OnDeck Earnings; OneMain Liquidity; Loan Mods Ramping

By Tito Donis

May 3, 2020

Greetings,

Equity markets continued its levitation act, posting the strongest gains since January, 1987.

Here are a few statistics to dimension what is happening in the real economy:

- Weekly jobless claims hit 3.84MM, topping 30MM jobs lost over 6 weeks.

- We estimate the unemployment rate is now 18.5%.

- Weekly trend rate has declined. Note that PPP funds have suppressed or delayed layoffs for at least 8 weeks.

- Q1 GDP dropped 4.8% vs. the estimated 4.0%. Major contributors:

- Household consumption dropped 5.6% annually.

- Healthcare consumption dropped 2.25% (due to suspension of elective procedures).

- We estimate more than 50% of states will have relaxed quarantine restrictions by the end of May.

- S. traffic has nearly doubled in the past three weeks. Americans are experiencing quarantine fatigue - especially in the midwest.

- TransUnion reported a 29% YOY drop in consumer credit report unit volumes and a 38% jump in mortgage volumes.

- First Data reports credit card spending is down 25% YOY.

We recommend taking a look at the data rich Apple Mobility trends report for additional data points.

A Perfect Storm for Small Businesses Pushes OnDeck Into Portfolio Run-Off

OnDeck reported earnings this past week.

In January, OnDeck was executing on plan. The macro picture was looking good. OnDeck was even buying back its own shares.

By the end of March, OnDeck had tapped out all of its U.S. credit facilities, laid off 25% of its workforce, and ceased all marketing and origination efforts.

OnDeck is now seeking to amend all of its credit facilities (presumably to avoid a trigger breach, which would cut-off much needed cash flow due to rapid amortization). OnDeck has about $1.05Bn drawn on its credit facilities, funding $1.2Bn in assets.

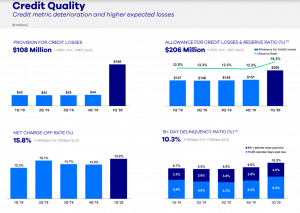

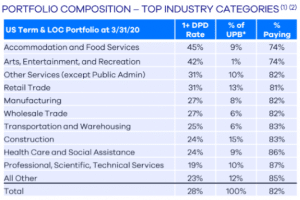

Delinquencies jumped from a base rate of 10% to 28% (March end) to 45% now.

The flip in DQ metrics in under a month suggests that willingness to pay has markedly shifted. Small businesses are choosing to skip debt payments, even if some modest liquidity is available, in a desire to build cash and preserve their ability to pay. It’s similar to the strategic default behavior that U.S. consumers engaged in during the mortgage crisis.

It is not clear whether OnDeck is treating partial payments as current or delinquent. This would be the only question we would ask on the conference call: “Why?”

Some lenders are treating partial payments as “current.” This understates the true level of portfolio risk. All things being equal, loans with a partial payment have a higher default risk than never-late loans making full payments. PeerIQ’s data standardization teases out these subtle differences in the loan-level data to create a true apples-to-apples risk picture. Reach out to your Client Delivery leader to learn more.

OnDeck was authorized to originate PPP loans, but management notes it will not be a material driver. (No surprise there - regulators were late to approve FinTechs for PPP.)

OnDeck today is essentially a portfolio in run-off. The average term of a loan is one year. The $1.2Bn asset portfolio runs-off about 20% to 25% per quarter. OnDeck is funding these assets with ~$900MM in liabilities. If 25% of the assets sour, that would be enough to wipe out the ~$300MM book value of OnDeck.

On the plus side, depending on how you look at it:

- OnDeck is technically trading below net cash assets.

- OnDeck has cash of $102MM on-hand as compared to a market cap of ~$60MM (at $1.10 per share as of today).

- OnDeck generated ~$71MM in cash flow - mostly from operations.

Overall, this is close to the worst-case scenario for any lender management team to navigate.

OnDeck’s path boils down (almost) to a single question: “Of the 45% loans in a delinquent status, will more than half of these loans cure?”

