined (3.8)%. On a YoY basis, finance company UPL originations remain well below 2022 figures, except for the super prime consumer category.

After multiple months of UPL origination growth across the credit spectrum, banks reported MoM declines for super prime (13.4)% and prime plus (6.8)%. However, prime +1.3%, near prime +6.7%, and subprime +4.8% continued their growth, albeit at a slower pace. Bank originations are up double digits from April 2022 levels, across the credit spectrum.

Source: TransUnion

Block Sues Visa and Mastercard

Block, the parent company of Square and Cash App, is suing Visa and Mastercard. The suit alleges the payment networks conspired to inflate interchange fees, which are paid by Square, which acts as a payment facilitator and merchant of record. Square, in turn, incorporates that interchange fee in what it charges end merchants. The suit claims Visa and Mastercard did so in order to maintain market dominance. These “inflated” fees lead to higher prices for retail consumers, the company argues in its suit.

While it is clear merchants dislike the high cost of payment processing in the U.S., it is less clear that they are likely to pass along any savings to end consumers. When Dodd-Frank and its Durbin amendment went into effect, capping debit interchange on many cards, analysis suggests that many merchants pocket the savings, rather than passing them along to shoppers in the form of lower prices.

New Capital Rules, Rising Rates May Benefit Fintech Lenders

Banks are facing multiple pressure points that are likely to reshape and have lasting impacts on the financial services landscape in the U.S. In the wake of the collapses of SVB, Signature, and First Republic, regulators are proposing higher capital requirements on banks with more than $100Bn in assets.

The change would require such banks to hold an additional 2% capital buffer. Currently, such additional capital charges only apply to banks with international operations and those with more than $700Bn in assets. Higher capital requirements for these mid-sized banks are likely to lead to further tightening of credit conditions and higher rates.

At the same time, regional banks are paying up for deposits, as consumers shop around for higher rates or seek the perceived safety of “too big to fail” institutions. With the prospect of a further rate hike later this month, regionals are unlikely to see relief from rate pressure.

Combined, these pressures could result in fintech lenders, who often partner with non-bank credit facilities as financing partners, becoming more favorable by comparison.

Private Markets Platform Anduin Raises $15.6Mn

Anduin, which offers a private market for alternative investing, announced it has raised a $15.6Mn Series B. The round was led by 8VC with participation from GC1 Ventures and existing investors. Anduin aims to democratize access to private markets by systemizing, streamlining, and automating mid- and back-office functions that have historically been done manually. The company offers fund subscription, data room, and investor access capabilities. To date, the company has facilitated more than 510 funds in onboarding 27,000 investors and raising $55Bn in capital. Anduin plans to use the fresh funding to expand its core platform’s integrations and deepen the functionality it offers.

Construction-Tech Startup Announces $9.9Mn Seed Round

Trunk Tools, a fintech company focused on the construction sector, has emerged from stealth and announced $9.9Mn in seed funding. The company aims to help address the shortage of construction labor by facilitating faster payments to workers. The seed round was led by Innovation Endeavors, with participation from Foundation Capital, Fifth Wall, and others. The company is also participating in Stanford’s dy/dx accelerator program. In addition to its EWA-like features, Trunk Tools offers a platform for construction companies to manage tasks and to provide incentives to foster higher employee productivity and engagement.

Karat Scores $40Mn in Equity to Expand Creator Financial Platform

Karat, a financial platform for creators, announced it has raised a $40Mn Series B and $30Mn in debt funding. The Series B round was led by SignalFire and included participation from Will Smith’s Dreamers VC and influencers like YouTube chef Nick DiGiovanni and gaming streamer Ludwig Ahgren. TriplePoint Capital is providing the $30Mn in debt capital. Karat’s core proposition is offering a charge card for creators. The company uses alternative data points, like an influencers’ follower counts, as part of its underwriting process. The company also offers bookkeeping and tax services tailored for creators.

Is Customers Bancorp Crypto’s New Favorite Bank?

In the wake of the FTX scandal and the collapse of Silvergate and Signature banks, crypto companies are increasingly having trouble finding banks that want to work with them. Increasing attention from regulators hasn’t helped either. Some have speculated regulators are pressuring banks not to work with crypto firms in repeat of Obama-era “Operation Chokepoint,” which sought to encourage banks not to work with legal but disfavored industries.

Amid the continuing uncertainty, Pennsylvania-based Customers Bancorp has emerged as a go-to choice for many crypto firms. The bank now partners with hundreds of firms in the sector, including market makers, stablecoin issuers, and exchanges. Cognizant of the risks, the bank has put a cap on the amount of crypto-related deposits it will accept and has emphasized crypto as part of a broader payments strategy. While the deposits that come with crypto relationships are appealing, they can also move quickly based on activity in crypto and stablecoin markets.

