Interest rates and Big Tech Banking dominated this week’s headlines.

According to one Fed economist, “the rent rates are too damn high.” The Fed’s research indicates that the neutral rate for a balanced economy (based on a global model of rates) should be -1%.

Differences in optimal rate policy are far and wide. At the risk of uttering famous last words, this time does seem to be different.

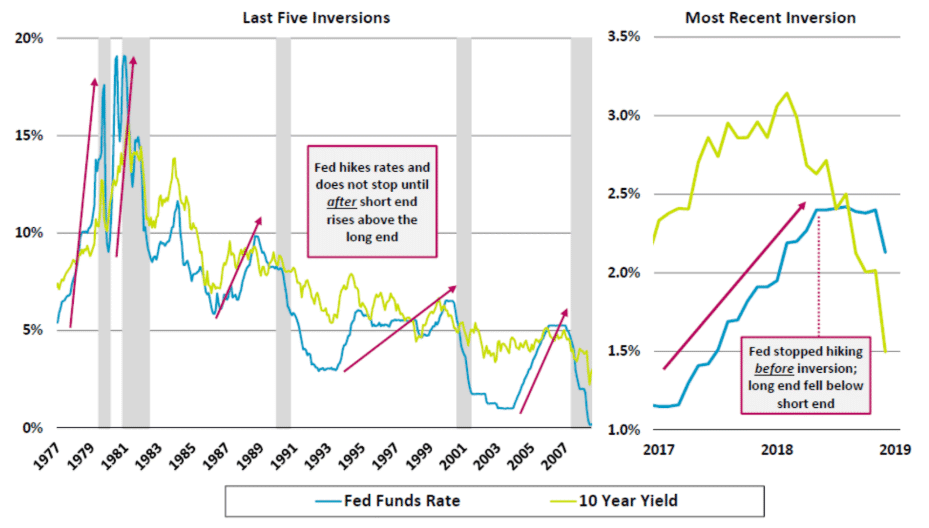

We show below how the pattern of rates at this end of the cycle are driven by long-end tightening (due to slower growth prospects and muted inflation) rather than a classic Fed tightening.

Is this time different? First-time inversion driven by the long-end…

Source: PeerIQ, Blackstone, St. Louis Federal Reserve

PeerIQ clients can email us for the full deck and analysis.

A mortgage refinance boom is underway. Refinance demand increased by 13% from the previous week and was 188% higher than a year ago, when rates were 114 basis points higher. The volumes represent a “last call” for homeowners that missed out on the post-crisis Re-Fi boom and adds disposable income to consumers entering the Q4 retail spend season.

Big Tech Race To Own The Digital Wallet

The WSJ reports that Google has partnered with Citigroup and Stanford Federal Credit Union to launch a “smart checking account” for consumers. Google’s project is code-named “Cache” and the approach is based on co-opting rather than compete with the many financial institutions that Google serves.

The checking accounts can be accessed via Google’s digital wallet, “Google Pay.” Google’s digital wallet is on track to hit 100 MM users worldwide (up from 38 MM a year ago), as compared to 140 MM users for Apple Pay.

Meanwhile, Facebook launched a new service, Facebook Pay, in the United States this week. (Dare we expect an Amazon Pay in the near future?). Facebook Pay is a digital wallet that runs on all of the company’s platforms – WhatsApp, Messenger, Facebook Marketplace and Instagram.

The digital wallet announcements from two big tech companies in the same week is noteworthy. Other US competitors include Zelle, Square Cash and PayPal. The race to own the digital wallet is on.

The U.S. Big Tech firms, as exciting (or as dystopian) as universal digital wallets sound, are still playing catch-up to WeChat Pay. WeChat Pay originally launched in China, and is already 5 years old. WeChat Pay has almost single-handedly reduced the reliance on cash in China. The success of WeChat Pay in linking payments to social media has inspired nearly all major U.S. tech companies to replicate here in the US.

The next move for Facebook would be to offer lending products most likely indirectly (e.g., via POS partnerships or via co-brand products such as Amazon Chase Visa, etc.).

