Greetings,

This week we start with Friday’s job report and dig into mortgage FinTech innovation.

The US has added 224,000 jobs in the past month – solid, but cooling from last year’s robust growth. Despite this growth in hiring, wage growth has remained contained (~3% YOY). Fed futures markets now expect a close to 100% probability of rate cuts at July 30-31, and expect further rate cuts before end of year.

Below we spotlight areas of growth and weakness across the sector. Healthcare remains the sole area of consistent growth. Retail remains weak due to the hollowing out of commercial real estate due to the “Amazon effect” – consumers continuing to shift towards e-commerce.

Source: Dept of Labor, WSJ, PeerIQ

Before we shift to the future of Mortgage FinTech, we thought we would recommend some history. In his blog, Peter Renton published Ten Years of Investing in Marketplace Lending a thoughtful analysis of what’s transpired in the personal loan market

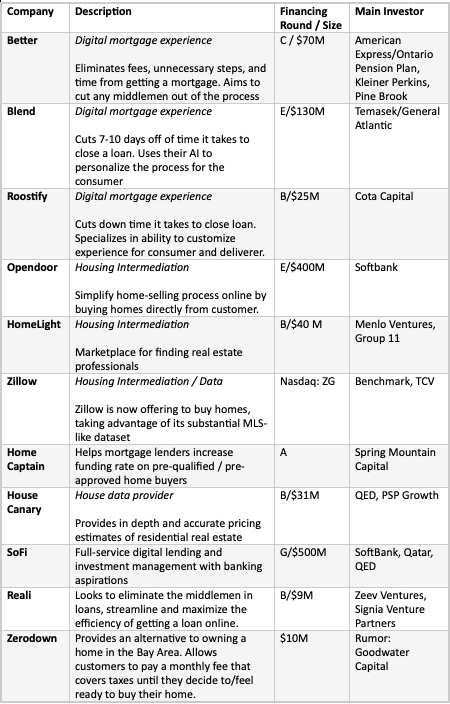

In broad-brush strokes, mortgage innovation centers on:

- Customer experience (Better, Roostify, Blend, HomeCaptain) solutions are re-inventing the onerous mortgage with a digital experience, speeding decision times and opening up the lending buy box in the process.

- Intermediation (OpenDoor, HomeLight, Zillow) – Some platforms are stepping in between buyers and sellers to provide liquidity, capturing transaction fees in the process

- Data (House Canary, Zillow, Atom Data) – are amassing large data sets to providing accurate, standardized pricing models for investment decisioning

- Banking 2.0 (SoFi, ZeroDown) – seek to provide a range of banking or investing services to consumers

PeerIQ in the News:

- Ten Years of Investing in Marketplace Lending (Lend Academy, 7/3/2019) Peter Renton reflects on 10 years of peer-to-peer lending

Industry Update:

- Goldman Sachs, Ally Financial Beat the Fed to a Rate Cut (WSJ, 6/28/2019) Rate on Marcus savings account decreases from 2.25% to 2.15%, following a similar cut by Ally.

- Banks Stay on Sidelines for Facebook Coin After Apple Pay Struggle (Bloomberg, 6/23/2019) Banks remain cautious despite recruiting efforts from Libra, lacking faith in digital wallets and fearing regulatory scrutiny.

- Citigroup Sees Asian Firms Like Ant Financial Setting the Pace (Bloomberg, 6/12/2019) Citi looks toward using tech popular in Asia like mobile payments and credit pre-approval

- Your Phone Could Help Make Mortgage Bond Traders Miserable (Bloomberg, 7/1/2019) In a particularly good time to refinance home loans, borrowers are turning to online methods saving up to 26 days

- How Will Fintech Companies Handle a Recession (Lendit, 7/1/2019) Established fintechs like LendingClub, CommonBond, and Affirm have been preparing for an inevitable recession

- Funding Circle shocks the City, plummeting 20% after slashing growth forecasts thanks to Brexit (Standard, 7/3/2019) Companies growth expectation drops 50% with dropping demand for loans from small business, founder blames uncertain US interest rates and Brexit.

- Capital One keeps closing branches, even as rivals open them (American Banker, 7/1/2019) company has closed half of their branches in the past decade, has fewer than 500 branches in 8 states and DC.

- Zopa plans £200m fundraise ahead of bank launch and IPO (p2pfinancenews, 7/2/2019) UK peer to peer lender looks for capital to prepare for bank launch and potential stock market flotation

- A ‘turtle bank’ plays catch-up in small-business lending (American Banker, 7/2/2019) Provident Financial partners with fintech Fundation to offer small, unsecured loans

Lighter Fare:

- Accounting for Innovations in Consumer Digital Services: IT still matters (Federal Reserve, 6/15/2019) Feel free to indulge this July 4th holiday…Netflix, Hulu, and Amazon Prime Video – “free goods” contribute ~50 bps to GDP in terms of customer satisfaction.