Here are some notable excerpts from the investor deck:

Source: OnDeck, PeerIQ

Loan Modifications Continue to Ramp Up

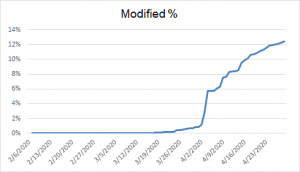

Below is a chart from the PeerIQ Data & Analytics Platform showing the rise in loan modifications.

The data here consists of U.S. consumer loans drawn from a sample of FinTechs. The WA FICO for this pool is 700 and the collateral represents a couple billion dollars of risk.

Extract from PeerIQ Platform

Source: PeerIQ Data & Analytics Platform

Consumer Lending Outperforming Small Business Lending

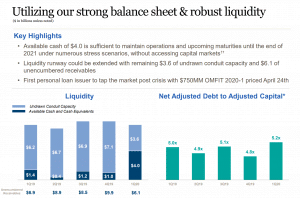

OneMain shared their liquidity picture in their most recent investor deck.

Notably, OneMain was able to tap securitization markets on April 24th. No FinTech consumer lender has been able to tap markets without a punitive negative gain on sale.

We’ve analyzed OMF before and discussed their markedly different approach to liquidity as compared to most FinTechs. During good times, OneMain routinely has access to multiple committed credit facilities representing billions in liquidity.

OneMain will tap higher-cost, non-callable corporate debt. They prefer surety of liquidity (and better matching of assets and liabilities) and are willing to pay higher fees for that. OneMain also uses revolver credit facilities.

Here is a summary of OneMain’s liquidity picture:

Source: OneMain, PeerIQ

One Main is estimating a peak net charge-off rate of 11.25% in Q1 2021. OneMain had 6% of customers in its borrower assistance program. This includes waiving late fees and suspending credit bureau reporting.

OneMain is also tightening underwriting by narrowing their credit box by about 25%.

Assume a Can Opener

To be fair, holding OMF as an example in the category is a bit like the old joke about the economist stuck on an island with a can of food. “Assume a Can Opener!” and voila!

OneMain has decades of thru-cycle experience under its belt. Digital lending performs as well as retail branch lending and investors do not have thru-cycle loss experience.

LendingTree Does First Strategic Investment

In financing news, LendingTree made its first strategic investment. The deal was $80MM in size as part of Stash’s $112MM Series F equity raise. Other investors include funds and accounts advised by T. Rowe Price Associates, Breyer Capital, Goodwater Capital, Greenspring Associates, and Union Square Ventures.

LendingTree has made nine acquisitions since 2016.

Industry News:

- Fed Pledges to Keep Rates Near Zero Until Full Employment, Inflation Come Back (CNBC, 04/29/2020) The Fed kept its benchmark interest rate near zero and said it will keep it there until the economy recovers.

- Fed’s Expanded Lending Plan Leaves Private Credit in the Cold (Bloomberg, 04/30/2020) Private credit firms will not receive support from the Fed’s expanded main street lending program.

- S. Economy Shrank at 4.8% Pace in First Quarter (WSJ, 04/29/2020) GDP in Q1 2020, recorded steepest contraction since the last recession.

- Financial Supply Chain In The Covid-19 Pandemic: Fuel Or Wildfire? (Forbes, 04/30/2020) If not controlled, the “financial supply chain” could turn into a wildfire.

- Small-Business Loan Program Resumes With Reports of Delays (WSJ, 04/27/2020) The SBA’s electronic loan portal was overwhelmed by demand shortly after it reopened.

- Federal Reserve expands access to its Paycheck Protection Program Liquidity Facility (PPPLF) to additional lenders, and expand the collateral that can be pledged (Federal Reserve, 04/30/2020) The Fed expanded access to its Paycheck Protection Program Liquidity Facility to more lenders, which will facilitate lending to small businesses.

- 'Banking in America is broken:' The CEO of $5.8 billion challenger bank Chime wants to put the customer first during the coronavirus crisis (Business Insider, 04/30/2020) Chime wants to put consumers first during the COVID-19 pandemic.

- Stash's CEO says LendingTree's participation in its $112 million funding round will help the fintech's expansion into lending (Business Insider, 04/29/2020) Stash, led by CEO, Brandon Krieg, raised $112MM in Series F funding.

Lighter Fare:

- 10 More Tricks to Appear Smart in Meetings (Medium.com, 03/26/2018) Tips on how to assert yourself in meetings.