Greetings,

In macro news, the Fed is expected to cut rates for a third time later this month to a range of 1.5% to 1.75%. The rate cut would indicate that we are definitely in an easing cycle, as opposed to an “adjustment” as initially portrayed by Fed officials.

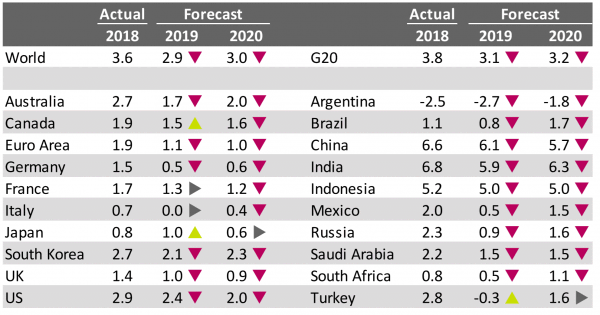

The global economy is moving into the flip-side of the simultaneous coordinated global growth witnessed two years ago. Global growth prospects are flat to cooling across all regions:

Real GDP YOY % Growth

Source: OECD Interim Outlook Projections, Blackstone, PeerIQ

US growth is linked to global growth. If the world catches a cold, it’s reasonable to expect the US to at least get the sniffles.

US Correlated to Global Growth

Source: WSJ, Cantor Fitzgerald, PeerIQ

In regulatory news, the Fed approves to reduce liquidity and capital requirements for banks with less than $700 billion in total assets by about 15%. Regulators are tying rules more closely to bank size, reducing the necessary level of cash and government bond stockpiles at all but the largest and most complex institutions.

In industry news, Upgrade led by CEO Renaud Laplanche released the “Upgrade Card”. The product is a cross between credit card and an installment loan. How does it work? Every month any new charges on the card transition into an installment loan of 12, 24, or 36 months. Customers can select the default payback period when applying for the card and they have the option to change the term for new charges at any time. Upgrade Card offers true risk-based pricing with a range of 6.49% to 29.99%. LendIt Co-Founder Peter Renton has a nice summary here.

Incidentally, Peter also released his Q2 marketplace lending returns. His returns are tracking 6.20% – the fifth quarter in a row with increasing returns and welcome news for investors.

Credit Karma, led by founder and CEO, Ken Lin, announced a high-yield savings account for consumers. The account is the company’s first bank-like product which will pay 2.03%. The offering is similar to other high-yield savings products offered by neo-banks, SoFi, and online banks such as Marcus. Credit Karma has ~90 MM customers and can conceivably make a real dent in capturing share, particularly from large banks where depository rates average 10 to 20 bps.

Robinhood Markets Inc. launched a checking and savings product 10 months ago, but went through some controversy. (Robinhood assumed that the Securities Investor Protection Corp. would cover the insurance on its planned checking product.) This past week, Robinhood unveiled a new feature called “Cash Management”. The service will move customers’ uninvested cash from their Robinhood accounts into existing banks, which are already insured the through the FDIC. Robinhood will offer customers a 2.05% interest rate on cash deposited through the program.

PeerIQ New Hire:

Jocelyn Cheah – Data Operations Manager

PeerIQ is excited to announce hiring Jocelyn Cheah to fill the role as Data Operations Manager. As part of PeerIQ’s Data Insights team, Jocelyn works closely with data engineering to build highly configurable and robust data processing infrastructure and applications. Prior to joining PeerIQ, Jocelyn was the VP of Data Analytics for Credit Suisse. There, she developed automated solutions and integrated big data analytics in risk reporting.

Jocelyn earned her B.S. in Actuarial Science at Saint John’s University.

PeerIQ Conferences:

- Installment Lending Roundatable Conference. PeerIQ CEO, Ram Ahluwalia, will be speaking about where we are in the credit cycle, and will address trends in consumer credit behavior based on PeerIQ’s datasets.

- PeerIQ will be at Money 2020 Oct 27th to Oct 29th. Reach out if you’d like to connect!

- On Oct 23rd, we will be at The Online Lending Policy Institute. Discuss policy trends and the voice of FinTech in DC. Friends of PeerIQ can book a 33% discounted ticket by using code “PeerIQ33”.

Industry News Update:

- 10-year yield holds higher after Fed minutes are released (CNBC, 10/9/2019) Treasury yield rates increase after investors review minutes of U.S.- China trade discussions.

- Market may be expecting more rate cuts than the Fed will deliver, meeting minutes show (CNBC, 10/9/2019) Officials of The Federal Open Market Committee believe markets will receive more rate cuts than what they consider appropriate.

- New Upgrade card could be a game changer (Lend Academy, 10/10/2019) Upgrade, led by former LendingClub CEO Renauld Laplanche, releases the “Upgrade Card,” an alternative credit product.

- My Quarterly Marketplace Lending Results – Q2 2019 (10/8/2019) Lendit Co-founder, Peter Renton, reveals his quarterly investment results for Q2.

- Credit Karma is launching a savings account. But as the Fed cuts interest rates, ‘High Yield’ is relative (Fortune, 10/3/2019) San Francisco-based startup, Credit Karma, announces a high-yield savings account for consumers as early as this month.

- Robinhood gives banking another shot a year after botched launch (Yahoo Finance, 10/8/2019) Robinhood takes a more traditional approach to savings with its new “Cash Management” feature.

- Fed votes to lighten regulations for all but the largest banks (New York Times, 10/10/2019) Fed approves to reduce liquidity and capital requirements for banks with less than $700 billion in total assets.

- Facebook’s pain could be visa and mastercard’s gain (Barrons, 10/5/2019) S. Treasury considers Facebook’s Libra project “a national security issue.”

- Auto, home equity are soft spots in consumer lending (American Banker, 10/8/2019) American Bankers Association’s quarterly report reveals increased delinquency for HELOC and Auto loans.

- JPMorgan donates $25M to get fintech in hands of underbanked (American Banker, 9/24/2019) JP Morgan announces $25 million commitment to fund program that develops FinTech tools for the underbanked.

Lighter Fare:

- ‘Planet Nine’ may actually be a black hole (ScienceMag.org, 9/27/2019) Physicist question if what Astronomers refer to as “Planet X,” could be a small black hole.