Goldman Sachs is preparing to launch a robo advisor. The new product might be built in part by using algorithms that Goldman Sachs acquired from financial life management firm, United Capital (acquired for $750 MM in May). The new robo advisor could be introduced to the market via Goldman Sachs’ Marcus segment, which could extend a portion of the personal touch it brings to its Private Wealth Management division. The deal helps close a product gap to Schwab’s bank and brokerage offering and is a blow to challenger banks and robo advisors seeking to build a complete consumer banking offering.

In regulatory news, lawmakers are taking aim at payday loan rates. Congress members plan to introduce federal legislation that would cap interest rates at 36%. The bipartisan legislation is built off the framework of the 2006 Military Lending Act.

PeerIQ is pleased to roll-out a new addition to its benchmarking analytics widget – ‘vintage benchmarking’. The feature enables lenders and investors to identify at-a-glance drivers of out-performance or under-performance at a cohort level. The platform automatically prioritizes by areas of impact and delivers results in an easy to understand way.

Reach out to PeerIQ to learn more.

Industry News:

- Even the Fed’s Own Research Shows Rates Are Too High (Bloomberg, 11/12/2019) Fed Economist estimates that the neutral real rate is -1%, which is well below the estimates of Fed policy makers.

- Prosper Reports Third Quarter 2019 Financial Results (Business Wire, 11/12/2019) Prosper reports that loan originations in Q3 2019, increased by 13% compared to the previous year period.

- A $45,000 Loan for a $27,000 Ride: More Borrowers Are Going Underwater on Car Loans (Wall Street Journal, 11/09/2019) Cars are getting more expensive and borrowers are paying the price with burdensome loans.

- Federal Lawmakers Aim to Reduce Payday Loan Rates from 400% Interest to 36% (CNBC, 11/12/2019) Congress members plan to introduce Federal Legislation that would cap interest rates at 36%.

- Apple Co-Founder Says Goldman’s Apple Card Algorithm Discriminates (Bloomberg, 11/10/2019) Tech entrepreneur states that Apple Card has gender discriminatory algorithms.

- Robinhood’s ‘Infinite Money’ Glitch Has Reportedly Drawn Regulatory Scrutiny — and the Company Could Be Fined (Business Insider, 11/08/2019) The SEC and Financial Industry Regulatory Authority might investigate Robinhood’s ‘infinite leverage’ glitch, which could lead to fines for financially-irresponsible behavior.

- The Marketplace Bank: Is LendingClub the Future of Banking? (Crowdfund Insider, 11/07/2019) LendingClub to put its own spin on digital banking by becoming a “Marketplace Bank.”

- Goldman Sachs Has Created a Market-Ready Robo Advisor (Business Insider, 11/08/2019) Goldman Sachs is ready to make its debut into the smaller investor market with their new Robo Advisor product.

- Edited Transcript of TREE Earnings Conference Call or Presentation 30-Oct-19 9:00pm GMT (Yahoo Finance, 11/05/2019) Transcript of LendingTree’s third quarter 2019 earnings conference call.

- Facebook Pay Brings ‘Impulse Shopping’ to Billions of People and Will Boost the Stock, Analyst Says (CNBC, 11/13/2019) Facebook launches Facebook Pay, which links a single payment system for all four of the company’s social media platforms and messaging apps.

- Next in Google’s Quest for Consumer Dominance: Banking (Wall Street Journal, 11/13/2019) Google partners with Citigroup and Stanford Federal Credit Union to launch a checking account for consumers.

- Nelnet Re-Files Application for Industrial Bank Charter with the FDIC and the Utah Department of Financial Institutions (PR News, 11/12/2019) Nelnet resubmits its application for Industrial Bank Charter, after withdrawing the application in 2018.

- Zillow, Opendoor Pay Close to Market Value for Homes, Study Says (Wall Street Journal, 11/12/2019) Study shows that iBuyers, like Zillow and Opendoor, are almost paying market value for properties.

Lighter Fare:

- The Best Slides from SoftBank’s WeWork Earnings Report (Crunchbase, 11/07/2019) Baldly honest and optimistic.