Earnings Season Coverage

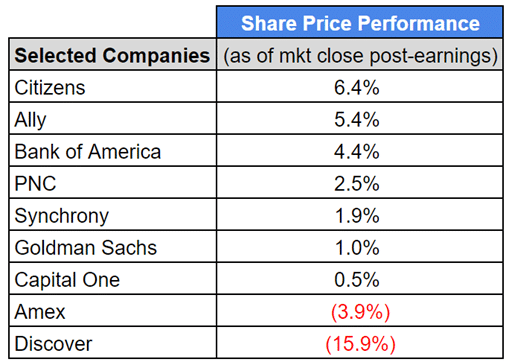

Source: PeerIQ

Earnings season continued, with banks reporting relatively stable consumer loan books on a sequential basis (Bank of America +1%, PNC +0%, Citizens (1)%. Capital One (2)%). Citizens explained that its decline was due to a planned runoff in auto and lower education largely offset by growth in mortgage and home equity.

Consumer NCOs ticked up (on a QoQ basis) at Goldman +120bps, Discover +50bps, Synchrony +36bps, and Bank of America +11bps, while NCOs improved at Capital One (13) bps, Ally (4) bps, Citizens (3) bps and PNC (2) bps.

Average consumer deposits fell (2)% sequentially for both PNC and Bank of America, while Capital One +1%, Citizens +0% and Ally +0% reported slight increases. Consumers continue to chase yield, with Citizens reporting that its (higher-yielding) term deposits were up 36% QoQ, while demand deposits fell (9)% QoQ. Banks are having to pay up for deposits. Capital One paid an average yield of 2.91% on its interest-bearing deposits, up 51bps from the first quarter. And Ally’s average retail portfolio deposit rate was 3.68%, up 52bps from the first quarter.

Despite persistent inflation, consumers continued to open their wallets, with spend volume increasing 8% at Amex, 6% for Capital One credit cards, 3% for Bank of America cards, 2% at Discover and 0% at Synchrony.

Discover’s stock fell after disclosing an investigation by the FDIC, described as “broadly around our compliance management system.” CEO Roger Hochschild noted that additional supervisory actions could occur. In addition, in Discover’s press release it revealed that it had incorrectly classified certain credit card accounts into its highest merchant and merchant acquirer pricing tier. The company established a liability on its balance sheet of $365Mn to accrue for estimated compensation owed to merchants and acquirers.

Goldman took a $504Mn impairment charge in connection with its exploration of a potential sale for GreenSky. Goldman continues to execute on its plan to exit the consumer business, disclosing a ~$100Mn gain on revenues related to the sale of “substantially all of the remaining Marcus loans portfolio”.

Hi all, Cole here. If you’ve made it this far, thank you for being a loyal subscriber to the PeerIQ newsletter. Looking for more updates on the companies covered during earnings season? Follow/connect with me on LinkedIn and join my Discord server for exclusive access to earnings updates, including bullet notes on important info from earnings releases, key quotes from earnings calls, and relevant slides from decks.

In the News:

SEC's Gensler warns AI risks financial stability (American Banker, 7/17/2023) SEC Chair Gensler says regulators must address tech risks, new rules may be necessary.

Rewards app loyalBe shuts down consumer operations (Finextra, 7/17/2023) Northern Ireland-based loyalBe to end operations and transfer user base to payments app Cheddar.

Nav announces second acquisition of the year with start-up Tillful (Fintech Futures, 7/17/2023) Financial health platform Nav acquires SMB health tool Tillful for undisclosed sum.

US fintech Earnest partners Nova Credit to make international student loans more accessible (Fintech Futures, 7/18/2023) Lender Earnest strikes partnership deal with credit data startup Nova to improve access to student loans.

As Mastercard enters the subscription management space, companies dedicated to the space are eyeing it with interest (Tearsheet, 7/17/2023) Mastercard partners with Subaio to offer consumers a subscription management app via bank apps.

Sezzle CEO Sees Banks Ramping Up FinTech Acquisitions in 2024 and Beyond (PYMNTS, 7/18/2023) BNPL CEO thinks banks’ acquisitions of fintechs are likely to pick up heading in to 2024.

‘FIs have an opportunity to treat creators as SMBs’: Marie-Elise Droga, Visa’s new head of fintech, on the creator economy (Tearsheet, 7/18/2023) Visa’s Marie-Elise Droga argues there’s an opportunity to better serve creators’ payments needs.

The Banking Crisis Has Only Just Begun (Forbes, 7/17/2023) Industry analyst Ron Shevlin argues the “crisis” facing banks is likely to extend far beyond 2023.

Lighter Fare:

A Cow, a Camel and a Finch Exploded in Space. What Is Going On? (NYTimes, 7/19/2023) Scientists have detected strange space explosions that they can’t explain.